Nano Dimension’s recent financial moves suggest they may be contemplating acquisitions in the near future.

The Israeli company is one of the very few publicly traded 3D printing stocks, along with long-time options such as Stratasys and 3D Systems. However, this past year has been pretty strange as far as their stock price went.

During 2020 you could buy one share of Nano Dimension for US$0.51. As I write this piece, their stock price is at US$8.50. While a mere $6 doesn’t sound like much, it represents a jump of 17X. In other words, if you had invested US$100,000 then, you’d now have US$1.7M. That’s huge!

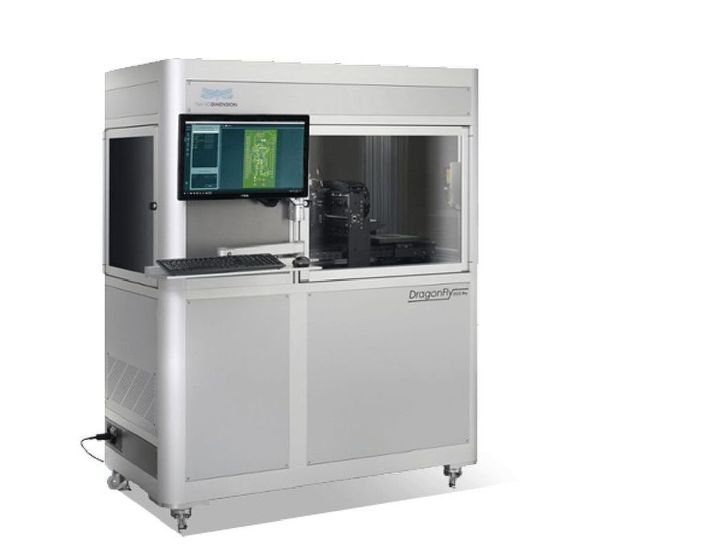

Why has this happened? It seems the company has become a bit of an investor darling, likely due to their breakthrough multi-layer 3D printed PCB unveiled earlier in 2020, made by their DragonFly LDM system (image at top). The stock price pushed higher then, and continued rising throughout 2020, and now into 2021. They also raised US$50M in October.

A report on Globes, an Israeli business daily publication, says:

“Despite having negligible revenue, the company has raised $590 million in four offerings in the past month and has raised $657 million since the end of the third quarter as it takes advantage in the boom in tech shares on Wall Street.

The company’s share price has risen 1,300% since March to give a market cap of $1.2 billion. The company’s market cap is similar to that of another Israeli 3D printing company Stratasys Inc., which had revenue of nearly $400 million between January and September 2020, while Nano Dimension had revenue of $1.5 million during that time.”

This is pretty astonishing, as Stratasys is a very large, long-time player in the industry, while Nano Dimension is only a few steps from their origin as a startup.

Globes suggests Nano Dimension is setting up for acquisitions, as they have apparently hired a US firm to advise on corporate acquisitions.

This is not surprising, as the amount of money raised is so large it couldn’t possibly be spent in a normal, organic fashion. For example, it would be challenging and likely inefficient to mount a galactic-sized sales and marketing program with that cash. Instead, the idea here would be to buy other companies that might:

- Add to Nano Dimensions’ existing product

- Complement existing products

- Compete with existing products (thereby taking them off the market)

With the amount of funding available to Nano Dimension they should have few issues in acquiring almost anyone they choose. If for some reason they require even more money, they can easily trade stocks with the other party, as is sometimes done in complex acquisitions.

This does not mean the company would enter the general 3D printing market, as they are focused on a 3D print niche: PCBs. The companies they would acquire could be in any of several areas:

- Software that helps drive the design of PCBs

- Materials used in PCB production

- Post-processing equipment for PCBs

- Companies that employ staff useful to Nano Dimension

- Relevant Sales and Distribution organizations

There’s a lot to choose from, and it should be interesting to see where Nano Dimension heads next.

Via Globes and Nano Dimension