Charles R. Goulding and Preeti Sulibhavi look at Tata Group’s use of 3D printing technologies.

In an effort to streamline all of Tata Group’s subsidiaries and related companies, Tata Group’s Chairman, Natarajan Chandrasekaran, is merging seven smaller metal units. This move is intended to form a leaner, fitter, Tata Group and reduce costs while boosting its asset portfolio.

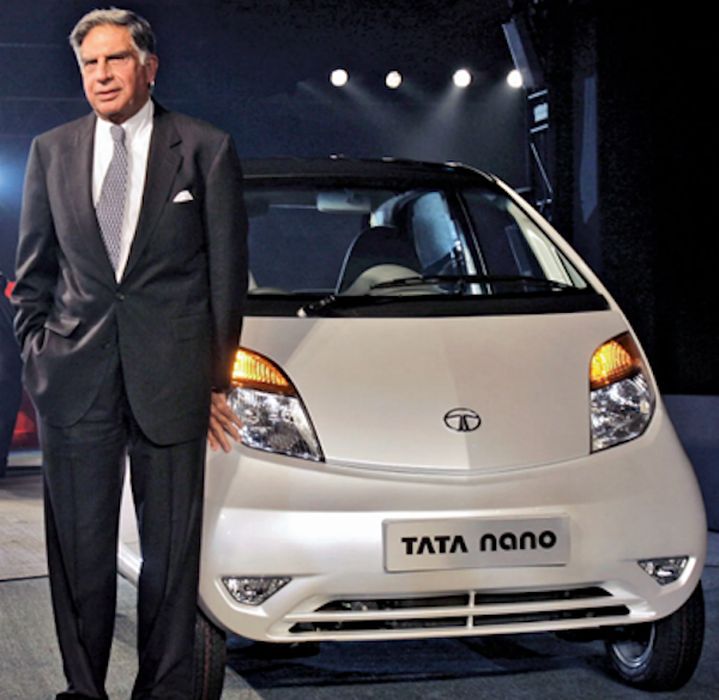

Before it was the global conglomerate that it is today, Tata was founded in 1868 in Mumbai, India by 29-year-old Jamsetji Nusserwanji. For Fiscal Year 2022, Tata Motors had sales of US$128B and it employed almost 935,000 people, globally. We have previously written about Tata’s bitter succession battle before on Fabbaloo. In fact, Tata Group, the 154-year-old industrial giant that provides everything from automobiles to Starbucks to Indians, has been utilizing 3D printing recently, in unique ways.

Many Americans are aware of Tata’s Land Rover and Jaguar product lines.

Tata and 3D Printing

Tata has been using high-quality industrial 3D printers to manufacture automobile plant and factory accessories. The company has been 3D printing gloves for its workers in its Jaguar Land Rover facility. The gloves are specially printed to prevent musculoskeletal disorders. This move came as the company found 30% of its workplace injuries were due to musculoskeletal disorders. The innovative latticed structure protects employees while working on assembly lines.

Tata is also taking advantage of Stratasys’ Objet500 Connex printer to produce small, single-material rigid Jaguar Land Rover parts. Tata cites 3D printing’s speed and simple post-processing capabilities as its reasoning for this shift.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

As Newton’s third law states, “every action has its equal and opposite reaction.” While Tata’s chairman is taking action to form a slimmer, leaner Tata Group, the equal but opposite reaction is to use 3D printing for growth and innovation in the industry.