![An enormous interactive chart of 3D printing technologies [Source: 3dpbm]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb096a5d143e.jpg)

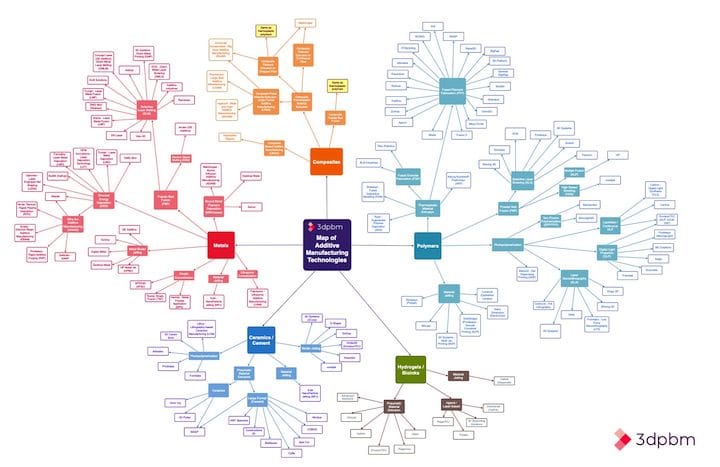

A comprehensive interactive chart of 3D printing technologies has been published.

Our friends at 3dpbm have developed a large chart containing a kind of tree-structure that one can explore to find vendors of various types of 3D printing technology. The chart includes 132 vendors across 38 different 3D printing processes within five different material types.

The chart focuses on Metals, Ceramics/Cement, Hydrogels/Bioinks, Polymers and Composites.

While I’m familiar with most 3D printer manufacturers, I found several on this chart that I’ve never heard of, and intend on investigating. It’s a large list, but is not quite comprehensive. The fused filament fabrication category, for example, includes 57 vendors, but in fact there are far more vendors in that category alone.

Prusa Research, for one, is absent, as are countless Asian companies that produce clone-like variants of machines on 3dpbm’s list. I’m okay with this constraint, as it would unnecessarily complicate the chart with companies that often are of fleeting existence. The companies listed seem to be those that might be considered for professional use in some way, rather than for more casual use.

3dpbm is in a good position for producing this chart, as they track vendors in the space by offering an online directory. Their directory contains far more than just the 3D printer manufacturers, and includes resellers, material vendors and media, like our own publication.

From this directory they’ve no doubt mined the information for this useful chart.

![Detail from an interactive chart of 3D printing technologies [Source: 3dpbm]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb096a6200d8.jpg)

Publishing charts of this type is a bit of an obligation, however, as things tend to change over time. New processes for 3D printing are constantly being developed, as we seem to report at least one per month over the past few years. As each new method becomes commercialized, they should appear in the chart.

The most amazing thing about this chart is the scale. If we were to wind back the clock a couple of decades, this chart would be nearly empty, holding only a small handful of vendors in perhaps three different material processes. Now we see a chart filled with over a hundred vendors.

Over those intervening years processes were invented and commercialized, leading to the creation of all these companies and many more. Among them, they employ tens of thousands of highly skilled individuals, people whose professional fate would be unknown if 3D printing had not emerged in the 1980s.

Going forward, I predict charts of this type will become increasingly complex as more companies, processes and even material types will gradually be added over a period of many years.

This chart is not the end state. It is a middle state diagram, where there is much left to do.

CoreXY is becoming a very popular approach for 3D printer motion systems, but is it the ultimate answer? We list the advantages and disadvantages.