Charles R. Goulding examines how Whirlpool’s use of 3D printing for parts on demand might expand across appliance suppliers.

In the May 31st Barron’s issue with an article aptly entitled The Everything Shortage, appliances are the top categories featured with the byline “Where is my Washer”. The appliance component shortage is a function of overall COVID-19 related disruption plus the strong demand from the new and renovated residential home market.

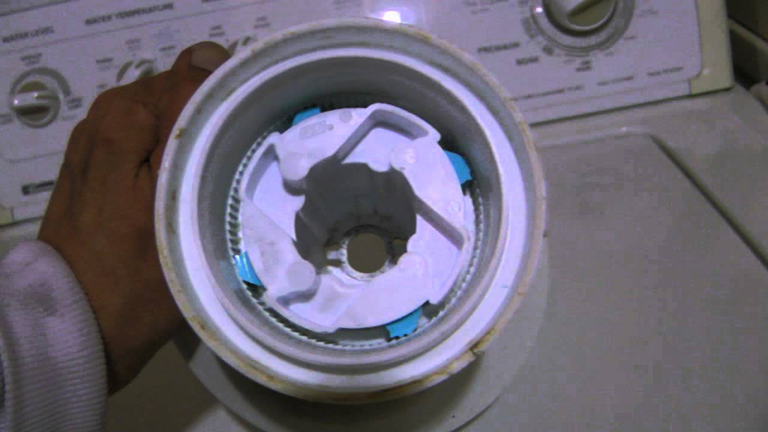

Whirlpool is a U.S. multinational giant with sales of $21 billion, 92,000 employees and over 70 locations. Famous brands include Maytag and Kitchen Aide. Whirlpool has extensive 3D printing expertise; the company has integrated SpareParts3D to create spare parts on demand and Digiparts software to analyze every part’s potential for being 3D printed.

These initiatives include matching part obsolescence metrics to the decision-making. This comprehensive approach enables the customer to get the parts they need when they need them while enabling the company to optimize inventory costs by reducing excess inventory. In a time of component shortages, Whirlpool should be able to use its demonstrated 3D printing expertise to solve additional component shortages.

Whirlpool’s U.S. manufacturing plants are in the Midwest and Whirlpool considers the Kansas City Southern (KCS) railroad, an award-winning vendor. The ongoing acquisition of KCS by the Canadian National Railway should further enhance Whirlpool’s shipping processes from Canada to Mexico.

Companies engaged in 3D printing activities similar to Whirlpool may be eligible for Research and Development tax credits.

The Research & Development Tax Credit

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Whirlpool is an accomplished user of 3D printing technologies. While it may be confronting some temporary supply chain disruption, 3D printing and an improved rail market should enable the company to manage the current challenge quicker.