Charles R. Goulding and Preeti Sulibhavi look at the recent shakeup at GKN.

In a September 8th, 2022, Financial Times (FT) article, the spinoff of GKN by its parent company, Melrose Industries, into a new UK-listed company was highlighted. It represents the break-up of one of Britain’s oldest engineering businesses.

Under the arrangement, Melrose will divide GKN’s automotive and smaller powder metallurgy businesses from its aerospace arm through a demerger of shares. This will leave Melrose shareholders with shares in the holding company while the new auto company will trade on the London Stock Exchange under a name yet to be provided. GKN Aerospace, a leading supplier of airframes and engine parts for companies such as Airbus and Rolls-Royce, will still be owned by Melrose.

GKN Powder Metallurgy is a unique, additive business. It specializes in developing 3D printing processes for low alloy dual-phase steels DPLA and FSLA for automotive and industrial applications. This widely used system particularly benefits the automotive industry and enables diverse designs and applications in other sectors as well.

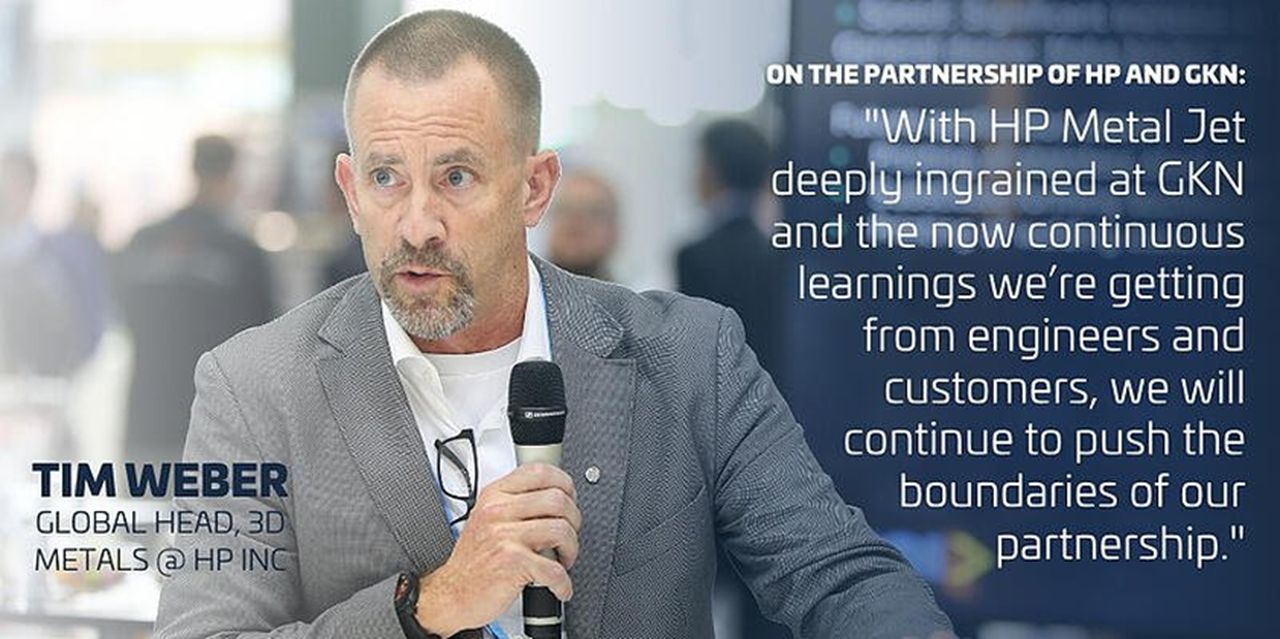

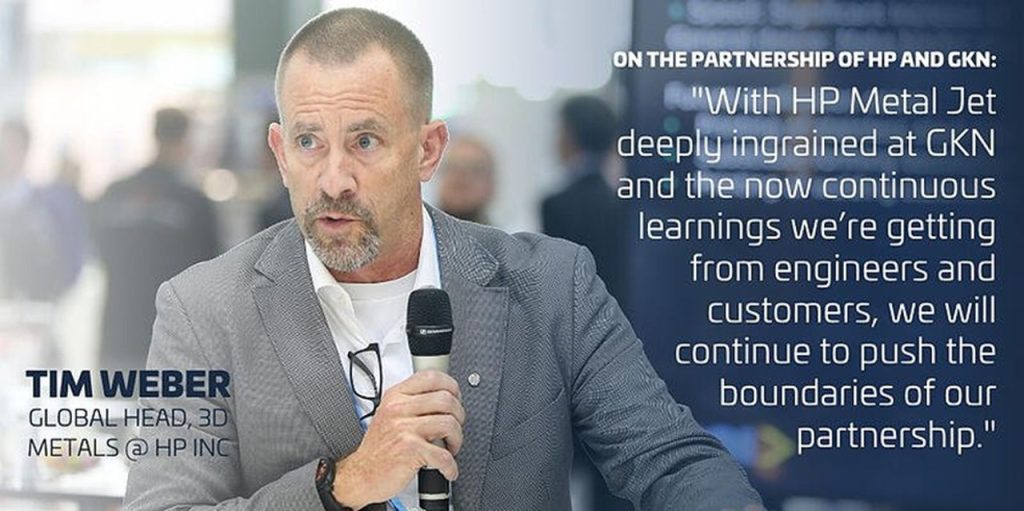

The metallurgy business has now joined forces with Multi Jet Fusion by HP in its 3D printing services sector. HP’s 3D printing technology utilizes fusing and detailing agents over a powdered nylon 12 building area, with infrared lamps fusing an entire layer in a single pass. This highly efficient method can build functional, geometrically complex parts 80-micron layers at a time – with mechanical properties that rival injection molded parts.

For the automotive business, GKN, in collaboration with Volkswagen and HP, is helping to 3D print car components.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

The spinoff of GKN is noteworthy. This is should be an opportunity for more use of 3D printing technology in industry.