Charles R. Goulding and Valentina Alzate review the use of personal 3D printing by a noted designer.

The Financial Times’ recent interview with Corin Mellor, creative director of David Mellor Design, is intriguing. David Mellor Design is a renowned cutlery and kitchen accessory design company which was begun by David Mellor. Mellor is considered an important designer in the UK, known particulary for his expertise in metalwork and cutlery.

Corin Mellor, continuing his father’s legacy, has worked to expand the David Mellor Design product line, as well as to leverage his own expertise in architecture to design the interiors of the David Mellor Design shops.

As mentioned in the Financial Times article, Mellor’s studio is a large building on a portion of his residence connected by a bridge. One of Mellor’s prized positions is a vintage 1966 Corvette, which he keeps in a garage that has become too small for his impressive collection of vintage cars. Mellor commented that he liked the 66 Vette because he likes the mix of art, craft and design which seems to describe his own artisan fabricator expertise.

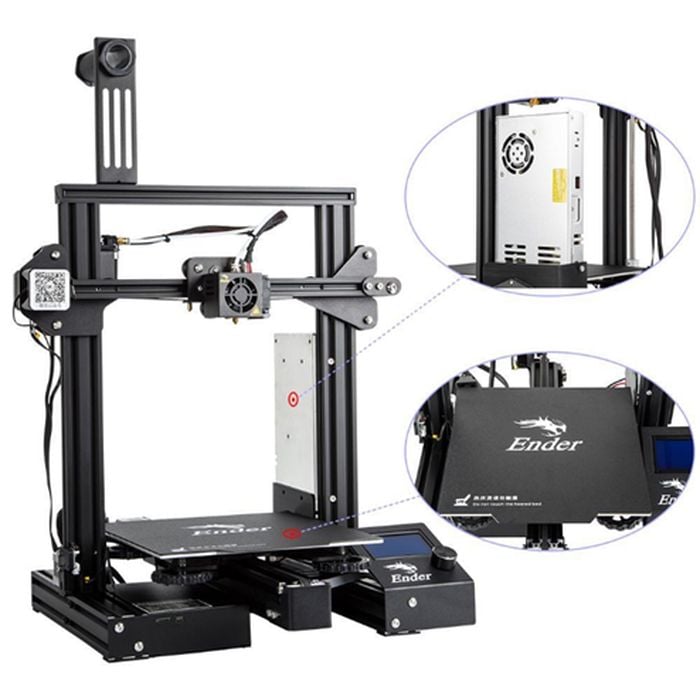

Mellor recently purchased a Creality Ender-3 Pro 3D printer, ostensibly for his son, but in actuality he has personally monopolized it ever since its purchase. The Ender-3 Pro offers good quality printing thanks to its precise positioning and stable structure. This machine also utilizes a V-profile as opposed to an iron profile, which allows for greater wear resistance, a lower noise profile, and more stable running. Mellor has admitted to using the Ender-3 Pro almost every day, possibly modeling prototypes of his designs. Mellor also uses a Bridgeport milling machine.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

When an established designer/fabricator embraces 3D printing in a personal sense, it’s likely that industrial use could follow.