Xerox seems to have quietly placed its first customer 3D printer installation as the company looks at innovation for future growth.

The announcement was brief in today’s release of Xerox’s Q4 and full year 2020 financial results:

“The Palo Alto Research Center (PARC) has been central in advancing the company’s innovation portfolio including 3D Printing and Digital Manufacturing, IoT Sensors and Services, and Clean Technology. Xerox installed its first 3D printer for a client in December, and IoT solutions are at work with the U.S. Defense Advanced Research Projects Agency and other clients.”

I haven’t been able to find any other mention about that first customer installation, but digging around online did uncover some interesting thoughts about where 3D printing might fit into the forward-looking Xerox strategy.

Xerox 3D Printing

As more big 2D players entered the 3D printing field, it was no surprise a few years ago to hear the name “Xerox” come up more and more. Then followed a few big moves: 3D printing on the company’s three-year plan, the acquisition of Vader Systems, the attempted hostile takeover of HP. The last of these was dropped last spring as COVID-19 picked up, but the attempt was still one with a lot of strategic echoes.

The last real noise from Xerox was the appointment nearly a year ago of Tali Rosman as the Vice President of the company’s 3D business.

“3D is the most advanced of our five new innovation pillars in terms of bringing systems to market and generating revenue. This requires a leader who thinks differently and can drive strategy as we move toward a commercial release of our liquid metal printer later this year.,” said Xerox CTO Naresh Shanker as of the February 2020 announcement.

For her part, Rosman commented:

“Being part of the team transforming and revitalizing this marquee brand is a unique opportunity. I’m excited to see how Xerox becomes the leader in the 3D printing industry, helping 3D printing cross the chasm from prototyping to manufacturing.”

Per the 2019 roadmap, Xerox’s five strategic focuses included — with breakout emphasis on the final pillar:

- Improve our core technology business

- Expand services & software

- Capitalize on the opportunity in SMB

- Transform client digital experience

- Drive innovation and new growth businesses

- Digital packaging and print

- AI workflow assistants for knowledge workers

- 3D printing / digital manufacturing

- Sensors & services for the Internet of Things

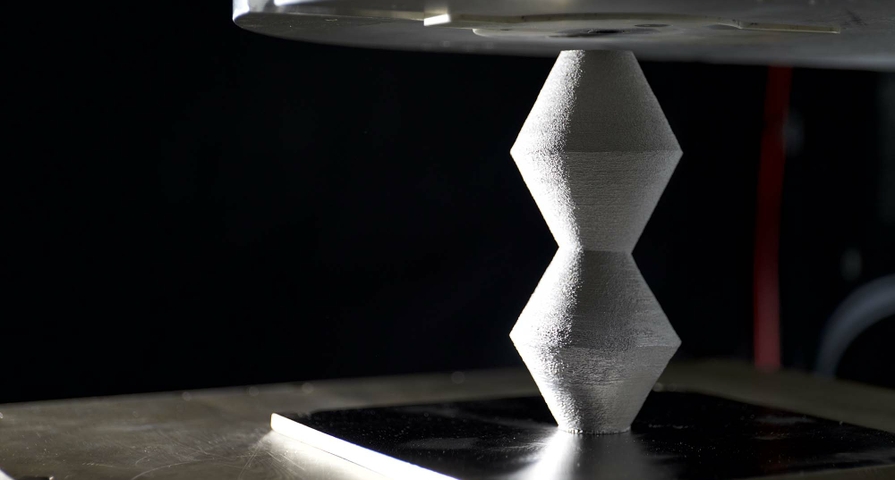

Per Shanker’s point last year, the “liquid metal printer” — a unique 3D printing technology that originated at Vader Systems — was approaching commercialization. Per today’s financial release, commercialization is here.

Xerox Innovation Strategy

There’s no additional news beyond simply that the first client 3D printer was installed last month. There’s also no easily navigable information about some of the multi-nozzle extrusion work we had previously heard about from Xerox, outside of their (2019) video about their 3D printing offerings. But what there is is an undertone of manufacturing realities. Xerox’s 3D Printing page lists specifically, for example, the “liquid metal advantage”:

- Off-the-Shelf Materials — Our technology uses off-the-shelf metal wires, which are safer, more cost-effective, and require less post-processing than powder-based 3D metal printing.

- Proprietary AI Software — Software developed at Xerox’s Palo Alto Research Center (PARC) optimizes the 3D printing process.

- Seamless Integration — Our 3D technology integrates into manufacturer’s current workflows, empowering their manufacturing line with repeatable production of strong parts.

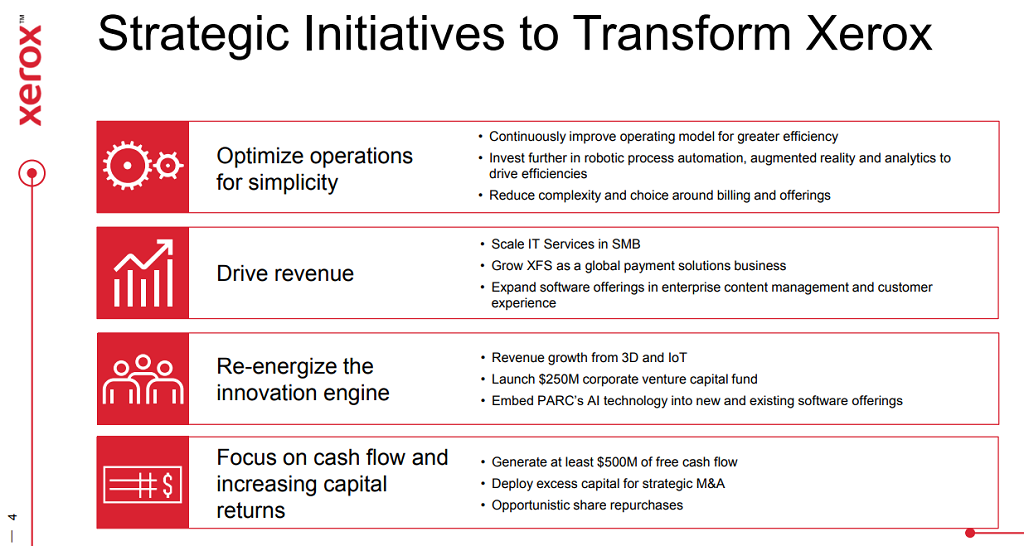

PARC in particular is quite interesting. The research center, effectively the heart of innovation at Xerox, celebrated its 50th anniversary in mid-2020. It stands as a key to what Xerox sees as a path forward to key revenue growth, as illustrated in this slide from the Q4 2020 results earnings presentation (pdf):

Further, it looks like PARC will soon be its own business, as the financial results announcement states:

“Xerox announced its intention to stand up its Software, Financing and Innovation organizations as separate and distinct businesses by 2022.”

A couple of interesting articles over at investment-focused Seeking Alpha also pointed out a few reasons why innovation is so key to the messaging Xerox is driving. In a late December 2020 article, they write:

“For those looking for the moonshot bull case, it is essential to consider the firm’s innovation subsidiary, the Palo Alto Research Centre (PARC). PARC has been responsible for some of the most significant innovations in recent technological history, including the personal computer, the graphical user interface, fibre optics, and the computer mouse. However, Xerox, failing to see the commercial potential in its inventions, did not commercialize any of these offerings and instead sold the license to Apple.

Years later, Steve Jobs said, ‘Xerox could have owned the entire computer industry today.’

It seems like Xerox is not making that mistake again. Its long-term revenue objectives involve commercializing several new PARC inventions, including ‘disruptive’ digital packaging technology, AI for complex documents, and 3D printing. With its large cash balance and positive free cash flow, it could be possible, albeit unlikely, that Xerox can come up with a new staple product. Even if it doesn’t, it could potentially buy several fledging young startups in tangentially related industries and complete an organizational pivot of sorts.”

When it comes to Xerox “not making that mistake again” we can see that mindset come to light in the bullishness with which the company discusses its 3D printing future. Over and over, Xerox messaging focuses on becoming “the leader” in additive manufacturing — note, that is not a leader, it is the leader. If they (theoretically) could have “owned the entire computer industry,” it seems they’re not willing to let another major technological opportunity pass through their fingers.

Another Seeking Alpha article, from early this month, says:

“XRX is on schedule to launch its liquid metal 3D printer that can print Aluminum 4008, an alloy used in the manufacture of end-use parts and prototypes. XRX is also planning to develop 3D printers that print other metals too. On-demand manufacture of products seems like a major disruptor, and when it becomes commonplace, XRX will be one of the forerunners which introduced the technology.”

As we roll into 2021, Xerox has shipped one (known) 3D printer. 3D printing is one of the pillars of innovation; they don’t have all their eggs in the additive basket, as it were, as IoT, AI, and other disruptive technologies also feature heavily.

For actual market leadership, significant focus needs to be on a singular area. There certainly is expertise within Xerox, especially with Rosman’s business acumen, experience, and leadership. And as we’ve seen with HP in particular, a focused segment within a large corporation can have major market impact. But even then, and with HP having participated for several years now with substantial customer installations, as well as both polymer and metal 3D printing technologies, they’re still not the market leader. It’s unclear, then, who exactly Xerox might seek to unseat; everyone?

The focus is clearly on manufacturing, and working with commodity metals within manufacturing facilities is certainly a strong positioning. Rosman shared some insights into their work at the recent IMTS Spark event:

Hopefully we’ll continue to hear more — with detail — from Xerox as the company moves more directly into the market.

Via Xerox financials (pdf) and Xerox Additive Manufacturing Innovation with 3D Printing