Charles R. Goulding and Preeti Sulibhavi look at how 3D printing could play a role in a major submarine deal.

The news media has been focusing on France’s outrage about having a large US$90B contract for Australian submarines suddenly taken away from them by the UK and the U.S. This has turned into a major diplomatic incident, with France withdrawing its ambassador to the U.S.

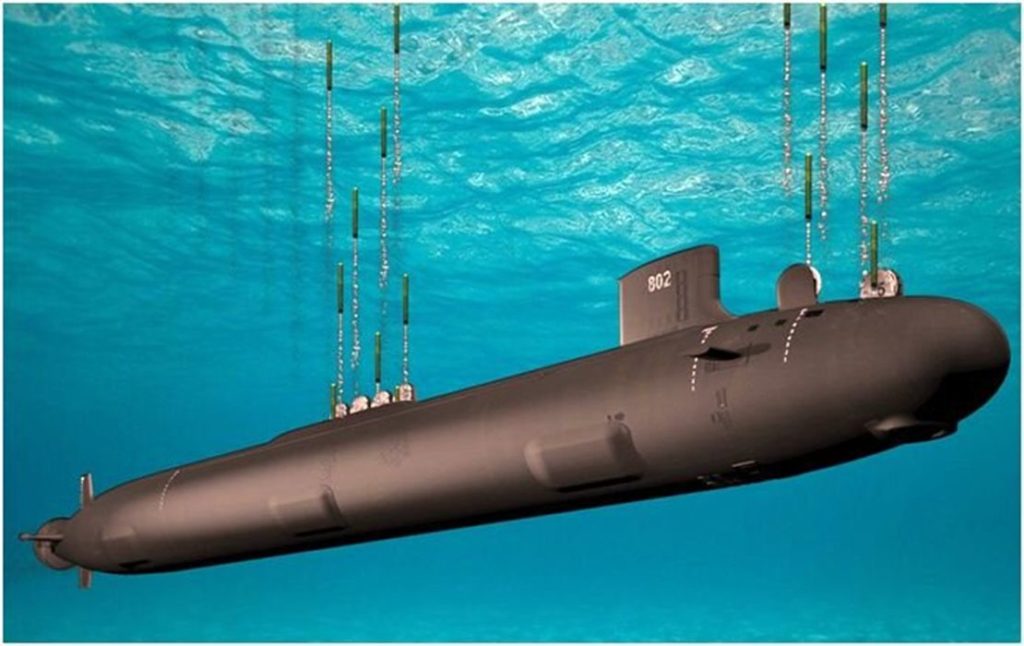

However, there is a back story since the Australians were having second thoughts about the utilization of diesel propulsion technology (requiring regular re-surfacing called “snorting”) versus the United States’ deep expertise in long-running, below surface, high endurance, nuclear propulsion technology.

The U.S. has critical security interests in the Western Pacific and needs to keep a watchful eye on China. The U.S. has entered a security partnership with the UK and Australia called AUKUS.

The U.S. shipbuilder leaders are General Dynamics’ Electric Boat Division and Huntington Ingalls Newport News and Ingalls’ shipyards. The real business opportunity with these huge contracts is the highly profitable long-term parts annuities. Securing the replacement parts business is a major opportunity for the 3D printing industry and we have recently written about how Singapore has become the Asian 3D printing epicenter (particularly for maritime parts).

The U.S. has commenced a major multiyear new submarine project and Australia can benefit from the concurrent knowledge accumulating with this initiative. The U.S. Navy research resources have been making a large investment in 3D printing, which hopefully will be integrated into all the submarine build programs.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

There are many ways to approach a problem. For the Australian Submarine Contract, 3D printing offers a variety of resources for parts and components.