Charles R. Goulding and Preeti Sulibhavi examine the legacy and high-tech steel environment in the U.S.

The U.S. has evolved in a two-tier steel production cost environment. We have large, old legacy plants that have high fixed costs and in some cases have actually shuttered some very large plants due to their high costs of production. However, we also have more modern new technology, lower-cost production steel plants that have evolved to be today’s industry leaders.

For the high-cost examples, two major steel producers, U.S. Steel and Cleveland Cliffs, have idled 7 million square feet of facilities they consider non-competitive because they are too costly to operate and upgrade. America’s largest steel producer, Nucor, is considered a low-cost producer. We have previously written extensively about Nucor. Nucor is virtually integrated and has its own 3D printing final product capability.

John Ferriola, former CEO of Nucor and now on the Board of Directors for Uniformity Labs, believes that it is exciting to watch the additive manufacturing industry advance as one of the most transformative innovations in modern times and that Uniformity Labs’ technology and advanced printing process is helping the industry leapfrog to the next level by greatly improving capital efficiency with faster production speeds and much higher quality output. This is indicative of how Nucor and the 3D printing community are in a symbiotic relationship.

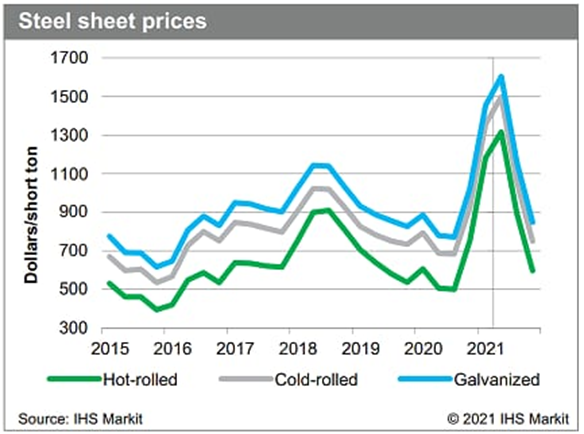

Steel Dynamics, another large steel producer headquartered in Fort Wayne, Indiana, is also considered a low-cost provider and has a large new plant in Texas. Steel Dynamics also has some end-use product lines. In an excellent Yale School of Management article about Titan Steel of Baltimore, Titan’s management explained how in today’s global market steel suppliers and their customers must be nimble and closely manage supply chains and product mix. Steel prices have recently tripled and are at a 10-year high in the U.S.

Now that metal 3D printing is mainstreaming and confronting this level of pricing volatility 3D printing steel end-users have to get a better understanding of steel market dynamics.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software. Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent. As of 2016, eligible startup businesses can use the R&D Tax Credit against $250,000 per year in payroll taxes.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

When raw material prices are tripling it is a challenging business environment for 3D metal purchasers. 3D printed metal users are going to need to get savvy about steel purchasing strategies including global sourcing, and, utilizing supply chain commodity purchasing optimization software.