Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

You might think it’s not important to monitor these companies each week, as their value is realized only when stocks are sold. However, events happen to companies occasionally that cause their value to rise and fall, and this weekly post is where we track such things.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s take a look at the 3D printing companies on this week’s list.

3D Printing Leaderboard

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 1,493 | +184 |

| 2 | Stratasys | 952 | +81 |

| 3 | Protolabs | 924 | +91 |

| 4 | Xometry | 824 | -571 |

| 5 | Nano Dimension | 798 | +70 |

| 6 | Desktop Metal | 715 | +241 |

| 7 | Velo3D | 600 | +21 |

| 8 | SLM Solutions | 538 | +1 |

| 9 | Materialise | 521 | +8 |

| 10 | Markforged | 297 | +41 |

| 11 | FATHOM | 161 | -1 |

| 12 | Steakholder Foods | 45 | 0 |

| 13 | Massivit | 40 | +1 |

| 14 | Freemelt | 27 | -4 |

| 15 | Shapeways | 24 | +1 |

| 16 | Titomic | 24 | +3 |

| 17 | voxeljet | 19 | -3 |

| 18 | Sygnis | 12 | +0 |

| 19 | Sigma Additive Solutions | 11 | 0 |

| 20 | AML3D | 11 | -0 |

| 21 | Aurora Labs | 5 | +0 |

| 22 | Tinkerine | 1 | +0 |

| TOTAL | 8,042 | +162 |

This week saw a nice, two percent rise in the total valuation of our leaderboard. Nice.

But that slim two percent hides the carnage and rocketry beneath, as certain companies rose and fell this week like missiles.

The reason for the big moves? It just happens to be the release dates of 2022 financials for many companies. For investors, it’s the reckoning of hype versus reality. Did the companies achieve what they said they intended on doing? Or did they fall short? Were the investments in these companies over- or under- valued?

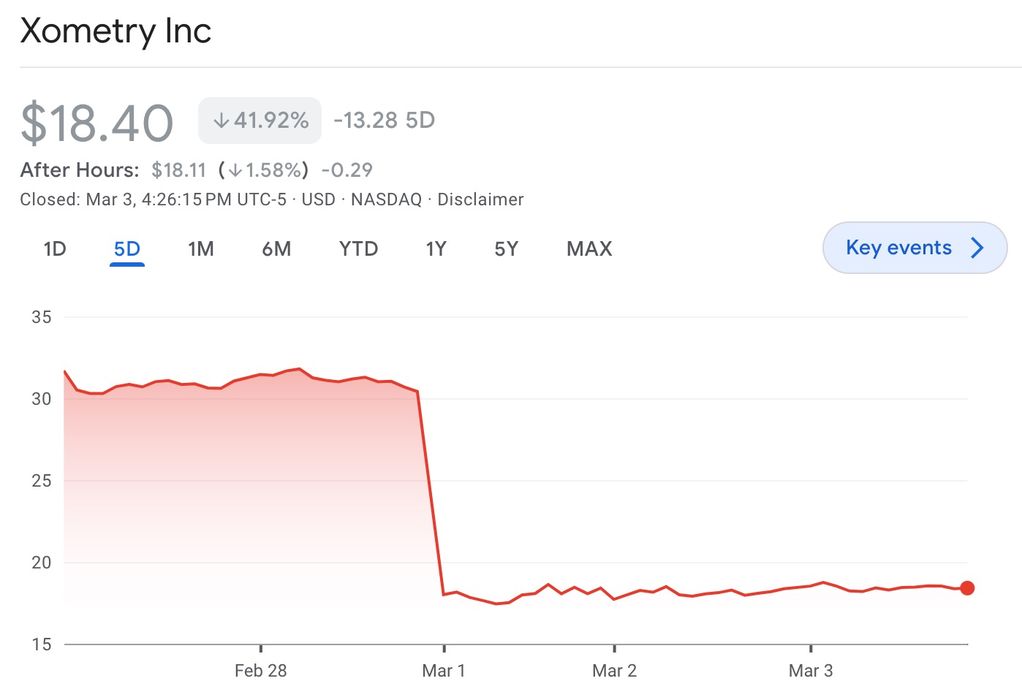

By far the biggest shift of the week was right at the top: Xometry, position one on our leaderboard for the pasts 42 weeks, dropped all the way to fourth position with an absolutely catastrophic 41% loss in value. In absolute dollar terms, they lost US$571M in value, more than half a billion dollars, in a single week.

What could have precipitated this dramatic price collapse?

First, remember that much of a leader’s value is predicated on the expectation of future growth. It turns out those expectations were deflated by the company’s latest financial results. They showed that while the company’s revenue increased, their losses also increased. This was clearly not the expectation of investors, who apparently expected profitability. The company missed their prior estimates, shaking investor confidence.

Their loss this week might be one of the largest we’ve seen on the leaderboard.

While Xometry had a tough week, that wasn’t the case for others. In fact, the leaderboard total rose in spite of Xometry’s massive drop.

Second spot 3D Systems, well, now in first place, rose an incredible 14% this week. The reason seems to be a combination of their financial report beating market expectations, and at the same time the company announced a program to cut costs. That’s important when you’re posting losses, and investors seem to recognize this.

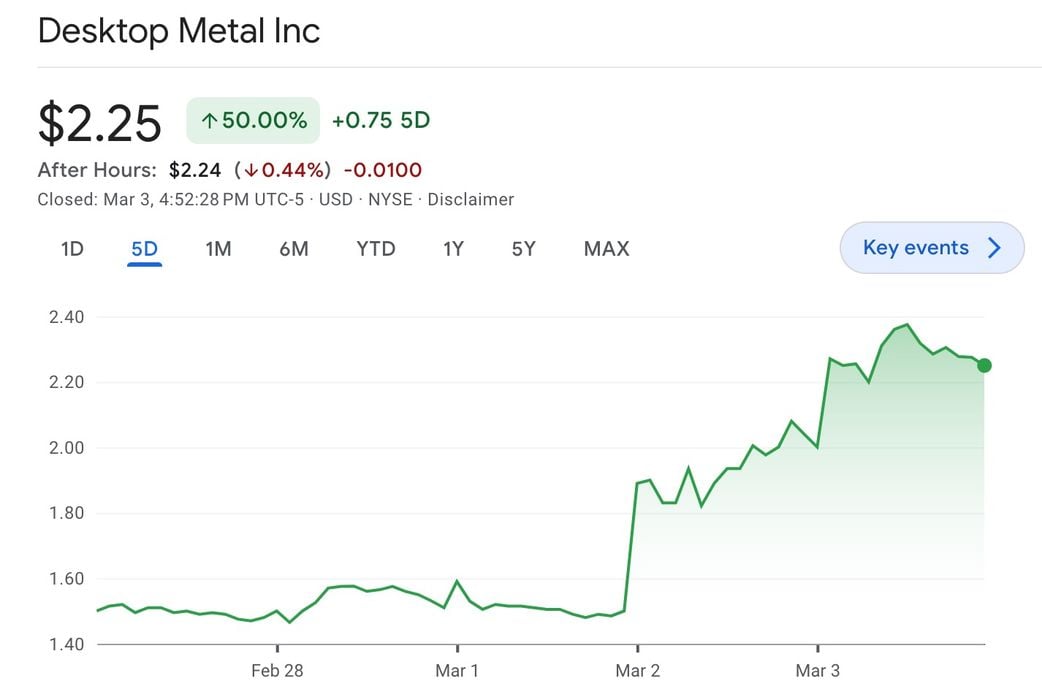

Desktop Metal rose an astonishing 51% in value this week, almost the opposite of Xometry. While the company is still posting tremendous losses (US$740M for 2022), they did almost double revenue and that’s now three years of what is becoming predictable growth. In addition, the revenue posted by Desktop Metal was quite a bit higher than analyst estimates, surprising investors. It seems that many see a bright future with Desktop Metal.

Then again, this is a pretty volatile market niche, as you can see above.

Upcoming Changes

A company set to appear was Essentium, who announced plans to use a SPAC-merger to launch on NASDAQ. However, that deal has been suspended so we’re wondering what the company’s next steps might be.

One company I’ve started to watch is ICON, the Texas-based construction 3D printer manufacturer. This privately-held company has been raising a significant amount of investment to the tune of almost half a billion dollars. At that level it is likely they will be discussing a transition to public markets at some point, which would certainly place them at or near the top of our leaderboard.

Another company that would seem logical to go public is VulcanForms, a manufacturing service using an advanced metal 3D printing process. They are currently privately valued at over US$1B, and going public could cause that to go even higher.

If you are aware of any other publicly-traded 3D print companies that should be on our leaderboard, please let us know!

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t know exactly what it is at any moment. The suspected bigger companies include EOS, Carbon and Formlabs.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.