Charles R. Goulding and Preeti Sulibhavi discuss the convergence of shims and 3D printing.

Reducing Wear and Tear: Shims are the Right Fit

There are arguably very few industries remaining today that do not utilize some form of 3D printing or additive manufacturing. The manufacturing industry, in both production and distribution sectors, utilizes 3D printing for various purposes. This includes the manufacturing of shims, as they are an important component in many industries.

A shim is a thin and often tapered or wedged piece of material used to fill small gaps or spaces between objects. Shims are typically used in order to support or better fit pieces, as well as to fill gaps between parts that are subject to wear and tear. One of the major custom manufacturers and distributors of shims is IGS Industries. IGS is a leading company with an excellent website that illustrates the wide variety of shims available, including:

-

Solid Shims

-

Laminated Shims

-

Pre-Cut Alignment Shims

-

Shim Packs

-

Motor Shims

-

Loose Leaf Shims

-

Color Coded Shims

-

Slitter Shims

-

Arbor Shims

-

Edge-Bonded Shims

-

Tapered Roller-bearing Shims

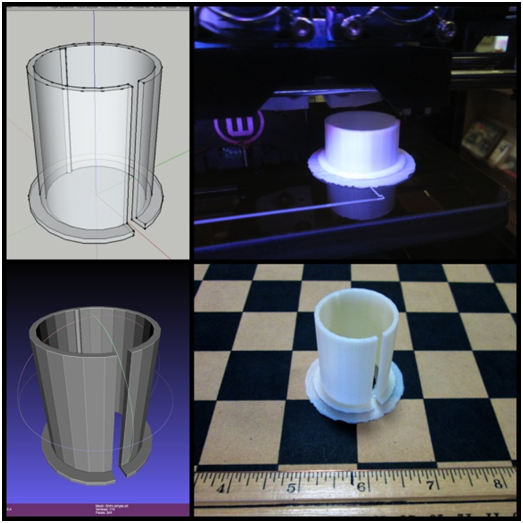

In addition to these industry standard cuts, much of the work for shims comes in the form of custom-fit specifications in both project dimensions and sizes, as well as in materials. In creating shims that require intricate detail, precision and unique shapes and sizes, 3D printing is the perfect fit. Companies that utilize 3D printing and innovative additive manufacturing techniques can also benefit from R&D tax credit incentives, largely because the very nature of 3D printing is iterative and dependent upon many variables. Any time a company is developing a new product or improving an existing product, a level of experimentation is necessary to achieve the final product design. Product designers evaluating the feasibility of integrating different types of shims and using software to then simulate the design is also considered credit eligible activity.

Shims and 3D Printing: Materials Seal the Deal

The type of material used to additively manufacture or 3D print shims is expanding. Materials that are used to make both standard and custom-designed shims often include:

-

Aluminum

-

Bronze

-

Carbon Steel

-

Laminated Materials

-

Monel

-

Plastic

-

Brass

-

Copper

-

Stainless Steel

-

Inconel

-

Mica

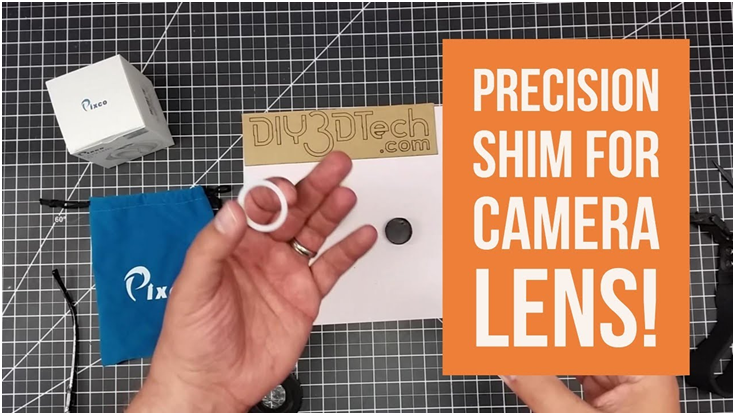

As a result of this variety, manufacturers may consider using different types of material to achieve an optimized design for a particular application. The shape, size and specificity of a particular shim necessitate the use of a limited selection of materials. For instance, materials commonly used for precision and slotted shims are: aluminum, rust-resistant stainless steel, cold-rolled steel strip, brass, and laminated plastic (PET). Materials for solid shims, which can be processed in thickness between 0.05 to 20 mm, can include: brass as well as stainless steel. If a project requires the use of a specific material for a certain type of shim, then most companies work with customers to help customize the shim to fit their needs. It only seems fitting, that 3D printing is now utilized to create expertly manufactured shims. In creating more precisely-shaped and durable shims, companies can benefit from R&D tax credits to help support further innovation.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Healthcare 3D printing attempts to solve two problems that plague providing care: customization and cost.