The partnership involving ExOne and Rapidia highlights some of the problems in 3D printing these days.

This week ExOne announced an arrangement with Vancouver-based startup Rapidia to exclusively market their unusual and highly efficient water-based metal 3D printing equipment. The powerful new process requires fewer post-processing steps, and thus should be of great interest by those requiring metal equipment.

While this announcement is absolutely great news for Rapidia, ExOne and metal 3D printer buyers, it highlights an ongoing issue in the 3D print community: great technologies get buried in the market before they can take flight.

3D Print Startups

In my experience at numerous 3D print trade shows and site visits (at least until this past year), I’ve had the incredible opportunity to find truly amazing 3D print technologies, typically brought forward by startups just like Rapidia.

Today the space is highly competitive, and it takes far more to get noticed than simply offering “just another 3D printer”. To succeed, a new venture must offer something highly unusual that is also productive, cost-efficient or otherwise have powerful and unique properties.

There’s no way a startup can compete simply by repeating the technologies already available at attractive cost levels. You’d have to somehow undercut the existing price levels, and that’s near-impossible for startups that don’t yet have the scale to do so.

Thus the way to succeed is by presenting a new technology that has unique properties, and that is precisely what Rapidia did in 2019. I was incredibly impressed with their progress and technology when I spoke with Rapidia in 2019, and hoped they would do well.

But I also knew they’d face incredible challenges trying to move forward.

3D printing is still new to many clients, and their naivety tends to push them toward well-known solutions in the market. Solutions where there’s a friendly local reseller that can talk them calmly through a transition.

Startups typically don’t have reseller networks, because they’re too small and don’t have brand recognition yet. Thus resellers aren’t that interested in them because there’s likely little demand. But there’s little demand because resellers aren’t selling the equipment. It’s a chicken and egg situation, to be sure.

Most 3D print startups face these and other challenges early in their trajectory, and unfortunately many will expire before they even get started. To me, these are technology tragedies that should never happen. Too many amazing technologies simply fade away when they really could have made a mark on the industry if used widely.

Rapidia was able to break through that barrier by means of their agreement with ExOne. The deal immediately “gives” Rapidia a vast reseller network, brand recognition and much more.

However, the partnership will cost Rapidia something, likely a cut of the proceeds of any sale. Terms of the partnership agreement were not made public. On the other hand, sales will be made that would never have occurred should Rapidia kept on their own path without ExOne.

The arrangement is “exclusive”, meaning no other party beyond ExOne will be able to sell the ExOne Metal Designlab printer and X1F advanced furnace.

And it’s even more exclusive:

“Under terms of this strategic partnership, ExOne has a right of first refusal for majority ownership of Rapidia, and Gelbart will now become a technology advisor to ExOne.”

This suggests that if the product proves successful and Rapidia wishes to sell the company, it goes to ExOne. Could this be a bit more of that corporate consolidation we wrote about earlier?

It’s a hard thing for a startup to do, partnering in this way, as it dilutes their control over things to some degree. Startups usually fear takeovers by bigger players, and thus they are often avoided.

However, in many cases this type of arrangement does make good business sense, and I believe that is the case with the ExOne / Rapidia deal.

ExOne Stock Price Rise

There’s one more very curious aspect of this partnership.

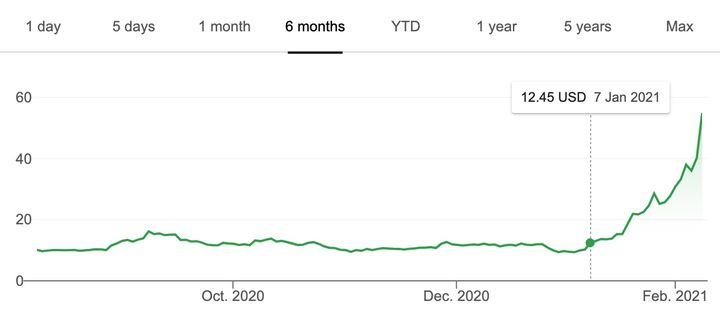

It seems that the market has noticed this development, as ExOne’s stock price has jumped considerably. On announcement day, it jumped from US$40 to US$54, a leap of 36%. Pretty decent gain for one day. Curiously, ExOne’s stock price has been sneaking upwards from the teens-level for about a month now, suggesting that some parties might have known or suspected the Rapidia deal was about to take place.

Even stranger is the fact that with ExOne’s rise after the announcement, several other 3D printer manufacturers also saw their stock prices rise: I don’t see how they could relate to the ExOne announcement other than they are in the same industry, but that’s the stock market for you.

Meanwhile, we now appear to have another metal 3D printing option on the table, as ExOne says the systems may be ordered immediately.

Via ExOne