Charles R. Goulding and Preeti Sulibhavi find 3D printing to be along for the ride in recent movements.

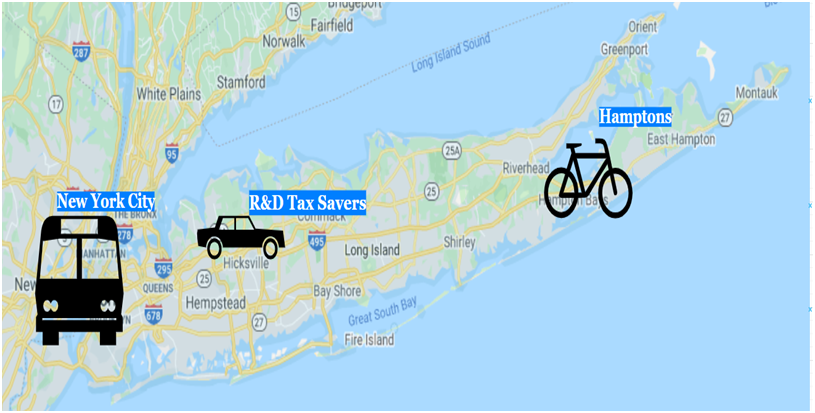

The COVID-19 global pandemic has resulted in the movement of hundreds of thousands of Manhattanites to the Hamptons on the eastern end of Long Island, New York. Since our office is in the middle of the two locations we are observing that our clients with 3D printing capabilities stand to benefit from this major migration.

1. Elevators are being installed in both existing and new multi-story residences

2. Bathrooms are being remodeled with touchless features

3. Glass for windows and protective barriers are being installed

4. Appliance sales are booming

5. Outdoor kitchens are all the rage

6. She-sheds and pool houses are being designed and built

7. Solar PV (ideal for the Hamptons location) projects are underway

8. Gardening is the new leisure activity

9. Lowe‘s and Home Depot are the popular destination spots

10. Cooking at home is more popular than ever

11. Jeeps are replacing Volvos

12. New lighting fixtures, candles and chandeliers are being purchased

13. HVAC designers are installing better filters and air handling equipment

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Reaching the Right Destination

The global novel coronavirus pandemic has resulted in a large regional shift or migration. The 3D printing industry is now a part of this new journey. Let’s see where it takes us.