Charles R. Goulding and Preeti Sulibhavi propose that the new CEO of Adidas should increase that company’s already notable use of 3D printing.

There is a new CEO in town. His name is Bjørn Gulden, and he is now “running” Adidas.

We have previously written about how new CEOs impact 3D printing companies.

Adidas began in Germany, in 1924, by Adolf Dassler, who persuaded Jesse Owen to use the shoes in the 1936 Summer Olympics.

While Gulden is still in the initial phase of establishing his plans for Adidas, we see this as a great opportunity for Adidas to think out of the box and perhaps utilize more 3D printing for manufacturing than it has already been integrating.

Adidas is also beating the Street. Operating profit was higher than anticipated at approximately US$76M and this news helped raise the stock price up 7%.

This is the perfect time to strategize how the company can utilize more 3D printing in its design, development and even manufacturing processes.

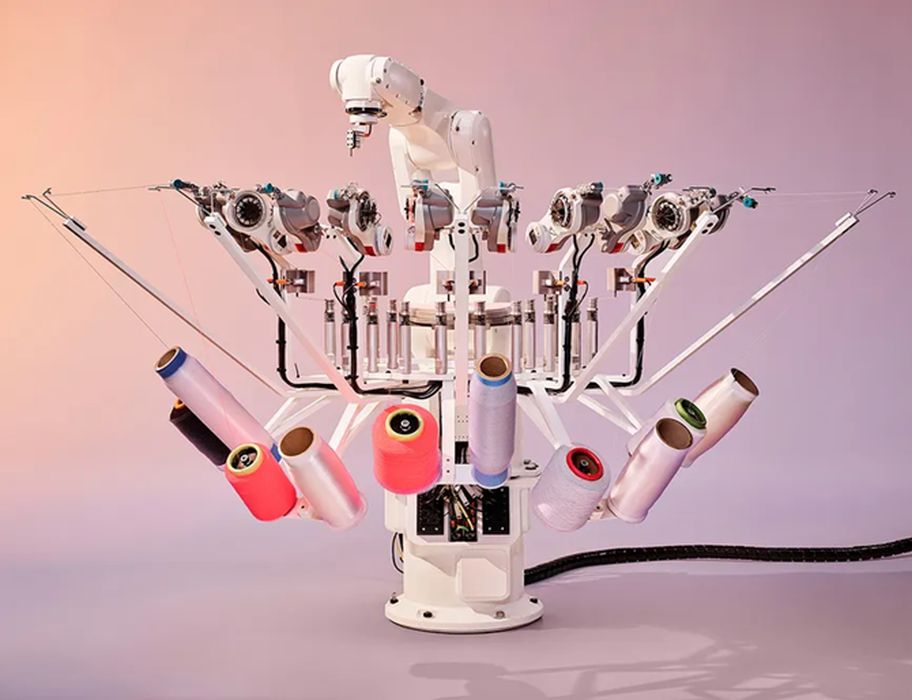

In 2021, Adidas released Futurecraft.Strung, a sneaker that is made with both robotic automation and 3D printing. For Adidas, using a customized, 3D-printed sole, a Futurecraft.Strung manufacturing robot can place some 2,000 threads from up to 10 different sneaker yarns in one upper section of the shoe. This is also helping to solve complex geometry design issues as well as create a fast, functional, and fashionable running shoe. This was one of the first mass-produced 3D printed consumer products visible to the public.

We have covered slip-on sneakers, Nike Spikes, Nike Vaporfly, Puma and how 3D printing is disrupting the footwear industry in general on Fabbaloo.

But this is a once in a generation opportunity for Adidas to really bring 3D printing to scale, potentially.

The sports and athletics industry can greatly benefit from the high-quality, lightweight yet durable nature of 3D printed products. One concern is athlete performance but balancing that is safety.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

There is more than just a sneaker at stake here. Under Gulden’s leadership Adidas can take on 3D printing with a running head-start.