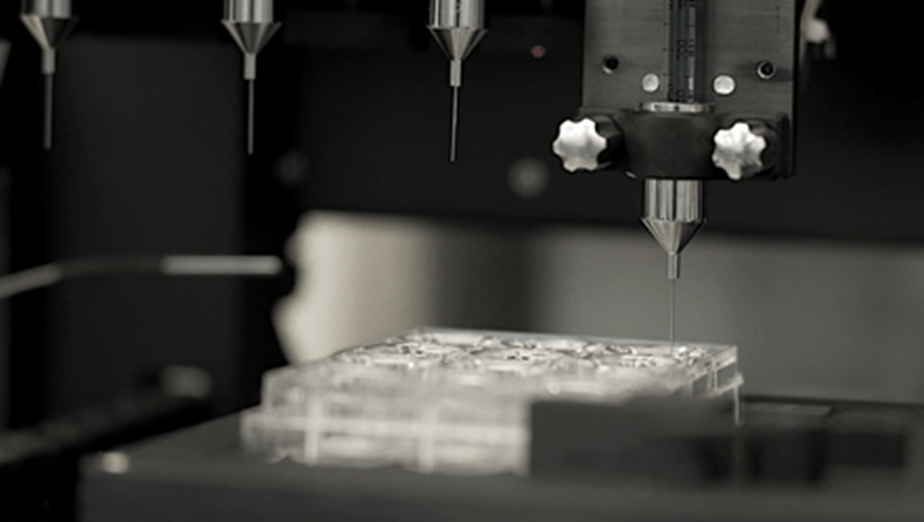

Charles R. Goulding digs into recent significant business changes at storied bioprinting-turned-drug-discovery company Organovo.

I have always been fascinated by bioprinter company Organovo Holdings, Inc. for two reasons:

- They are a small publicly traded company in the nascent and exciting bioprinting area, and

- They have had a very high annual R&D per capita spend for many years.

Organovo Strategy Shifts

In April 2021, the previous COO resigned and the new COO has a dual COO/CFO role. The company has announced a major business shift from bioprinting services to drug discovery. A May 28, 2021 Seeking Alpha article by Gunner Laine Hardy, titled “Organovo: New Strategy Targeting Internal Pipeline Development with Customized 3D Human Tissues Offers Upside,” presents substantial detail about recent developments at the company.

Organovo has provided the following specific yearly goals related to the new business model:

- Disease Model Building by 2021-2022

- Target Validation and Selection by 2021-2022

- Screening and Lead Compound Selection by 2022-2023

- Investigative New Drug Enabling Studies by 2023-2024

- Multiple IND Filings with FDA by 2024-2025

The company has a high cash burn rate, which presents pressing business challenges. They currently only have $19 million in cash on hand and an annual cash burn rate of approx $20 million.

It should be interesting to monitor ongoing developments at the company. If the historic high R&D spend has created valuable IP they might be a desirable acquisition target for one of the larger 3D printing companies seeking a presence in bioprinting. Organovo does have numerous patents.

Note that 3D Systems recently acquired the bioprinter company Allevi as part of its strategy to expand in the bioprinting area. Allevi is a Philadelphia-based bioprinter products company that offers bioprinters, biomaterials (such as bioinks), and software. With Organovo, the administrative and cost burdens for being a public company don’t seem to make sense for a company of this diminished size and new business model.

The Research & Development Tax Credit

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Major business changes are occurring at Organovo Holdings, Inc. With a long-term presence in the emerging bioprinter industry, this may be an opportunity for a financially stronger key industry player.