CASTOR announced two new investors, one of which is Xerox.

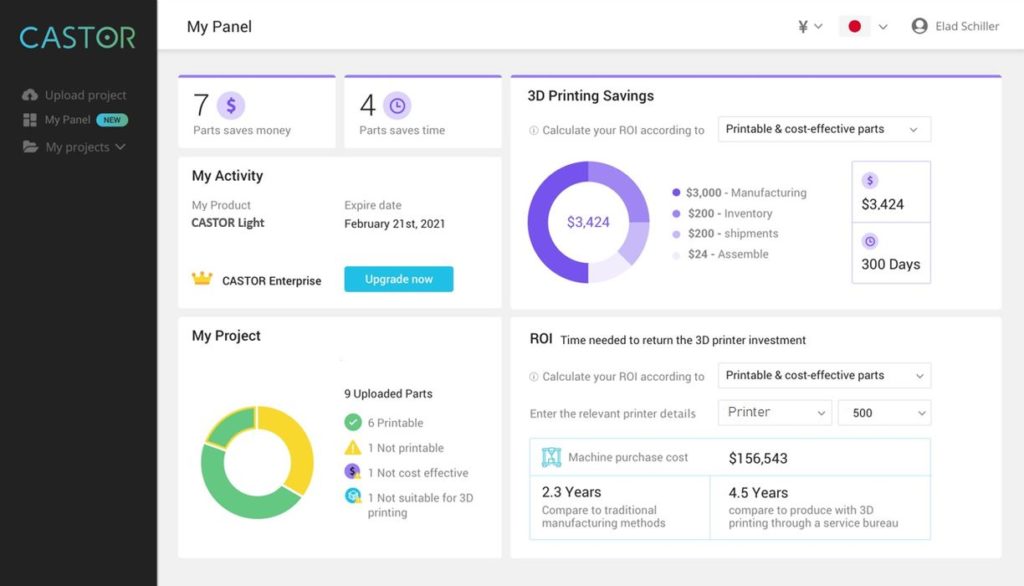

CASTOR is a California-based startup that’s developing a sophisticated part inventory analysis system. The goal is to sort through hundreds or even thousands of existing 3D design files to identify which designs are most amenable to 3D printing.

Why do this at all? Because the pandemic exposed the fragility of most manufacturing supply chains, many manufacturers are turning to on-demand regional production. While this strategy short-circuits problems in supply chains, it also frequently requires a move to additive manufacturing.

Then the question becomes, “Which parts can we 3D print?”

For companies having little expertise in additive processes, the prospect of inventorying their entire catalog of parts can be daunting. That’s why automated inspection and evaluation systems such as CASTOR’s are becoming quite important.

That sentiment seems to be recognized by investors, as CASTOR has picked up a seed round from two new investors and several existing investors, including Evonik through their VC arm. One of the newcomers is Spring Ventures, an Israeli VC company that’s funded a number of notable startups.

The other newcomer is none other than Xerox.

Xerox is a well-known brand name, but not so in the 3D printing community, at least not yet. The company has only put together a portfolio of products for 3D printing in the past few years, with perhaps their biggest step being the acquisition of metal 3D printing startup Vader Systems in 2019.

That technology eventually led to the release of the Xerox ElemX 3D Liquid Metal printer earlier this year.

Now they’ve invested in CASTOR.

Why do this, aside from getting in on a good product in a growing market? I think there’s some key strategy moves for Xerox with this investment.

Xerox’s 3D printing strategy is one of industrial production. The acquisitions they’ve made and the products they’ve released are all targeted at industry, not professional applications.

It may be that Xerox believes that by promoting CASTOR they could find a path to direct some of the new additive production described above towards their equipment and materials. Being a part-owner of a company usually implies some level of operational relationship, and here we may see CASTOR clients having slightly less friction when moving to Xerox products in the future.

This is not a surprising strategy, as there’s been a shift in marketing in recent years.

For a long time sales of 3D printers were focused on the machine specifications, where printer manufacturers believed they could attract buyers seeking those specs.

Later, things changed to a focus on materials: by offering wider material capabilities, 3D printer manufacturers believed they could attract more buyers who sought specific materials.

Now another shift is occurring, where 3D printer manufacturers attempt to get involved closer to the point where decisions are made to use the technology through software such as CASTOR’s.

It’s a good idea because at a high level, where would you find the most decisions about whether to 3D print happening? I think that would be when someone runs an inventory evaluation: dozens or hundreds of parts could be tagged as additive-capable. Companies receiving a list of said parts would certainly be then seeking methods of producing the parts.

That’s definitely a good place for any 3D printer manufacturer to be.