In March of 2020, the global economy experienced a negative demand shock.

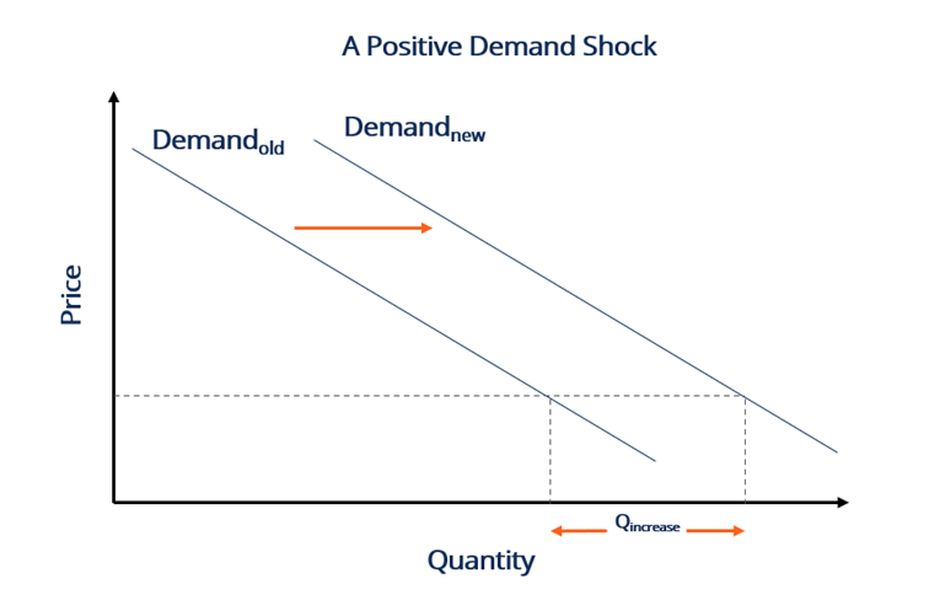

Over a year later we are now experiencing a positive demand shock. In economics, a demand shock is defined as a sudden and temporary increase or decrease in the demand for a good or a bundle of goods. Graphically, a demand shock is shown as a shift of the entire demand curve (see above).

Equivalently, we can say that the shock causes the quantity demanded to increase or decrease at any given price. Usually, the phrase “demand shock” is used in the context of aggregate demand, which describes the cumulative demand for an entire economy. Some characteristics of a positive demand shock are supply disruptions and higher commodity costs.

The 3D printing industry needs to react and plan around these developments. Supply chain disruptions can often be addressed with new 3D printing product offerings, as we saw during Covid with ventilator and respirator parts and a variety of PPE high volume supplies. Commodity price increases such as the current increase in metal prices are inflationary. The law of supply states that there is a positive relationship between the quantity that suppliers are willing to sell and the price level. Solutions can include material substitutions from new 3D printing materials, material reduction from topology, reduction in material consumption when switching from subtractive to additive manufacturing, and perhaps final product price increases.

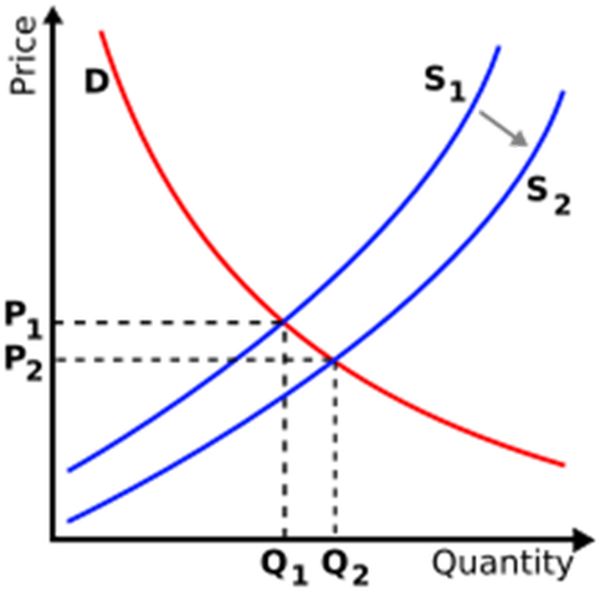

The law of supply is a fundamental principle of economic theory. It states that an increase in price will result in an increase in the quantity supplied, all else held constant.

An upward sloping supply curve, which is also the standard depiction of the supply curve, is the graphical representation of the law of supply. As the price of a good or service increases, the quantity that suppliers are willing to produce increases and this relationship is captured as a movement along the supply curve to a higher price and quantity combination.

The Research & Development Tax Credit

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Shocking Results

It is time for the 3D printing community to be proactive as opposed to reactive. It would benefit the 3D printing industry, and our community, if solutions were found to current-day supply chain and positive demand shock issues based on 3D printing and additive manufacturing.