Charles R. Goulding and Preeti Sulibhavi discuss how investment in U.S.-manufactured cranes can be supported by 3D printing.

The Biden administration recently announced a US$20 billion investment to replace China-made cargo cranes at U.S. ports over espionage concerns. The cranes, manufactured by Chinese state-owned company ZPMC, currently account for nearly 80% of ship-to-shore cranes at American ports.

The replacement plan aims to eliminate potential national security risks posed by the cranes’ sophisticated sensors and software systems which can track shipping data. There are also fears the cranes could be manipulated to impede military or commercial shipping during a conflict.

Restoring Domestic Production

A key priority is restoring domestic production of port cranes which has been nonexistent for over 30 years. The US$20 billion investment, sourced from 2021’s bipartisan infrastructure bill, will support U.S. subsidiary Mitsui in manufacturing the new cranes.

Strategic Planning Needed

Replacing over 200 port cranes across the country will require careful planning and input from port operators, engineers and logistic experts. Safety and adequate training for new crane systems should also be paramount.

The design process should identify all current crane inadequacies including maintenance, repair and overhaul issues. Extensive site visits to well-run alternative crane vendors will inform the planning.

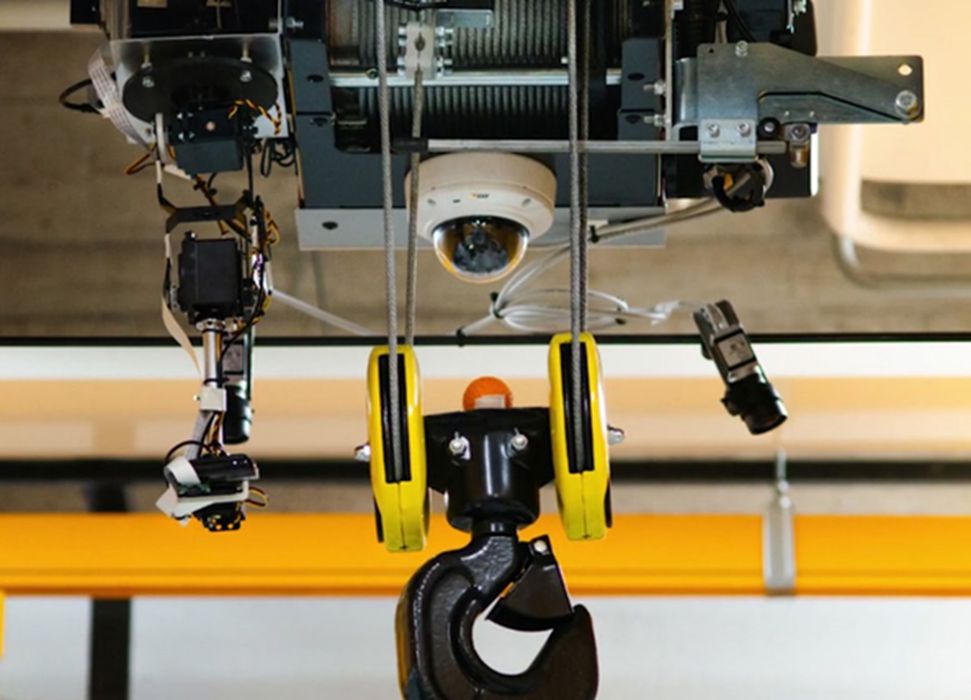

Software, sensors and integration of technologies like AI and machine learning need thorough vetting to ensure flexibility, cybersecurity and predictive analytics capabilities. Supply chain transparency and prototype testing to performance criteria are also critical preparatory steps.

Top Crane Manufacturers

Leading international container crane manufacturers include Konecranes (Finland), Liebherr (Germany) and Mitsui (Japan). American company Manitowoc is another major crane industry player.

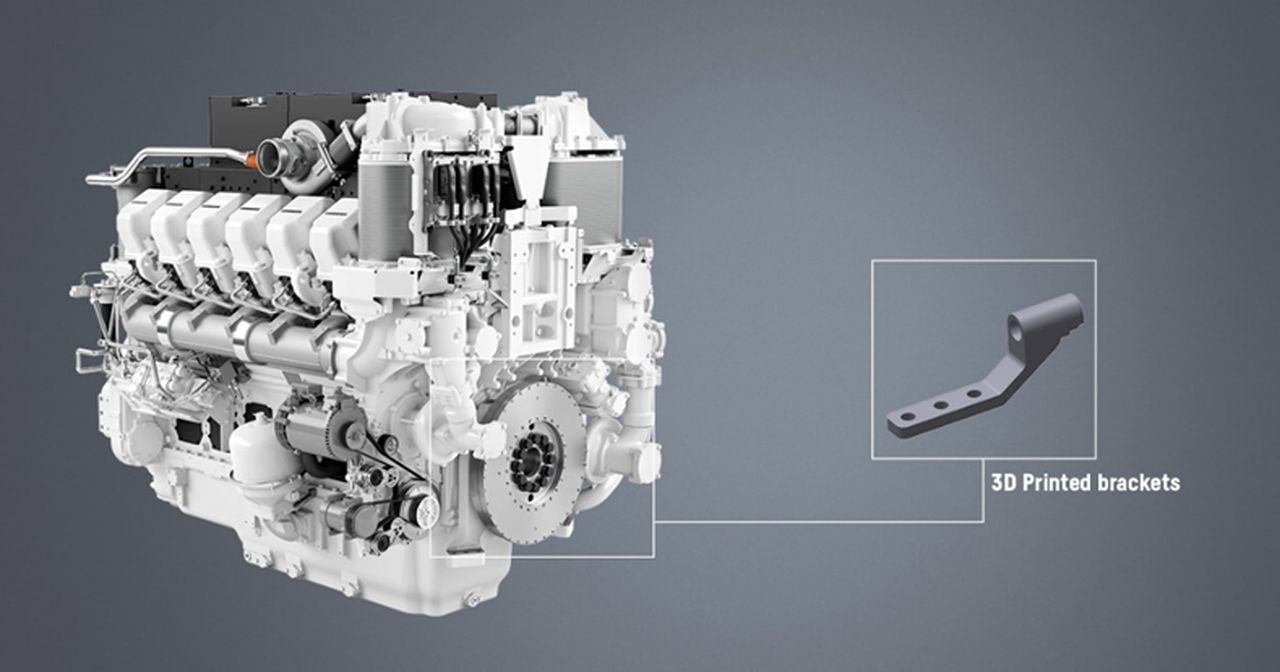

Additive manufacturing is transforming production in these companies. Konecranes uses 3D printing to prototype and produce end-use parts like hoist components with better strength-to-weight ratios.

Liebherr adopts additive techniques to make lighter, high-performance parts for new crane concepts. 3D printing helps streamline its product development cycles. Mitsui relies on 3D metal printing for components in ship-to-shore cranes including housings, pulleys and gear systems. The technology aids low volume production of customized parts.

The Research & Development Tax Credit

The now permanent Research & Development Tax Credit (R&D) Tax Credit is available for companies developing new or improved products, processes and/ or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits

Conclusion

Replacing Chinese-made cranes at U.S. ports could take years to complete. But addressing potential cybersecurity and espionage risks now through strategic domestic production, improved design and supply chain transparency will pay long-term dividends in port efficiency and safety.

Leveraging additive manufacturing in the new crane systems also promises performance benefits. With thorough planning and input from port operators and crane specialists, the coming transformation promises a more secure and optimized wave of American-made cargo cranes.