Charles R. Goulding and Preeti Sulibhavi look at how ESG goals are assisted by additive manufacturing in the snowmobile industry.

The May 16th issue of the New York Times (NYT) had a front-page article on Taiga Motors (Taiga) headquartered in Quebec, Canada and the manufacturer of the first, widely sold, electric snowmobile. Taiga’s first fleet sale was to Tao Ski Valley in New Mexico.

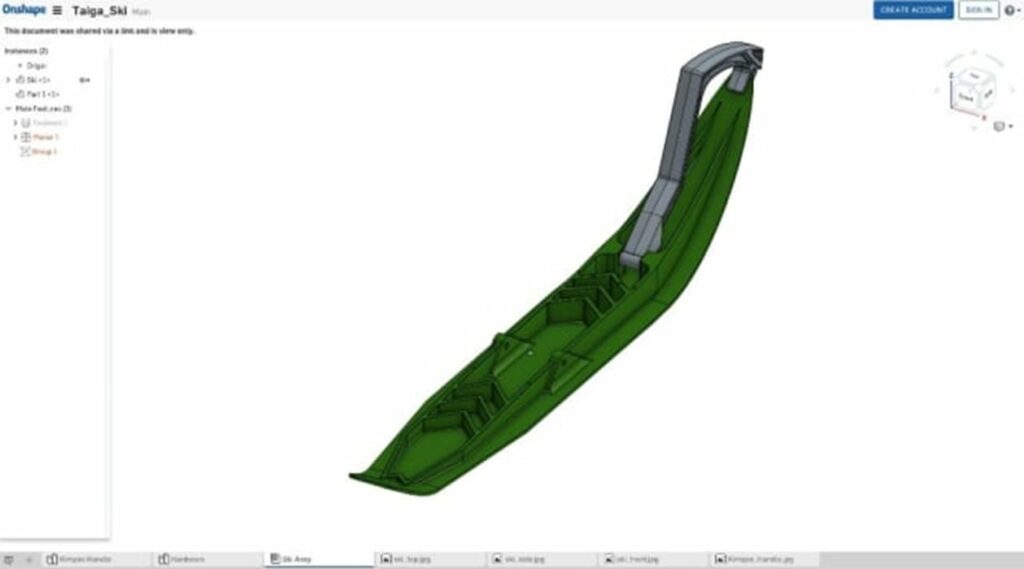

To meet their ESG goals the large ski mountain chains will be carefully monitoring these developments. We like new product categories that make use of 3D printing and the cofounders of Taiga, Gabriel Bernatchez and Samuel Bruneau, used 3D printing from the onset. Since their first prototype was fabricated using a 3D printer in 2017, Taiga has used 3D printing not only to solve manufacturing issues but to help our environment as well.

Taiga also makes electric watercraft. These vehicles use similar advanced technologies as well.

The company went public at the beginning of 2022 and had a market valuation of over US$400M. Replacing small motor gasoline equipment is very beneficial for the environment because unlike large vehicles they don’t have catalytic converters to cleanse emissions.

The Quebec location is nostalgic since Bombardier created the first snowmobile, which became the market-leading brand, Ski-Doo. Ski-Doo is now part of BRP Inc, a large multi-product manufacturer including ATVs with sales of US$1.8B that has recently announced a five-year investment plan of US$300M to electrify all of its vehicle lines.

We have previously written about the large off-road vehicle manufacturer, Polaris which also plans to electrify its wide range of vehicles.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Multiple small, gasoline engine categories are quickly going electric. The 3D printing industry needs to be part of this trend.