In a $280M digital manufacturing deal, Protolabs is set to acquire 3D Hubs.

It’s M&A season in 3D printing as the major consolidation announcements keep rolling in. Last month, it was Stratasys acquiring Origin; last week, it was Desktop Metal acquiring EnvisionTEC. Today, it’s not 3D printer manufacturers but service providers in the spotlight — though the focus of the acquisition activity remains squarely on production.

Digital Manufacturing Focus

3D Hubs’ team offers a comprehensive blog explaining their rationale, as Bram de Zwart, Brian Garret, and Filemon Schöffer explain:

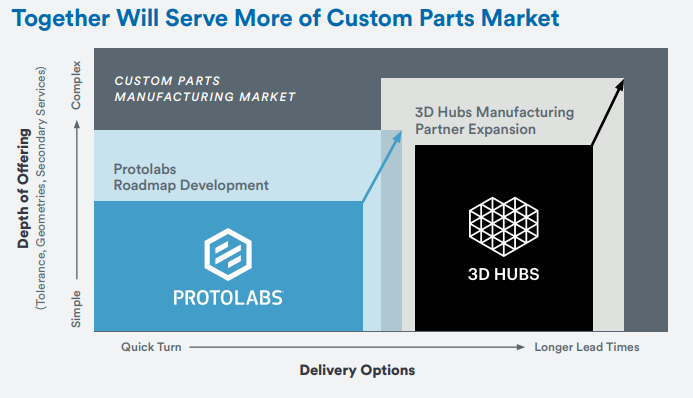

“By combining the offerings of 3D Hubs and Protolabs, we’re giving our combined user base access to increased design complexity, tighter tolerances, additional finishing options, more materials, and broader range of pricing and lead-time options.

It is this ambition, to create the world’s most comprehensive manufacturing offering, which has led to the acquisition, the largest transaction ever in online manufacturing.”

Protolabs offers perspective of their own in their company blog:

“That’s right, 3D Hubs is joining the Protolabs family to create the world’s largest digital manufacturing platform, offering the broadest set of manufacturing services with the help of a global network of premium manufacturing providers.

For now your current manufacturing service will remain the same, but over time you’ll start to see a broader offering that allows for more part complexities, tighter tolerances, additional finishing options, and enhanced material selection along with pricing and lead times to fit every stage of your project.

…Our goal here is the same as it has always been: to accelerate your entire product development and manufacturing cycle through an end-to-end experience.”

A nicely thought-out FAQ on the 3D Hubs blog also lays out some of the specific questions you might have as a customer of either service provider.

They say, for instance, that “nothing will change for our customers” initially as the companies merge — but when things do change, it’s to speed up lead times and to enhance manufacturing service offerings and certifications. Joining the Protolabs family, for example, will see 3D Hubs customers gain access to AS9100 certifications for CNC machining, 3D printing, and sheet metal fabrication.

Existing customers of either platform can also, on the ease-of-use side, keep to business as usual for their part. Working through the 3D Hubs or Protolabs platforms will remain the same. And if you already work with both?

“If you have an account with both 3D Hubs and Protolabs, nothing changes for you. You can continue to use both platforms as before,” 3D Hubs explains.

Protolabs x 3D Hubs Business

A deal like this is obviously business-minded. The transaction — expected to close by the end of this month — is set to create a massive distributed manufacturing network. And that means significant financial figures at play.

The press release describes the money-minded aspects:

“Under the terms of the agreement, closing consideration of $280 million will be funded with $130 million in cash and $150 million in Protolabs common stock. An additional $50 million of contingent consideration is payable subject to performance-based targets over two years after close, funded with 50% cash and 50% Protolabs common stock. Protolabs has also established an employee incentive fund payable to 3D Hubs employees based on achievement of both financial performance and employee retention targets.

Protolabs anticipates the acquisition of 3D Hubs will accelerate its revenue growth rate and be marginally dilutive to non-GAAP earnings per share in 2021. 3D Hubs’ 2020 revenue is estimated to be $25 million and the company’s revenue has had a compound annual growth rate of over 200% since 2017.”

For its part, Protolabs generated revenues of $459 million in 2019, “representing a 17 percent compounded annual growth rate since 2014.”

Protolabs has established manufacturing facilities in the US, the UK, Germany, and Japan. These will, following the deal’s close, be complemented by 3D Hubs’ “network of 240 premium manufacturing partners across 20 countries.”

3D Hubs, founded in 2013 with a distributed manufacturing vision based more on home users with idle 3D printer time, has been increasingly business-minded as the years, technologies, and strategies have gone on. In 2018, 3D Hubs turned its focus wholly to manufacturing — and has seen strong signs that this strategy was the right one for continuing to run a successful business.

With the fold into Protolabs operations, that strategy is showing 3D Hubs to be not only successful in itself but a major player in the global distributed manufacturing game.

Digital Manufacturing Consolidation

In a statement worth a second in-article quote, the 3D Hubs team says its merge into Protolabs will form “the world’s largest digital manufacturing platform.”

While much of the market has been watching M&A on the OEM and materials sides recently as consolidation truly picks up in the additive manufacturing (slash-advanced-manufacturing) world, this move points to a trend already ongoing on the service side. In 2019, FATHOM was acquired, and in 2020 the latest FATHOM acquisition created “the largest privately held digital manufacturing service provider in North America.”

Will we be seeing more consolidation moves to come from some of the other major players in digital manufacturing? More claims of global or regional largesse? It’s possible — perhaps even likely, to stay competitive. Just as mom-and-pop stores often have difficulties when Walmart rolls into town, larger operations simply have greater ability to offer lower pricing, wider selections, faster timing, and broader distribution.

We can speculate all we want. But if this early theme of 2021 is anything to go by, perhaps we just need to wait another couple of days for the next major M&A announcement to shock our systems and reshape our industry.