A long post from Josef Prusa held some hints at where the company may be heading next.

The 3000+ word post mostly reviewed the company’s progress in 2021, which was actually quite significant, and notably so given the arduous business conditions that still persist. With this post, the company continues their incredible transparency with the public.

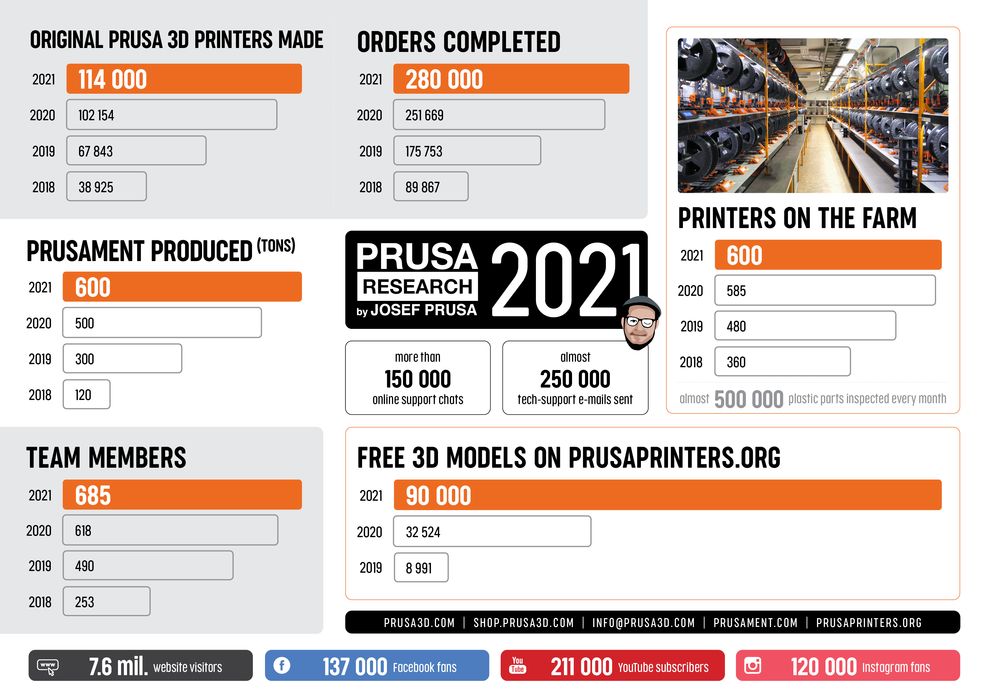

Let’s first take a look at the review material, which contains some fascinating statistics. Here is their infographic showing these stats. Let’s see what we can determine from them.

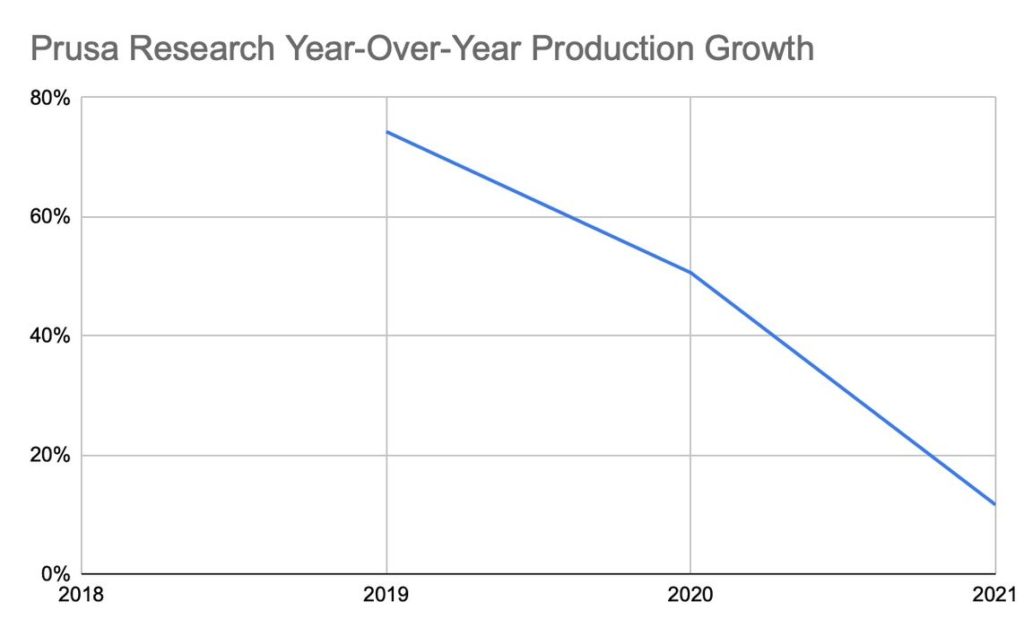

An amazing 114,000 3D printers were produced during 2021, and almost certainly were all sold to customers. That’s because they have a waiting list that seems to always have new customers. While this production is more than 2020’s, it did not grow nearly as much as previous years, as you can see on this chart:

As you can see, their year-over-year growth of equipment builds has been slowing. Note: they are stil growing, but not quite as fast. While some of that decrease could be due to the pandemic, a slowdown is to be expected, because the market for desktop 3D printers is finite. It may be that we are seeing their production rate slowly plateau due to inevitable market saturation.

Prusa Shifts Towards Industrial Markets

If so, that would explain their several moves towards the industrial market, including:

If one market is slowing, it’s best to open up more, and that is clearly what Prusa Research is doing. They are a very smart company, and this is the right move.

We can also see they completed 280,000 orders. But if 114,000 were orders for prints, then there are 166,000 orders for other items, most likely dominated by material sales. In fact, they say they produced an amazing 600t of filament in 2021. This shows they have been very successful in their materials business, which now includes resins as well as high-quality filaments.

Importantly, Prusa said:

“While we’re planning to expand to the industrial sphere, it doesn’t mean we’re changing our direction and steering away from our most successful models! After all, our printers are being utilized by a number of large industrial companies for years already, so we can run both developments in parallel.”

This is good news for the thousands of 3D printers operators using and depending on the company’s flagship FFF devices. Prusa Research developed a winning product, and it would seem they will continue along that path in addition to the new lines of business.

Prusa Industrial Risks and Benefits

That dual-strategy comes with risks and benefits.

The benefits could be that more advanced tech developed for their industrial equipment could leak down to the entry-level equipment. This is apparently already happening. According to Prusa:

“If you really dig into the 3D printer announcements we made last year, one thing becomes quite clear – our machines will start sharing more technologies among various models. For example, the machines in Prusa PRO AFS share the Nextruder, segmented heated bed and load cell sensor with the XL. And those are just some of the examples.”

In addition, the diversification of the business will make them more financially robust overall.

But there is a risk that the profits and scope of the industrial segments could, over time, grow much more significantly than the desktop business. In fact, many analysts propose there is a USD$12 Trillion market for manufacturing, and most 3D printer manufacturers are scrambling to get a piece of it. I can’t see Prusa Research doing anything different.

If they succeed in the industrial market, it could be vastly larger than their desktop business. This might eventually cause them to lessen their focus on desktop gear. Or it might not. It’s just that it is now a possibility, whereas it was not when they were solely in the desktop business.

Prusa Supply Chains

I appreciated Prusa’s explanation of their supply chain woes, which was quite detailed. I have not seen such a description from other 3D printer manufacturers, who no doubt are suffering the same problems. As an example, Prusa said:

“Even such simple things as cardboard boxes are scarce goods because the pandemic also caused a significant increase in online sales worldwide – suddenly, more boxes were needed everywhere. Leadtimes up to 75-80 weeks are now common.”

Incredible — and amazing that Prusa Research has done so well in spite of these staggering challenges behind the scenes.

Prusa 2022 Moves

The company is taking an interesting move by adding their own injection molding production line as well as PCB manufacturing with an SMT production line. It’s not specified when this would take place, but likely as soon as possible to avoid further supply chain difficulties.

Note that Prusa Research is large enough to contemplate bringing those functions in-house, whereas some of their smaller competitors might not be able to. This could provide Prusa Research with not only supply chain advantages, but possibly also speed and quality advantages.

A major focus area in 2022 is to be remote printing using their Prusa Connect system that’s currently being beta tested. This makes sense, as that technology would be required for industrial operation, too.

PrusaPrinters is also set for a major change. Apparently the name of their community site discourages non-Prusa users at times, so they intend on implementing a complete rebrand. This should be quite interesting, and will certainly attract many more 3D models from the community. They also will launch “pay” options for designers seeking payment for their works. Prusa said:

“It’s gonna be a real Thingiverse killer! 🙂”

Finally, Prusa admitted there is even more in the company’s pipeline, saying:

“Is there anything else? Of course, there is… we’ll just keep it secret for a bit longer. But not by much. Stay tuned!”

For anyone following Prusa Research or involved in 3D printing, this is a tremendous read that gives you an excellent perspective on one of the industry leaders.

Via PrusaPrinters