Charles R. Goulding and Matt Selman examine how a recent increase in robotic system sales might affect 3D printing activity.

The recent global COVID-19 pandemic has left many companies struggling to hire enough workers to fulfill orders. This shortage of workers, combined with recent advancements in robotics, has led to more companies adopting robotic solutions into their workplaces. Robot orders, valued at US$1.6B, climbed 22% in 2021 alone. In addition, orders for workplace robots in the U.S. has increased by 40% from the first quarter of 2021 to the first quarter of 2022. This record increase is an indicator that more companies are finally buying into robotic automation.

Robots are often a valuable improvement to workplaces. They are able to complete tasks faster and more efficiently than human workers. They do not get sick or tired, and would never ask for a day off from working. They are also capable of performing more complex tasks that require a mixture of strength and flexibility. Tasks that require heavy, moving parts are especially improved upon through robots.

An example of this effect can be found at Athena Manufacturing LP, a fabricating and machining company for metal equipment, which was able to reduce the time to grind the welds on a rack from three hours to thirty minutes by implementing robots.

Today, workplace robots are essentially a lifecycle investment. They require notable upfront costs, but they often return the investment by increasing output while also reducing costs.

Delphon, a California-based manufacturing company, has ten operating robots. One robot saves them an estimated US$16K in expenses each month by increasing output and requiring less labor for the automated tasks. With such a large increase in robot orders, it is clear that many companies believe robots will be a valuable workplace improvement.

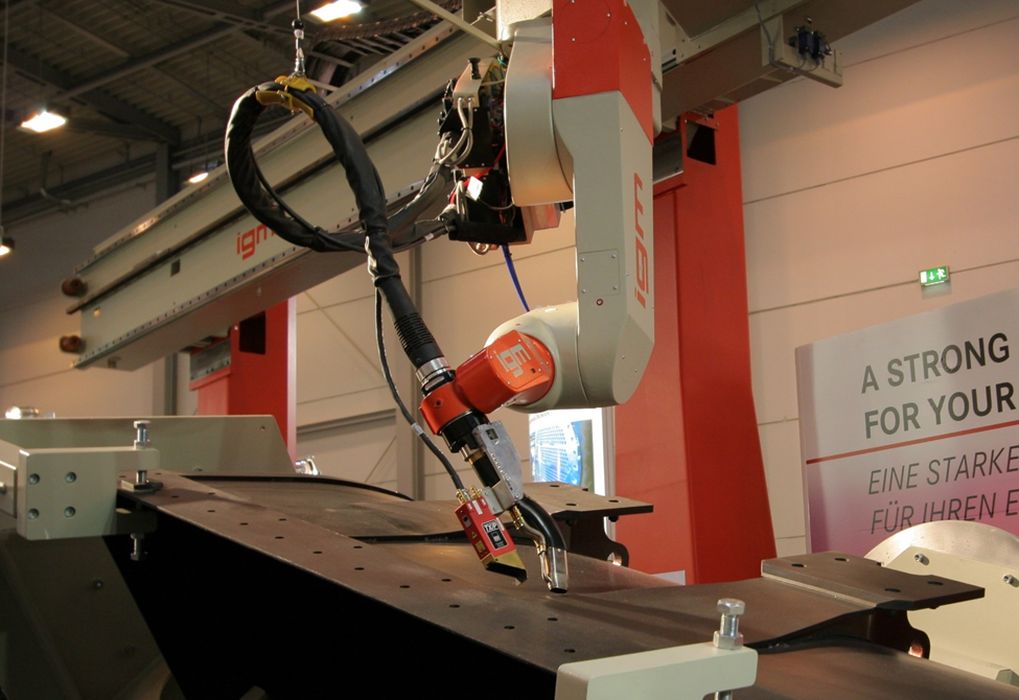

3D Printing Robots

Advancements and increases in robot automation technology provide opportunities for 3D printing. While robots are not entirely 3D printed, some critical robot components could be made with 3D printing.

End of Arm (EOA) parts for robots are often 3D printed, as it is the most effective approach since they are often made in very low quantities. The 3D printed end of arm parts can be as simple or complex as needed, which allows the EOA to be printed specifically to meet the desired function.

The design flexibility and countless possibilities make 3D printing robot parts a valuable option. Whether the robot EOA needs a vacuum channel, a sharp edge, a gripper, a welding torch, or any complex shape, 3D printing is very often the most efficient way to make it.

3D printed EOA parts can also be made to be lighter, as printed parts made of Nylon are about 70% lighter than Aluminum (an already lightweight metal). Lighter EOA parts can reduce energy consumption, and make changing the part easier. 3D printing is also very useful to test parts and their functionality, without requiring welding or cutting. 3D printing also allows immediate changes to the EOA design, should someone realize a way to improve effectiveness.

The higher the demand for robots, the higher the demand for 3D printing. 3D printing has been one of the most promising technologies for the future as it can reduce costs, reduce waste, and save time. With such a large increase (40% in one year) in orders for workplace robots, 3D printing will too increase to help construct more robots. Companies developing products using 3D printing and similar iterative activities may be eligible for federal and state Research and Development Tax Credits.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

For years there has been discussion of how robots will become more prevalent in the workplace, as they offer automation and other improvements. However, we have never seen such a large increase in robotic orders prior to the jump seen in 2021-2022. With such a large increase, 3D printing will also increase to keep up with demand. Robots and 3D printing are tied together, and 3D printing will follow the recent success seen by robots.