[Source: Medical Expo]

Charles R. Goulding and Ryan Donley examine the ramifications of Stryker’s acquisition of Wright Medical.

Another high-profile acquisition is set to have implications on medical 3D printing.

Stryker, one of the global leaders in medical technology, announced in November 2020 that it will acquire Wright Medical, a company recognized as a leader in medical technology in its own right. Stryker (SYK) is a publicly traded company on the New York Stock Exchange and worth approximately $15 billion. Wright Medical (WMGI) is also a publicly traded company on the New York Stock Exchange worth approximately $1 billion, prior to the deal that is valued at $5.4 billion. Wright Medical brings aboard a full product portfolio of upper and lower extremity implants including over 100 patents for their implant products. The merger of these two orthopedic giants presents an opportunity to flesh out a full complementary product line within the same market segment.

“This acquisition enhances our global market position in trauma and extremities, providing significant opportunities to advance innovation and reach more patients. We welcome the Wright Medical team to Stryker and look forward to growing the combined business by delivering solutions that improve patient outcomes,” said Stryker Chairman and CEO Kevin Lobo.

Stryker operates across numerous medical device networks that include extremities and biologics and have been keen on 3D printing practices in these fields. Stryker’s already deep portfolio of implant products such as spinal and knee products gains more depth as Wright Medical adds to the flow of Stryker’s activities as they have a leading 3D printing ankle replacement practice backed by their Total Ankle Institutes INFINITY, INBONE, and INVISION initiatives for extremity implants.

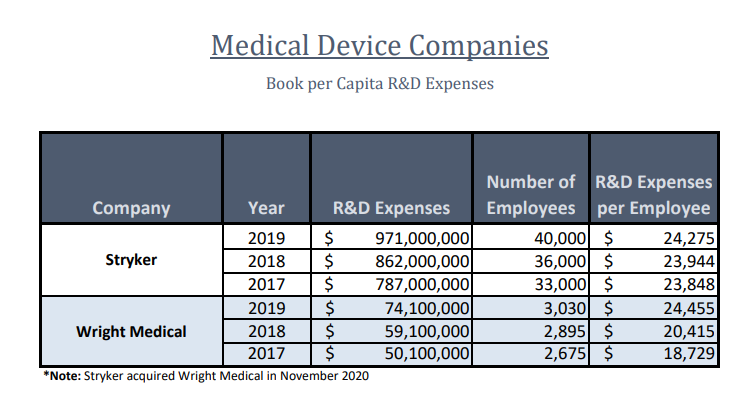

The merger fits just right for the two companies as they also gain an advantage in serving the same customer bases including sales, distribution and financing initiatives. Even though the two companies have a vast difference in size, their expenses in R&D Per Capita per employee is strikingly similar as shown below:

Examples of Stryker 3D Printing Medical Practices

Stryker has been an early adopter of additive manufacturing practices as they were one of the first medical companies to invest in Concept Laser and Arcam Machines (both later acquired by GE Additive) and leverage 3D printing in the healthcare industry. The early adoption of additive manufacturing came to fruition in 2017 when Stryker entered in agreement with GE Additive to partner in the growth of additive manufacturing including new additive machines, materials, and services for Stryker’s global supply chain.

A unique segment of Stryker had been Tritanium Technology which has been a major piece of their portfolio. Tritanium products include a wide range of unique products designed and developed for bone-in growth and biological fixation such as the Tritanium PL Posterior Lumbar Cage and Tritanium Anterior Cervical Cage.

The Posterior Lumbar Cage is a hollow rectangular implant that consists of a configuration of both solid and porous structures built using additive manufacturing. The implant was designed to mimic cancellous bone with interconnected pore structures being randomized for better endplate to endplate insertion. The Anterior

Cervical Cage is built utilizing the same practices and is design to minimize subsidence to the impacted area. The porous structure has an elastic modulus that can fit between cancellous and cortical bone. The results have shown a reduction in overall stiffness to the cage and allowing room for a bone graft to fit correctly as well as a unique surface area design to assist in normalizing load transmissions.

Both examples of the Tritanium products also present a new avenue towards imaging as the products can be visualized on CT and X-Rays. These products also present a small insight into Stryker’s robust additive manufacturing practices.

Examples of Wright Medical 3D Printing Medical Practices

Wright Medical’s Total Ankle Institute is comprised of three programs known as INVISION, INBONE, and INFINITY. All three programs utilize components and processes in conjunction, however, each serves a different purpose in ankle orthopedics. INVISION has the Total Ankle Revision System which is designed and developed with ankle revision surgery in mind. INBONE has the Total Ankle System designed and developed for complete ankle replacements. INFINITY is another Total Ankle System product that serves as a scaffold to facilitate bone in-growth utilizing 3D printed porous metal components. The ankle replacement programs are all a continuum of products designed and developed to work complementary in ankle implant surgeries.

3D printing and similar activities in the medical field may be eligible for the R&D Tax Credit, which is briefly described below.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The acquisition of Wright Medical by Stryker presents a unique opportunity for further experimentation in the medical tools and technology field. The combination with Wright Medical’s expertise in 3D printing of implants and Stryker’s enormous presence in 3D printing for healthcare could lead to significant advancements in the fields of implant surgeries and patient care.