Charles R. Goulding and Preeti Sulibhavi investigate the possibilities of 3D printing in the textile industry.

Kvadrat might not be a household name — yet. But it is certainly making a name for itself and its own niche in the textiles and interior décor industry. Kvadrat was established in Denmark in 1968 and has deep roots in Scandinavia’s world-famous design tradition. A leader in design innovation, Kvadrat produces high-performance, design textiles, rugs, window coverings and acoustic solutions for both commercial and residential interiors.

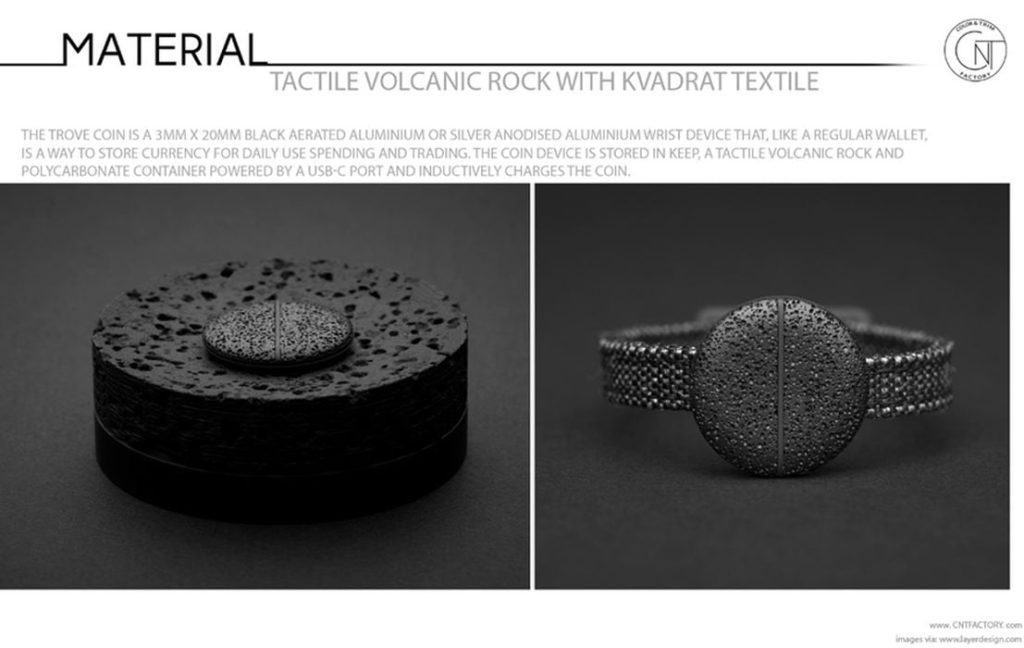

They offer unique designs that feature their brand of aesthetic. Their products reflect their commitment to color, quality, simplicity, and innovation. Kvadrat pushes the boundaries of both the aesthetic design as well as the technological and functional properties of their textiles. Constantly pushing the boundaries of materials and technique in their manufacturing processes, Kvadrat has begun integrating 3D printing technology in unique and creative ways. Featured above is a unique coin wallet that was 3D printed and worn on the wrist.

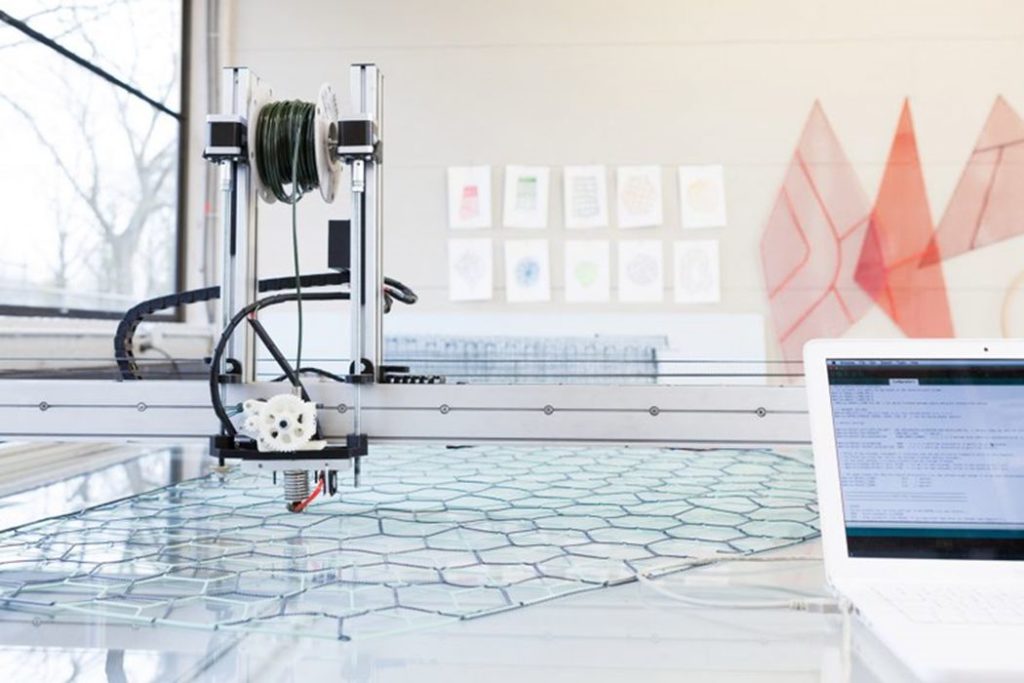

Dutch textile companies are also hopping on the 3D printing bandwagon. Studio Plott, of the Netherlands, created a mesh rug collection called Crossing Lines that features geometric patterns using 3D printers. Nina van Bart of another Dutch brand, Carpet Sign (of Holland), is using a new 3D-tufting technique to create their unique line of rugs.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Kvadrat is on the horizon of a new dawn of technology-driven textile manufacturing. And, it is not the only player in the industry utilizing 3D printing either. It is remarkable how 3D printers can create unique geometrical patterns while sourcing used and unconventional materials to create these masterpieces.