As Xometry moves toward IPO, the company has updated its SEC filings with share pricing.

In early June, Xometry announced its intention to go public. Rather than taking the SPAC route of many other companies in the 3D printing industry today, Xometry filed an IPO. That initial public offering means a paper trail through the US Securities Exchange Commission.

Xometry IPO

The initial SEC filing had several blanks listed for the section on initial public offering price for the Class A common stock. These blanks have been filled as of today.

Xometry “set terms for its initial public offering on Monday, with plans to offer 6.9 million shares priced at $38 to $42 each at a valuation of up to $1.5 billion,” MarketWatch reports.

Upon initial news of the forthcoming IPO, Forbes noted that PitchBook had valued Xometry at $558M as of September 2020. It seems 2021 will see a rather heftier valuation.

When Xometry hits Nasdaq trading under “XMTR” it will be among the most significant public players in on-demand manufacturing.

Xometry as an Emerging Growth Company

Xometry lists itself in SEC filings as an “emerging growth company.” This, per the SEC, means:

“A company qualifies as an emerging growth company if it has total annual gross revenues of less than $1.07 billion during its most recently completed fiscal year and, as of December 8, 2011, had not sold common equity securities under a registration statement. A company continues to be an emerging growth company for the first five fiscal years after it completes an IPO, unless one of the following occurs:

- its total annual gross revenues are $1.07 billion or more

- it has issued more than $1 billion in non-convertible debt in the past three years or

- it becomes a ‘large accelerated filer,’ as defined in Exchange Act Rule 12b-2”

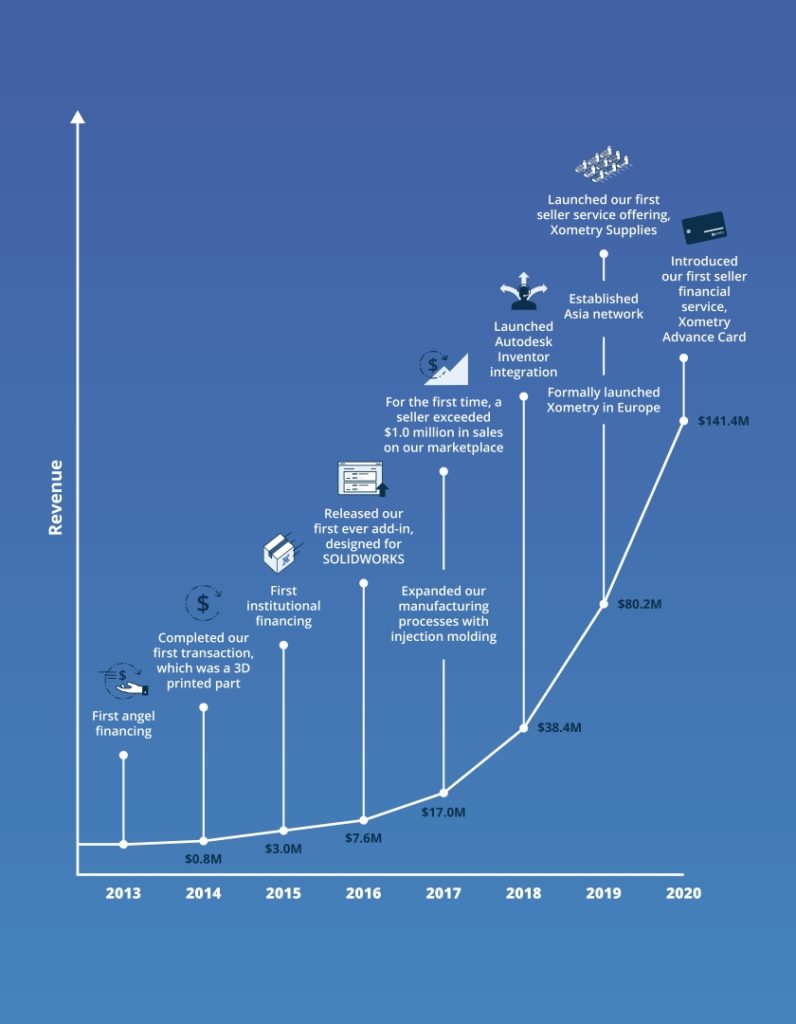

Xometry’s 2020 revenues clocked in at $141.4M; healthy, growing, but safely below this $1B cap. Point two also seems to not be an issue now. For point three, Xometry ticked the box on the updated SEC form as a “non-accelerated filer.” Each of these suggests Xometry will remain safely considered an emerging growth company for these first five fiscal years.

The SEC outlines that that means:

“Emerging growth companies are permitted:

- to include less extensive narrative disclosure than required of other reporting companies, particularly in the description of executive compensation

- to provide audited financial statements for two fiscal years, in contrast to other reporting companies, which must provide audited financial statements for three fiscal years

- not to provide an auditor attestation of internal control over financial reporting under Sarbanes-Oxley Act Section 404(b)

- to defer complying with certain changes in accounting standards and

- to use test-the-waters communications with qualified institutional buyers and institutional accredited investors”

Eyes on Xometry

With more financial figures tied now to the IPO, we can understand more about how Xometry is positioning itself for its Nasdaq debut as XMTR.

As of press time, Xometry is still declining interviews. We’ll keep an eye out as more information becomes publicly available for another advanced manufacturing company on the public market.

Via MarketWatch, SEC, and Xometry