Shapeways is set to become SHPW on the NYSE via SPAC.

That’s a lot of acronyms; let’s spell it out. Digital manufacturing mainstay Shapeways Inc. has entered into a merger agreement with Galileo Acquisition Corp., which is a special purpose acquisition company (SPAC). Following the closure of this deal, the new Shapeways Holdings, Inc. will be traded on the New York Stock Exchange (NYSE) under the ticker symbol “SHPW”.

Shapeways Digital Manufacturing

Shapeways is a mainstay in not only digital manufacturing, but also here at Fabbaloo. We’ve been covering the company for years now, and have had opportunities to visit the company in NYC as well as keep up with the CEO.

Shapeways offers digital manufacturing services from end to end, offering everything from design to production and shipping. The company is hardware and material agnostic, working with a variety of technologies from a variety of manufacturers. Today, they offer 11 different 3D printing processes with more than 90 materials and finishes.

They’ve also now delivered more than 21 million parts to a million customers in more than 160 countries.

The metrics are there, the expertise is there; it’s no surprise the company has drawn attention.

Shapeways SPAC

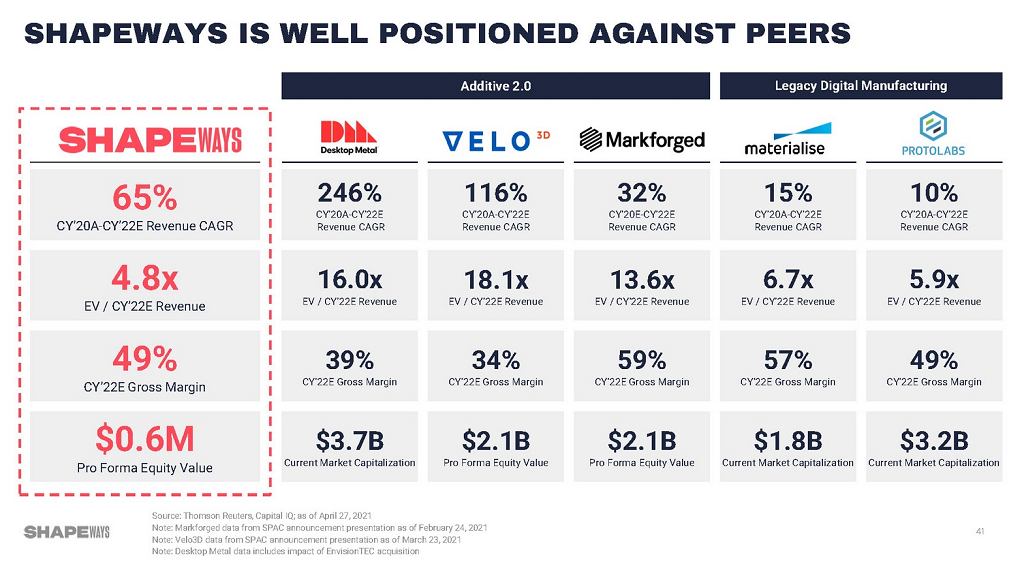

Shapeways is the latest company in the 3Dp printing world to go the SPAC route. They join the likes of Desktop Metal, Markforged, and VELO3D in maneuvering to the public world via SPAC.

The partner this time around, Galileo Acquisition Corp., has a “serial SPAC team” that has already “successfully completed four business combinations, plus Shapeways in progress.” Experience is good in this sort of deal, and finding the right fit is a vital two-way street.

In today’s investor call, Alberto Recchi, Co-Founder and CFO of Galileo Acquisition Corp., explained:

“Galileo was established to focus on companies with a US and European nexus, with a generalist approach, including specialty industrials, targeting high-growth companies that are poised to capitalize on their differentiated technology. Galileo assembled a diverse team of professionals from Europe and the US with proven track records of principal investing, M&A and public company operating experience in both the North American and European markets. In particular, we have a long and successful history of leading SPACs having completed four successful business combinations prior to this transaction with Shapeways.

Over the course of the last year and a half we embarked on an extensive search which included over 200 potential targets. By far the most exciting of these was Shapeways, which is led with passion and great professionalism by Greg [Kress, CEO] and his team. We were highly attracted to Shapeways as a unique and compelling investment opportunity due to its proven, high quality, flexible on-demand digital manufacturing platform and proprietary, purpose-built software which fills a major gap in the global manufacturing marketplace.”

Recchi highlighted the Shapeways management team, particularly CEO Greg Kress and CFO Jennifer Walsh, both of whom have been in their roles for three years and, Recchi said, “during this time have expanded the enterprise capabilities of the business, go-to-market strategy, and substantially improved gross profit margins.”

Along with the team’s leadership is what the company does, of course. Recchi pointed to another key here: timing.

“The additive manufacturing industry is approaching an inflection point. We believe it is at the brink of moving from prototyping parts and tooling, to production at scale. In our opinion this will unlock large adoption and drive growth over the next decade.”

Shapeways on the NYSE

The financials are of course intriguing in moving to the publicly traded market.

The announcement explains:

“The business combination values Shapeways at a $410 million pro forma enterprise value, at the $10.00 per share PIPE price which implies an equity value of $605 million assuming minimal redemptions by Galileo shareholders. The transaction will provide more than $195 million of net proceeds to the Company, including a $75 million fully committed common stock PIPE anchored by top-tier institutional investors including Miller Value Partners and XN, along with a strategic partner Desktop Metal. Cash proceeds will primarily be used to accelerate Shapeways’ metal additive manufacturing capabilities, expand the Company’s material and technology offerings to extend market reach and grow customer share of wallet as well as to provide additional working capital.”

Going a bit further into the figures and partners here, Shapeways CEO Kress added on today’s investor call:

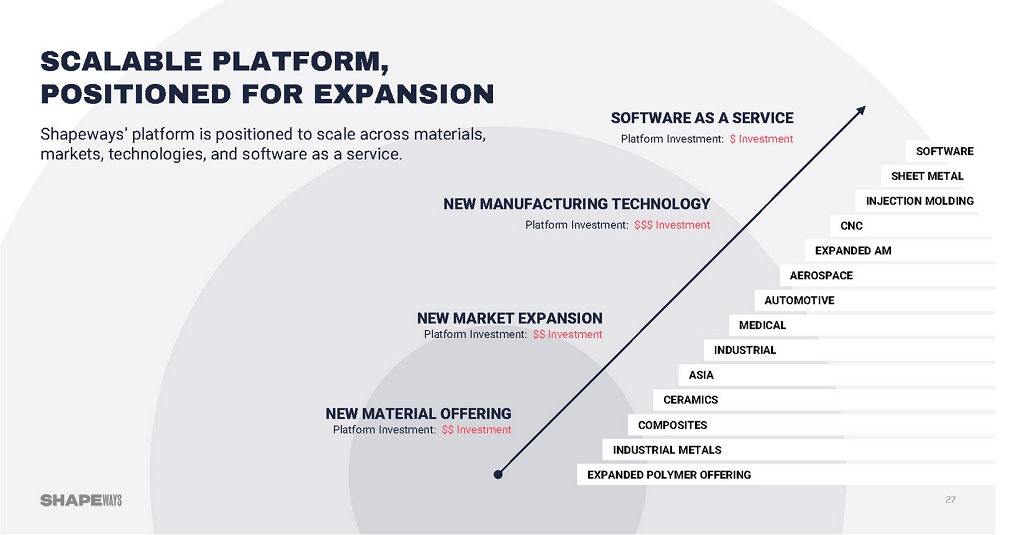

“With this capital injection, Shapeways is positioned to continue to invest in scaling the business further to address the market needs and enable global manufacturing with our proprietary software. Shapeways is projecting growth to ramp from $32.8 million in revenue in 2020 to over $400 million in revenue in 2025, representing a 66% compounded annual growth rate all while further expanding gross margins to over 50%. As we look at our projected revenue build over the next few years we know that historically our customers have grown with us. We know how to add and optimize new manufacturing technologies as we have demonstrated in the past. We are also planning to further commercialize our software that will provide new revenue opportunities in the form of implementation fees and licensing fees. We believe this revenue growth and margin expansion will ultimately lead to higher cashflow and EBITDA. We are projecting over $100 million in adjusted EBITDA by 2025 and believe we will be cashflow and EBITDA positive by 2023. This plan is fully funded and does not require additional funding to meet these targets.

With this capital injection, we plan to invest $100 million in CAPEX over the next five years into new technologies and materials to fuel our growth. To help accelerate this roadmap, Shapeways has signed a strategic partnership agreement with Desktop Metal, a leader in additive manufacturing metal technology, which enables Shapeways to effectively expand its metals portfolio.”

The strategic partnership with Desktop Metal is of course an interesting addition to all these goings-on. A lot of Shapeways’ available materials are in the polymer realm, and working with Desktop Metal will help broaden the focus into more metals. Further, Shapeways seems to be examining future broadening in composite and ceramic materials.

Additive manufacturing has long been the peg on which Shapeways hangs its hat — but more options for manufacturing technologies will add more for customers. Through work with “supply chain partners,” Shapeways is also eyeing adding CNC, injection molding, and sheet metal capabilities.

On top of materials and technology expansion, Shapeways is also considering geographic expansion. The announcement highlights Asia as “an attractive opportunity for expansion beyond the United States and Europe.” The investor presentation particularly highlights Taiwan, India, South Korea, Japan, and China.

The deal is expected to close in Q3 20201.

Disclosure: Shapeways has been a client of mine through Additive Integrity for content services; this piece is outside the scope of that relationship and is solely produced for Fabbaloo.