Charles R. Goulding and Preeti Sulibhavi discuss energy-based Inflation Reduction Act tax incentives as solutions for hospitals amid rising labor costs.

Since the commencement of the COVID-19 pandemic, hospitals have experienced unprecedented supply chain disruptions and labor shortages. Hospitals are labor-intensive, and their cost of labor has greatly increased. For example, 75,000 Kaiser Permanente union workers who recently went on strike received a 21 percent wage increase over 4 years.

The Inflation Reduction Act (IRA) has a myriad of tax incentives for energy-efficient upgrades that hospitals can benefit from to help offset rising labor and supply chain costs.

On October 20, 2023, the White House put out a briefing room statement regarding how healthcare organizations can take advantage of tax and other economic incentives in the Inflation Reduction Act. What is unique about the White House announcement is they are emphasizing using the IRA to reduce operating costs.

Hospitals tend to be large structures, often with multiple wings, that require constant maintenance and energy resources. This is where the IRA’s energy-based tax incentives can be of assistance, especially when labor costs are rising.

There are a whole host of new and updated energy tax incentives that could help hospitals reduce costs while increasing the energy efficiency of their facilities and buildings.

Hospital energy project designers implementing energy designs can now earn up to US$5.36 per square foot in tax incentives.

Nonprofit and government hospitals can now receive large cash direct payments for implementing qualifying HVAC projects including combined heat and power (CHP) and a myriad of other alternative energy incentives.

Hospitals and 3D Printing

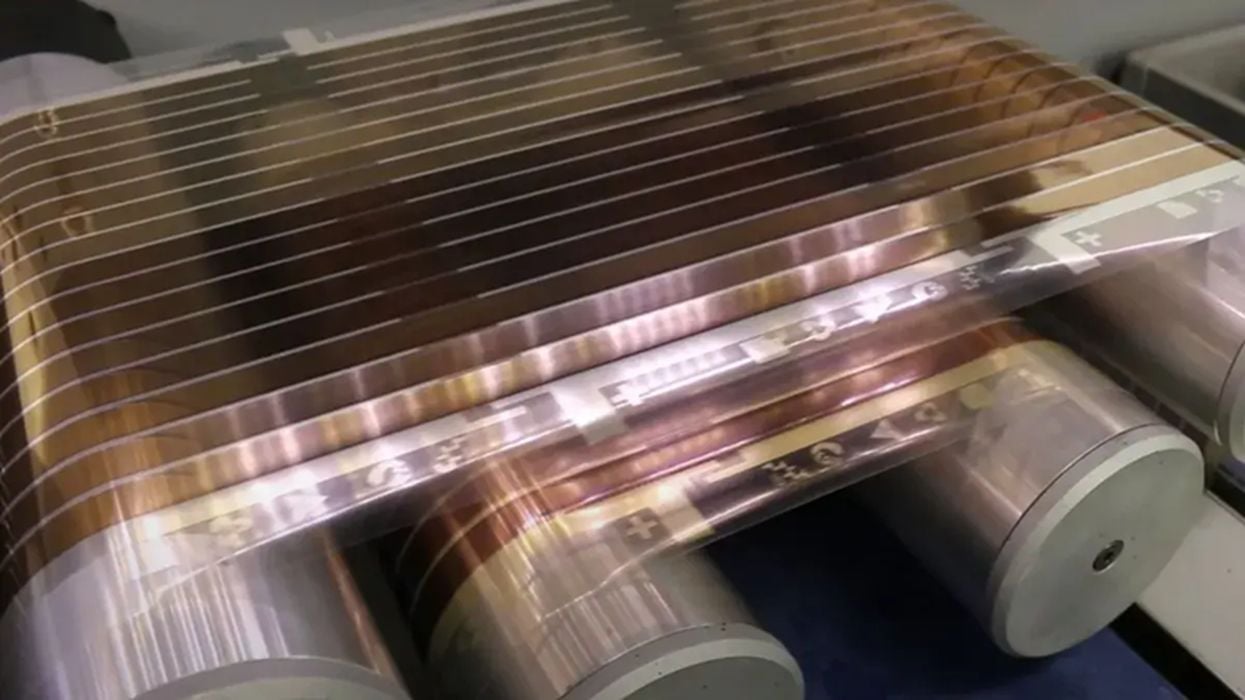

There have been several pieces that we have published on how medtech can benefit from 3D printing technology. In fact, in the healthcare industry, there are multiple ways in which 3D printers can be used to enhance patient care.

Hospital Pharmacies

Using 3D printers to create pills for patients suffering from multiple illnesses with different drug compartments (to reduce the number of pills patients must take in a day) and different release profiles is a useful way to streamline drug administration. Many compounding pharmacies are attempting to do just that.

Orthopedics

3D printing has made continuous improvements in orthopedics including replacements for knee, spine, hip, or ankle. Using 3D printed implants is something that can both reduce costs and increase quality at the same time. There are also ways to apply 3D printing technology to exoskeleton fabrication and prosthetics.

There is no shortage of ways in which 3D printing can be applied to the hospital industry, especially at a time when hospitals are looking to implement these technologies but need budget dollars to do so.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

The incredible suite of energy-based tax incentives offered in the IRA is astounding. Hospitals that are experiencing rising costs should consider availing themselves of these opportunities. The healthcare industry can then expand and with the help of 3D printing offer high-quality patient care that is more affordable.