In the wake of the Stratasys merger shipwreck, Desktop Metal is more confident than ever that it can achieve mass production (and profitability) on its own.

Ever since Stratasys and Desktop Metal signed their merger agreement last May, a lot of press releases and statements about the deal have populated our daily industry insights content. Many had things to say about the merger but one company remained surprisingly quiet: Desktop Metal. So, when Ric Fulop, the company’s Co-founder and CEO, said he wanted to speak with VoxelMatters about the implications of the merger not going through, we welcomed the opportunity to finally understand his point of view.

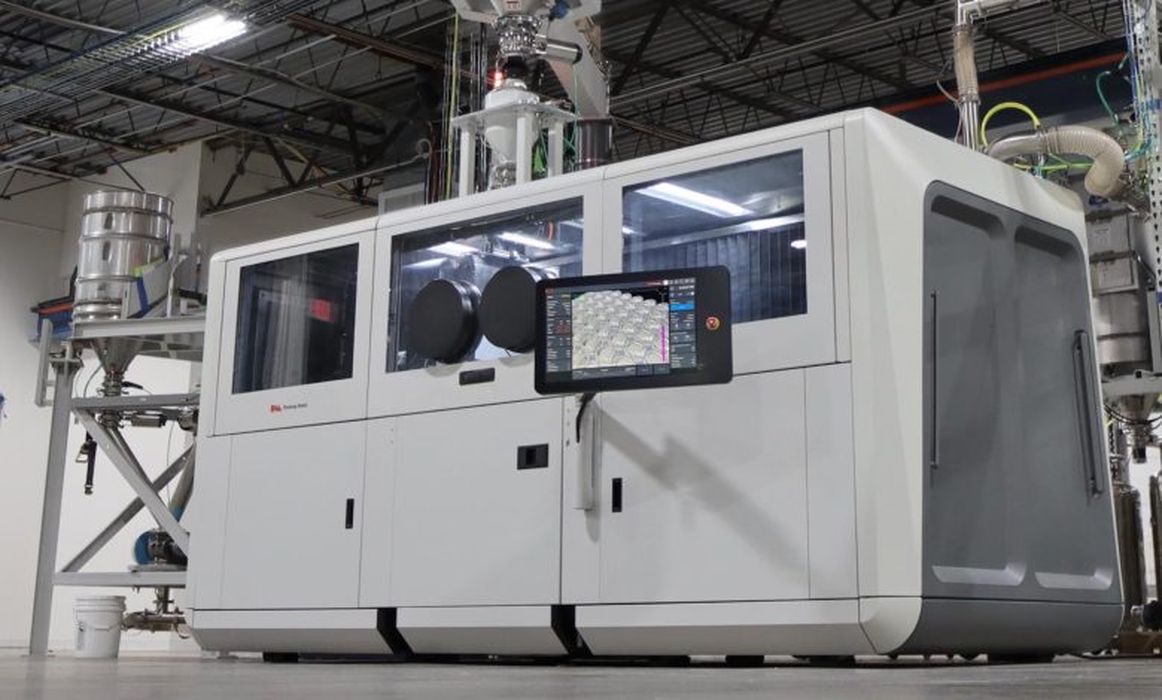

We found that, while many considered the merger as a last resort to realize Desktop Metal’s vision of bringing metal AM into mass production, in reality, the company’s management has been working quietly to cut costs and grow the adoption of its technologies. Many forget that these are not just any technology but some of the most market-ready systems and materials for photopolymer 3D printing, metal 3D printing, technical ceramic 3D printing and sand 3D printing of molds for metal casting.

Ric is convinced that Desktop Metal will achieve profitability by next year, with cash still in the bank, and that additive mass production in automotive, aerospace, medical, dental and consumer products is within reach. He also provided data to support these claims.

Shortcut to a billion

The first and main question on everyone’s mind is: ‘If Desktop Metal can achieve profitability and even scalability, why did the company want to merge with Stratasys?’

One way is to look at it as a shortcut to build a one-billion-dollar company. “Stratasys has a great management team,” Fulop says. “CEO Yoav Zeif came in and turned the company around. They figured that by merging with us they’d be in the ideal position to continue bridging the gap from prototyping and tooling to mass production. Because that is what we do. We have more parts in cars than any company in AM [more about this claim later in the article], we’re going to be in consumer electronic products and we have final parts flying as well as in dentistry. Our dental materials are in such high demand that even Carbon is using them now.

“On the other hand – Fulop continues – Stratasys is also our industry’s only major profitable company. We expect that we will be the next one but the industry needs consolidation and companies that can generate more than a billion in yearly revenues. If we merged – because the deal was intended as a merger, not an acquisition – we’d have built a billion-dollar business by combining growth-based synergies in very different areas.”

The point Fulop is making here is that the merger between Desktop Metal and Stratasys would have increased the overall revenues that the combined companies could generate by growing into new markets.

On the other hand, the merger with 3D Systems would be focused on reducing costs by leveraging synergies in the commercialization of many very similar technologies across many existing markets. In other words, the 3D Systems deal, which clearly penalizes Stratasys’ current management, represents a more conservative approach while the Desktop Metal deal, which Stratasys’ current management welcomed, may have been riskier but it also might have brought bigger returns.

Read the rest of this story at VoxelMatters