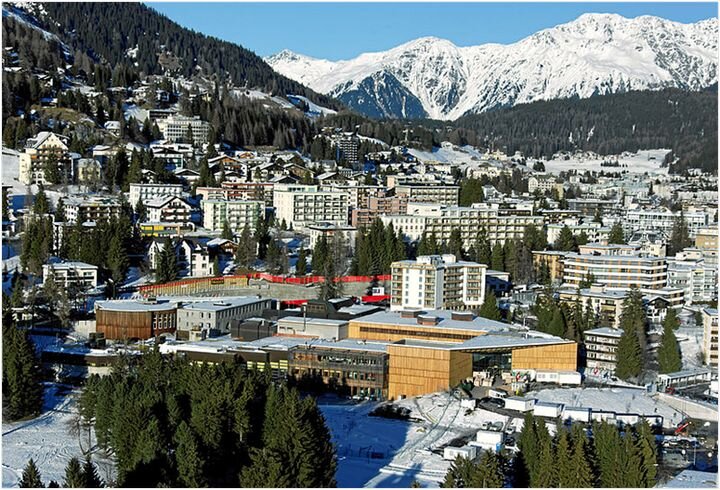

![Davos Congress Centre located in Davos, the biggest tourism metropolis of the Swiss Aalps [Source: Wikimedia ]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb0508e4b53d.jpg)

Charles Goulding reviews 3D printing news from Davos.

Two major themes addressed at the 2020 World Economic Forum (WEF) in Davos, Switzerland were environmental sustainability and 3D printing.

Philips, the world’s largest lighting company, has consistently used the Davos forum as an important part of its global branding strategy. Using it’s Signify solid-state/LED lighting brand, Philips concurrently retrofitted the Davos Congress Centre as well as 500 of the 1,000 street lamps with energy-efficient LEDs.

Signify’s CEO, Eric Rondolat, took a multifaceted active role in the Davos conference. As a panelist, he participated in both the ‘Stimulating Circular Innovation’ and ‘Helping Cities Transition to the Digital Age’ sessions, in addition to moderating the CEO Climate Leader session and speaking at the launch of the UN’s new SDG Ambition initiative during a launch luncheon with Secretary-General António Guterres.

In their Davos-related press release, they included a reference to the fact that their fixtures are 3D printed. Philips has set up production-level 3D print manufacturing facilities for lighting in the Netherlands, the U.S., India, and Indonesia. Philips is committed to circular economy product sustainability and the 3D printed lighting fixtures use fewer materials with the capability of using recycled materials.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 5%-8% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Conclusion

Philips/Signify used the Davos forum to demonstrate its accomplishments with both 3D printing and the environment.

Their CEO’s active role tells the market that the entire organization is committed to these initiatives.