![[Source: Lighting Research Center ]](https://fabbaloo.com/wp-content/uploads/2020/05/LRC_img_5eb099de88f3a.png)

Charles Goulding and Rafaella July of R&D Tax Savers discuss 3D printing in the lighting industry.

The Rensselaer Polytechnic Institute in New York and its Lighting Research Center (LRC) is the world’s leading lighting research and education center. In 1990, the LRC became the first university to offer graduate degrees including a Master’s and a PhD in lighting.

In February of 2019, the LRC, in partnership with Carbon Group Global, organized a discovery group of leading lighting companies, 3D printer companies, and 3D printing materials suppliers. Their goal was to take a proactive approach to applying 3D printing in the lighting industry. The group included the following leading companies: Acuity Brands Lighting, Current by GE, Desktop Metal, DSM, Eaton Corp., Finelite, Focal Point, Henkel, HP, Hubbell Lighting, Lumileds, Stratasys, Tempo Lighting, and Ultimaker.

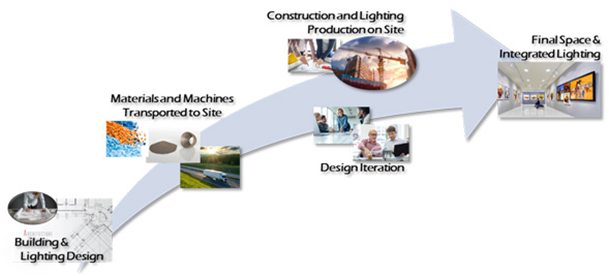

The collaboration among these leading companies will result in an industry roadmap that will incorporate 3D printing as a viable option in the lighting industry. Additive manufacturing in the lighting industry will allow manufacturers to create uniquely designed lighting products. With the instant availability that 3D printing provides, both manufacturers and customers will benefit from lower costs and less time-consuming labor. Traditionally, 3D printing has been utilized in the lighting industry for prototyping. The research at the LRC and collaborations among additive manufacturing and lighting companies has resulted in 3D printing being utilized in production, improving both design and functionality of lighting products.

Since the time of Edison, Tesla, and Westinghouse the lighting industry has continuously innovated. At the very least, this discovery initiative will cause many more leading 3D printing product providers to give more consideration to opportunities in the lighting industry.

New product development that arises from this effort should be eligible for R&D tax credits.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Charles Goulding reviews 3D printing news from Davos.