The team at Mantle shares insights into their intriguing new precision metal 3D printing offering.

The California-based company emerged from stealth last month with a low-cost, high-precision metal 3D printer that incorporates CNC machining in the process to ensure actual precision. Their TrueShape technology is focused on creating tooling; essentially, it’s a manufacturing technology for manufacturing technologies.

But how does it compare to other additive manufacturing options out there today — and why focus on tooling for traditional manufacturing? I caught up recently with Mantle’s Ted Sorom, Co-Founder and CEO, and Paul DiLaura, Chief Commercial Officer, for a conversation about the technology and where it might fit into today’s (additive) manufacturing market.

Mantle TrueShape

“I feel like there’s a lot of baggage associated with the 3D printing industry and the promises not delivered,” Sorom said to kick off our conversation. “Fundamentally, 3D printing has a ton of promise. Fundamentally, everyone in manufacturing believes that 3D printing is the future of manufacturing. There’s amazing things we can do with this technology. The problem is finding what 3D printing can do where it actually makes sense. I think that’s been the challenge.”

In its early days, the Mantle team started working with metals. Then, Sorom noted, “we stopped and looked at an application area that could have a big impact.” They found that “in making the tools that help mass produce the products all around us.”

He acknowledged that DMLS and other metal 3D printing technologies have been used in this area for some time — but with notable limitations. Cost is certainly high among these limiting factors, but so are off-the-printer results. Rough parts with DMLS; rough-but-near-net parts with binder jetting; existing options all required not-insignificant post-processing to smooth surface finishes to exactly what would be helpful for mass production.

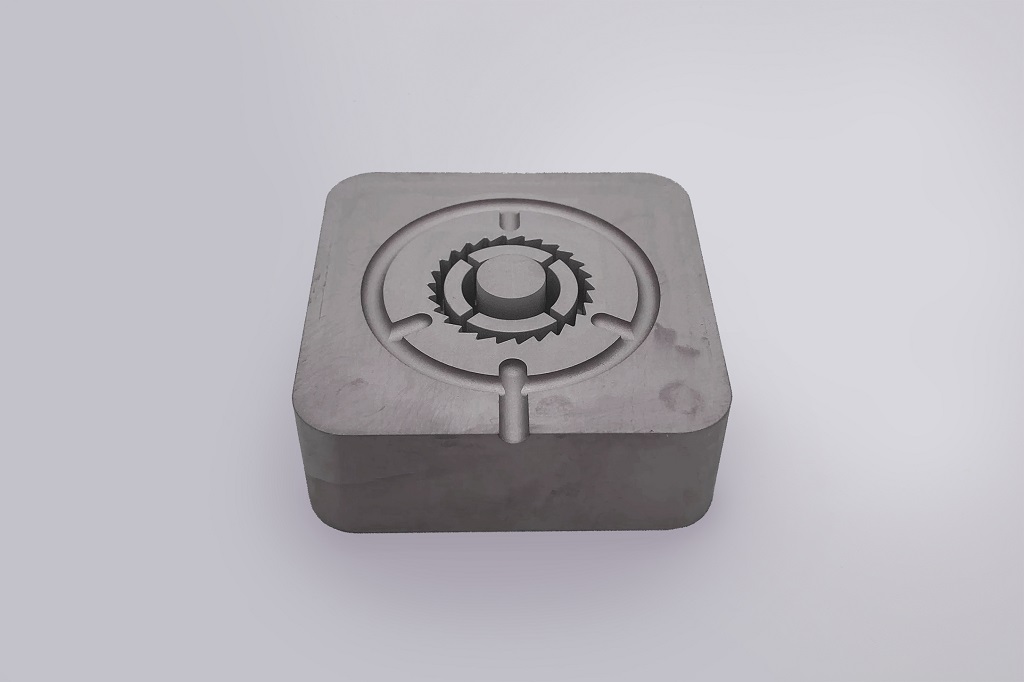

As we spoke via Zoom, Sorom held example parts up to the camera to show off exactly what he meant. Comparable parts made with different technologies, all sintered but not otherwise post-processed, “still need every surface touched prior to application,” he pointed out. And then he held up a COVID test kit off a Mantle system. With no surface finishing, “these edges are sharp enough to cut.”

“Our advantage is two-fold,” Sorom laid out clearly: “First, matching our technology to a really huge application area, in the $45 billion tooling market. Second is fundamentally speeding time-to-market while also reducing cost to get products into production. Traditionally, 3D printing has been limited to niche productions. We’re focusing on the tooling that makes the end-use part, instead of the end-use part itself. That impacts really any part around us that has a die-cast or molded part, and can reduce the time and costs to get to market.”

Historically in the 3D printing industry, new technologies were invented first and applications found only afterward. The better way, from Mantle’s point of view, “is to deeply understand what your process can do and what’s the application for it.”

While with TrueShape, “you won’t see flashy end-use parts and thousands of different materials,” Sorom added, the impact is very real. Major customers like L’Oréal, a medical part manufacturer, and an appliance producer are gaining the speed and efficiencies of additive manufacturing with tooling that has “the exact same level of wear and performance” compared to their traditionally manufactured counterparts.

This, Sorom says, is the “evolution in manufacturing that revolutionizes in terms of time-to-market for these types of products while reducing parts.”

Manufacturing Impact

So where can TrueShape fit into the traditional manufacturing market for that evolution that revolutionizes?

Enter Paul DiLaura, who recently joined the Mantle team as their Chief Commercial Officer following impactful work at companies like Carbon and Dassault Systèmes. These high-growth companies have seen significant commercial success — and that’s just what Mantle is after now. DiLaura offers a balanced, realistic view of what a new additive technology can offer in manufacturing.

“We think to really have a big impact on the massive manufacturing market, there’s opportunity to co-exist with existing processes,” DiLaura said. “Most parts are made with tooling. But there are a lot of problems with how tooling itself is made; it’s a very expensive and time-consuming process. It becomes the gate item in processes.”

While often the 3D printing industry looks at ways to circumvent tooling altogether — which, yes, remains a major benefit of the technology — for mass manufacturing, tooling isn’t going anywhere anytime soon. Addressing that particular bottleneck is a strong opportunity for its own additive evolution.

DiLaura pointed out that a successful 3D printing application requires at least three things:

- Appropriate material

- Meets accuracy/surface finish

- Some unique value, whether time or cost savings or superior performance for geometry

Mantle can already tick those boxes. The company emerged with “two key materials tested and proven.” In our initial coverage, Kerry pointed pointed to the company’s first two proprietary metals:

- P2X, which “acts like” P20 tool steel, but with better abrasion and corrosion resistance

- H13, which “acts like” H13 tool steel, but can achieve greater hardness

The parts Sorom showed highlighted the accuracy and surface finish requirements. That those finishes are intrinsic to the TrueShape process leads neatly into criterion #3, creating a unique value proposition. 3D printed tooling can reduce lead time, which Mantle’s existing customers have already shown can lower costs — and all that while leveraging the benefits of the technology, like adding conformal cooling and more geometries not possible for traditionally made tooling.

“We’re working with companies using our tools to inject hundreds of thousands of parts, testing out with very aggressive materials,” DiLaura added of real-world Mantle usage.

Mantle on the Market

Mantle emerged with $13M in funding, which is being put to use to continue technological development. The company is already “working with a number of major manufacturers that each spend up to $100 million each year on new tooling,” Sorom noted.

Today, the company is focusing on 3D printing parts in its San Francisco-based facility and shipping them to customers for validation. That’s not the final strategy, though, as later this year Mantle will be deploying its first units to customer sites “at bigger names we can’t name yet, but names you’ll definitely know,” Sorom said.

Getting their 3D printing systems directly on those users’ production floors is intrinsic to their actual future impact. Tooling companies always create strong relationships with the OEMs they work with, as each has to understand the ins and outs of how they each work and how they work together. When that can be brought in-house, a more impactful future unfolds.

Faster response, easy-to-use equipment, and new molding/stamping/tooling needs within reach with an affordable structure — it’s an intriguing proposition, to be sure.

“The long-term business model is sale of the printer as well as materials uniquely qualified to reach the surface finish, material properties, and cost structure associated with each customer’s specific needs,” Sorom said.

Importantly, another aspect of Mantle’s structure is low-cost positioning.

“DMLS technology is routinely around $1 million. The normal amount a tool shop spends on new equipment is around $200K every one or two years to upgrade their equipment,” Sorom said. “We haven’t announced pricing, but directionally it will be at the lower end of the spectrum, at a level where competitors can’t hit.”

Our conversation also touched on how TrueShape stacks up to competitive technologies — and why the Mantle team thinks they’re uniquely advantageous for tooling. Stay tuned for more in the history, applications, focus, and strategies from Mantle.

Via Mantle