Charles R. Goulding and Preeti Sulibhavi consider implications of Xerox’s move into the 3D printing world.

Xerox had been tentative about 3D printing for a while. For years many have been anticipating their expansion from 2D printers to 3D ones. In 2020, Xerox has made the 3D printing leap.

When a company is a late entrant into an already developing industry, in order to position itself, it has to show some real accomplishments (cutting edge technology, etc). It will take much effort to leapfrog from entrenched participants currently in the 3D printing industry.

3D Printing in Mass Production?

3D printers have been found to be very useful for plastics and making great progress with metals. It has also been found to be less expensive. So why isn’t a standard piece of equipment in mass production already? Xerox is ready to answer that question.

To go beyond several additive manufacturing (AM) techniques that range from laser 3D printing to using pressurized gas to eject powdered metal at supersonic speeds, then to integrate AM into standard operating procedures does not come without challenges. Even with identical methods of 3D printing, parts produced can be different. In fact, parts produced from the same machine may vary based on tray location, the material used, as well as other considerations.

There is also the issue of operating procedures and processes that may vary when utilizing 3D printers as opposed to traditional manufacturing equipment. In traditional manufacturing, a specific machine produces a very specific part, repeatedly. This allows floor workers and plant foremen to monitor and mitigate variations in parts. With 3D printers and additive manufacturing, a single machine may produce a wide variety of parts with diverse geometries, making it difficult to establish a calibrated standard and improve part consistency. The reason: different applications place different GD&T demands on designs.

Then there is the speed issue. Additive manufacturing is relatively slow compared to CNC machining or injection molding. But with the recent technological advancements in 3D printing, the industry is catching up on speed – quickly.

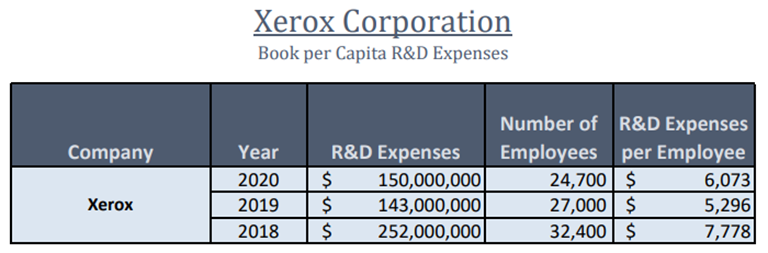

The resources that Xerox can bring to any market are evidenced by the below table, evidencing more than $500 million in R&D spending in the last three years.

Enter Xerox

Perhaps it was the massive pandemic-induced supply chain disruptions in 2020, but Xerox took a leap of faith from its comfortable 2D printing legacy to now enter the ring in establishing a 3D printing one. Xerox believes that 3D printers utilized in mass production are not a thing of science fiction anymore. Xerox has advanced a unique liquid metal 3D printing technology where it is almost ready to be commercialized. In the beginning, Xerox found that 3D printing replacement parts for its production equipment were faster and more economical than ordering from outside vendors. The parts were also of high quality.

Then, Xerox drew upon decades of printing experience to attempt to disrupt traditional manufacturing through its acquired 3D liquid metal technology (in combination with AI-based design software) to design and manufacture parts that are producible to scale.

After acquiring Vader Technologies and including 3D printing on its three-year plan, Xerox seemed well set on a new path to focus on innovation. That has been playing out as earlier this year the company introduced the ElemX 3D printer and its first installation at the Naval Postgraduate School. Xerox is now very publicly involved in the industrial 3D printing scene.

The Research & Development Tax Credit

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

“A Xerox Copy, Please….”

The iconic copy printer company is now ready to become a part of history – this time as a 3D printing company (as opposed to 2D). To many, utilizing 3D printers as a standard piece of mass production equipment is still a long ways away. With the entry of Xerox into the 3D printer game, though late, it may prove those naysayers wrong and give U.S. manfucaturers the boost they need.