Charles R. Goulding and Preeti Sulibhavi look at developments from Caterpillar.

In a great example of a circular, sustainable economy, Caterpillar, the large farm, construction and mining equipment manufacturer, is rebuilding and recycling large numbers of used engines. In a May 11th Wall Street Journal (WSJ) article, it was reported that in 2021 Caterpillar took in 127 million pounds of used equipment to be reprocessed.

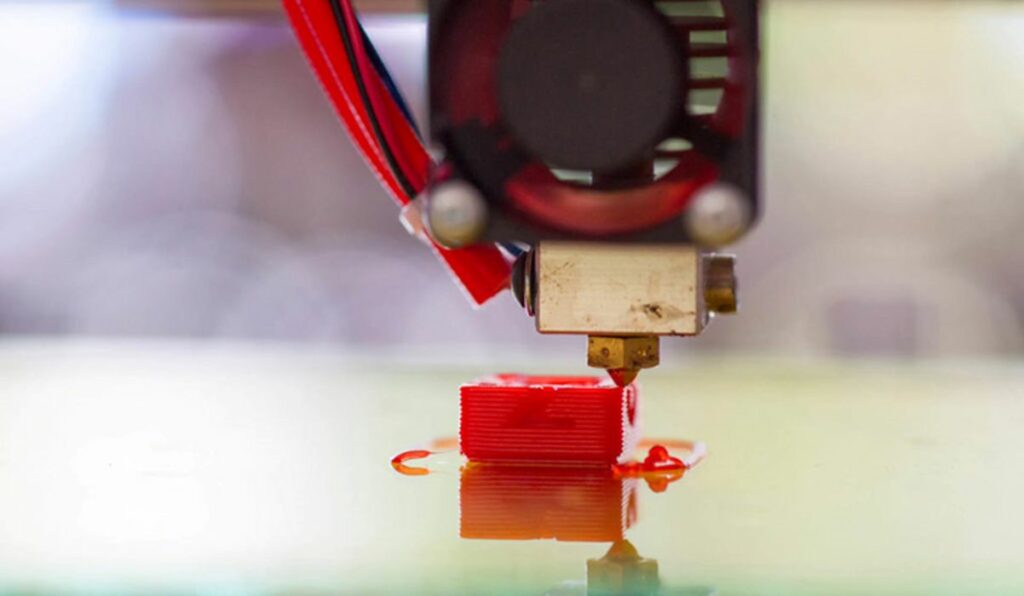

Caterpillar has been a long-standing major user of 3D printing technology. Caterpillar is also remanufacturing entire excavators. Caterpillar can use its 3D printing expertise to manufacture needed replacement parts for any used engine. The growing replacement engine and excavator segments are also available to fill supply chain gaps.

Other heavy-equipment manufacturers are pursuing similar efforts according to the WSJ article. Farm equipment producer AGCO Corp indicated that it wanted to increase its manufacturing revenue 150% by 2025 in comparison to levels in 2020.

In 2021, AGCO Corp generated $68 million in manufacturing revenue. Deere & Co reported $360 million in re-manufacturing revenue last year and has targeted a 50% increase by 2030. Caterpillar declined to disclose its remanufacturing revenue at this time. All the companies recycling used equipment can use these accomplishments in their sustainability disclosures which will help their ESG efforts and attract investors.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Recycling used equipment has multiple benefits for the environment, inventory planning, and improving supply chains. 3D printing should be an integral part of these efforts.