Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

You might think it’s not important to monitor these companies each week, as their value is realized only when stocks are sold. However, events happen to companies occasionally that cause their value to rise and fall, and this weekly post is where we track such things.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s take a look at the 3D printing companies on this week’s list.

3D Printing Leaderboard

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 1,329 | +17 |

| 2 | Stratasys | 970 | -42 |

| 3 | Protolabs | 843 | +16 |

| 4 | Xometry | 684 | -27 |

| 5 | Desktop Metal | 673 | +16 |

| 6 | Nano Dimension | 667 | -3 |

| 7 | SLM Solutions | 656 | +10 |

| 8 | Materialise | 453 | +19 |

| 9 | Velo3D | 412 | -23 |

| 10 | Markforged | 170 | -19 |

| 11 | FATHOM | 90 | -7 |

| 12 | Steakholder Foods | 45 | 0 |

| 13 | Massivit | 39 | -1 |

| 14 | Freemelt | 30 | -1 |

| 15 | Shapeways | 20 | +0 |

| 16 | Titomic | 18 | -2 |

| 17 | voxeljet | 18 | +1 |

| 18 | AML3D | 11 | +0 |

| 19 | Sigma Additive Solutions | 11 | 0 |

| 20 | Sygnis | 10 | -2 |

| 21 | Aurora Labs | 5 | -0 |

| 22 | Tinkerine | 1 | -0 |

| TOTAL | 7,154 | -48 |

This week saw was pretty flat, with the leaderboard total dropping less than a percent. That is a bit curious, in a week where the market overall went upwards a percent or two, depending on which index you’re examining. Evidently 3D print technology was not viewed as favorably as other industries this week for some reason.

Being a pretty flat week, there were not a lot of big moves on the leaderboard.

However, one notable change came from Markforged, which dropped over ten percent in value this week. This is likely a lingering effect from their 2022 annual results that were released a couple of weeks ago, and some analysts are only now reviewing the material.

Their financial results showed that while their revenue increased eleven percent over the year, their gross profit actually decreased. Those are not critical numbers for any company, but the problem here is that the enormous valuations of companies near the top of the leaderboard are largely based on the expectation of future growth.

That means that any signal suggesting the expected growth may not occur or be less than expected automatically means a dent in the stock price. That seems to be what’s happening here.

Velo3D dropped over five percent this week, which, to be frank, is not unexpected with this company. Their valuation bounces up and down like no other company we track.

Materialise’s value rose by over four percent, beating the leaderboard average. This could be due to their recent announcement of a new process control system that should make their software even more attractive to clients.

Desktop Metal was the winner of the week with a modest two and a half percent gain. This increase is mostly likely associated with their March 1st financial release, where they reported generally good results. The company’s value has been slowly rising since then, and this week is most likely a continuance of that.

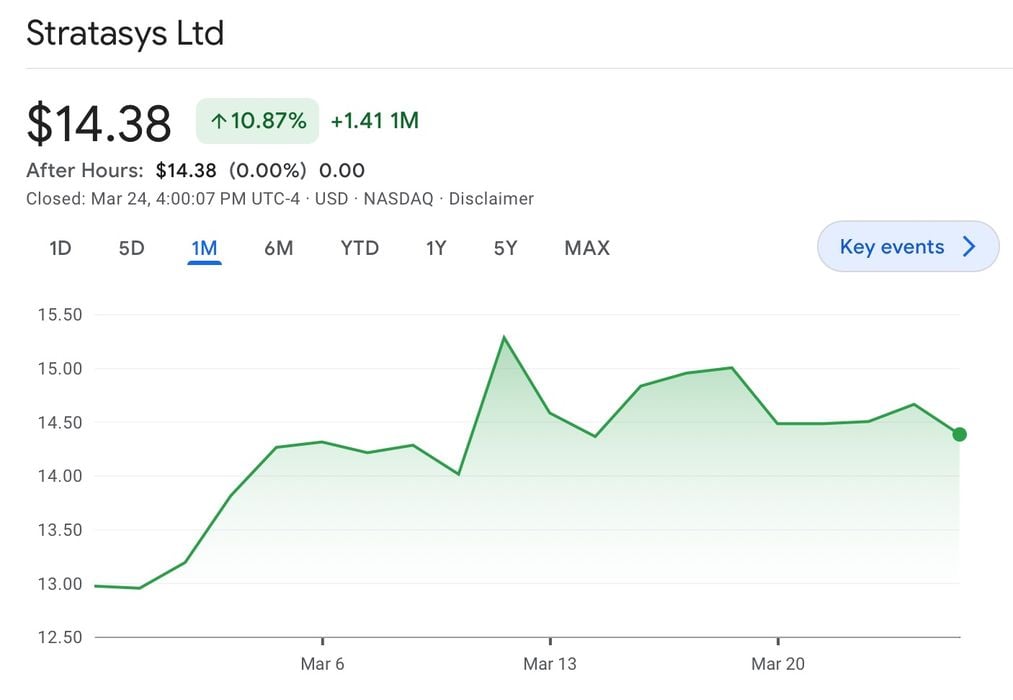

Finally, we have to look at two companies currently in the midst of a takeover bid: Nano Dimension and Stratasys. Nano Dimension publicly offered to buy the larger company at a slight premium over their current value, but this week was firmly (and “unanimously”) rejected by Stratasys’ board of directors. The Nano Dimension CEO, Yoav Stern, has taken to publishing daily unorthodox videos explaining his position.

My question is, how has this move affected the valuation of each of the two companies?

For Stratasys, it seems that the offer has boosted their value. Three weeks ago they were valued at US$952M, while this week they are at US$970M, having been as high as US$1030M in between. It seems the offer has brought good attention to Stratasys’ stock.

On the other hand, Nano Dimension was valued at US$798M three weeks ago, but their valuation has dropped each week since the offer. This week they are at US$667M, which is incredible because they hold a cash reserve of US$1.1B. How can a company be valued at less than what’s in their bank account? It may be because investors feel that the bank cash could be wasted on an acquisition that does not work out.

Nano Dimension dropped one spot on the leaderboard this week, by the way, overtaken by Desktop Metal.

Upcoming Changes

A company set to appear was Essentium, who announced plans to use a SPAC-merger to launch on NASDAQ. However, that deal has been suspended so we’re wondering what the company’s next steps might be.

One company I’ve started to watch is ICON, the Texas-based construction 3D printer manufacturer. This privately-held company has been raising a significant amount of investment to the tune of almost half a billion dollars. At that level it is likely they will be discussing a transition to public markets at some point, which would certainly place them at or near the top of our leaderboard.

Another company that would seem logical to go public is VulcanForms, a manufacturing service using an advanced metal 3D printing process. They are currently privately valued at over US$1B, and going public could cause that to go even higher.

If you are aware of any other publicly-traded 3D print companies that should be on our leaderboard, please let us know!

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t know exactly what it is at any moment. The suspected bigger companies include EOS, Carbon and Formlabs.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.