Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s first take a look at the major 3D printing companies on this week’s list. I consider these companies “major” because their market valuations are significantly larger than others in the space.

Major Players

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 3276 | -774 |

| 2 | Xometry | 2261 | +274 |

| 3 | Desktop Metal | 2244 | -68 |

| 4 | Stratasys | 2176 | -94 |

| 5 | VELO3D | 2156 | -84 |

| 6 | Protolabs | 1635 | -76 |

| 7 | Materialise | 1475 | -39 |

| 8 | Nano Dimension | 1408 | -35 |

| 9 | Markforged | 1356 | +77 |

| 10 | ExOne | 597 | -1 |

| 11 | SLM Solutions | 445 | +11 |

| 12 | Shapeways | 380 | -46 |

| TOTAL | 19410 | -912 |

This week saw a couple of notable shifts in our leaderboard, mostly related to the expected quarterly financial announcements that were generally made this week by most companies.

The big winner of the week was Xometry, which reported outstanding results for their first quarterly report, with growth of 35% year over year, and revenue now at US$56.7M for the quarter. This was seen quite positively by investors, who generated a near 14% gain in the company’s valuation, and shifted them from fifth place last week to second overall this week.

The other major change was leader 3D Systems, who suffered a massive loss in value exceeding 19% over the week.

This is quite surprising, given their stellar financial results. They posted a profit of US$0.08 per share, exceeding analyst expectations. In such a situation, you’d expect the stock price to rise.

However, it didn’t, and instead fell significantly. It could be that the stock sell off was perhaps long term investors that finally saw an opportunity to sell their shares that have been underwater for years. Based on the profitability, it’s likely 3D Systems valuation will quickly bounce back. In any case, they’re still at the top of the leaderboard, and by quite a margin, in spite of this week’s staggering US$774M loss in value.

Usually when one or more of the “big guys” drops, it pulls down the value of others in the space, and this week was no exception as the other players also incurred moderate losses in value. However, this makes the Xometry jump that much more impressive.

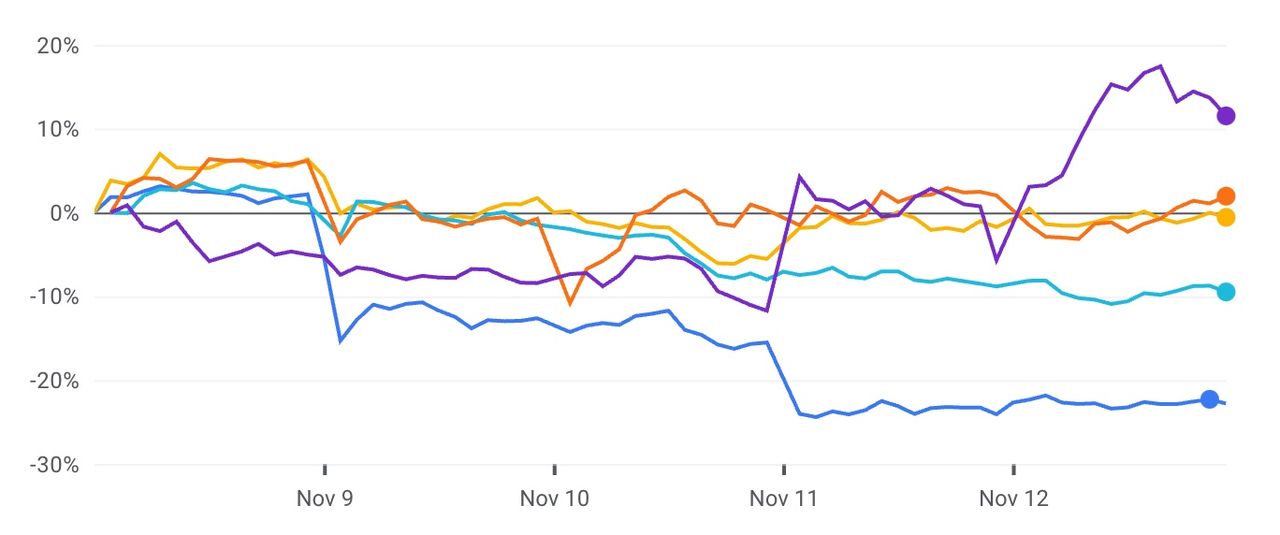

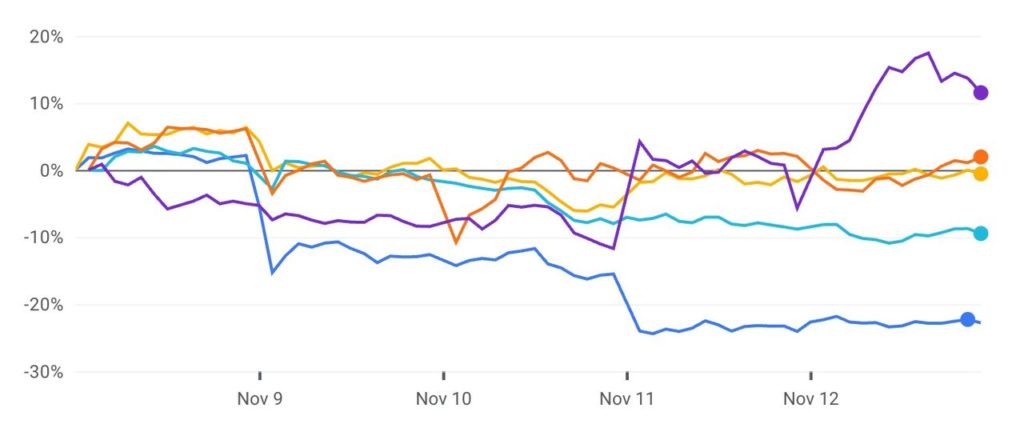

You can see this effect in this week’s stock chart, where 3D System in blue dropped, Xometry in purple rose, and the others were mostly flat.

One other item to note: Desktop Metal suffered a significant drop on the 8th upon news they had opened an internal investigation into a whistleblower complaint related to one of their recent acquisitions, EnvisionTec. Coincidentally, EnvisionTec CEO and board member, Ali El Siblani, announced plans to resign. It’s good to see Desktop Metal taking whistleblower complaints seriously, and although they have suffered a bit of a valuation drop here, I’m sure they will recover as things are sorted out.

Other Players

| RANK | COMPANY | CAP | CHG |

| 13 | Massivit | 125 | +4 |

| 14 | MeaTech3D | 82 | -3 |

| 15 | voxeljet | 61 | -6 |

| 16 | Aurora Labs | 12 | -4 |

| 17 | AML3D | 11 | -1 |

| 18 | Tinkerine | 2 | 0 |

| TOTAL | 293 | -10 |

The lesser valued companies tend to have much smaller shifts in their market capitalization because there is far less trading occurring on their stocks. The big money tends to hover around the larger players.

This week saw no positional changes in our chart, and most companies saw drops in value of various amounts. Massivit saw a gain of over three percent, likely on news of a new set of materials that opens up more application possibilities for the company.

Aurora Labs suffered a 25% loss in value, which is significant. After some looking around, it would appear this dramatic drop is due to an unusual capital raise offered by the company. In an announcement to shareholders, they said, regarding the price of the share offering:

“The issue price represents a discount of 17.9% to the last closing price recorded on the ASX on 3 November 2021.”

Evidently this move devalued the stock price accordingly: if a stock is sold at a price, that’s what all stocks are priced by observant investors, and that would account for the majority of the change.

Upcoming Changes

Desktop Metal announced the closing of their deal to acquire ExOne. This means that the ExOne stock listing will disappear, and the value of that company will be absorbed into Desktop Metal. Expect that company’s valuation to be quite a bit larger next week.

We are still awaiting the appearance on the market of two other 3D print companies. One is FATHOM, a digital manufacturer, which has been developing a SPAC (Special Purpose Acquisition Company) maneuver to complete later this year. The other is Fast Radius, a digital manufacturing cloud service.

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t know exactly what it is at any moment. The suspected bigger companies include EOS, Carbon, Formlabs and SLM Solutions.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.