Charles R. Goulding and Randall Rothbort look at the implications of Desktop Metal potentially competing with their own clients.

On September 9th, Desktop Metal, the innovative 3D printer company specializing in producing personal and industrial-scale metal 3D printers, announced their acquisition of Aidro, an Italian designer and manufacturer of various hydraulic and fluid power systems components.

This acquisition is part of Desktop Metal’s “Additive Manufacturing 2.0” (or AM 2.0) initiative, which is focused on developing specialized 3D printing systems for a variety of unique applications. Previous Desktop Metal acquisitions (such as their acquisition of ExOne, one of the oldest 3D printing manufacturers) were focused on expanding their 3D printer manufacturing capabilities. This is an interesting situation, as previously, Aidro was a client of Desktop Metal, and worked previously to supply equipment, rather than producing specialized products such as this. This acquisition (as well as other similar ones) can have a wide range of impacts as Desktop Metal continues to expand into specialized industries.

What is Aidro?

Aidro was founded in 1982 and is based in northern Italy. They have extensive experience in developing and manufacturing hydraulic components, especially valves, manifolds, and various other components. These components are used in a wide range of applications and industries, most notably aerospace, as well as the agricultural and oil industries.

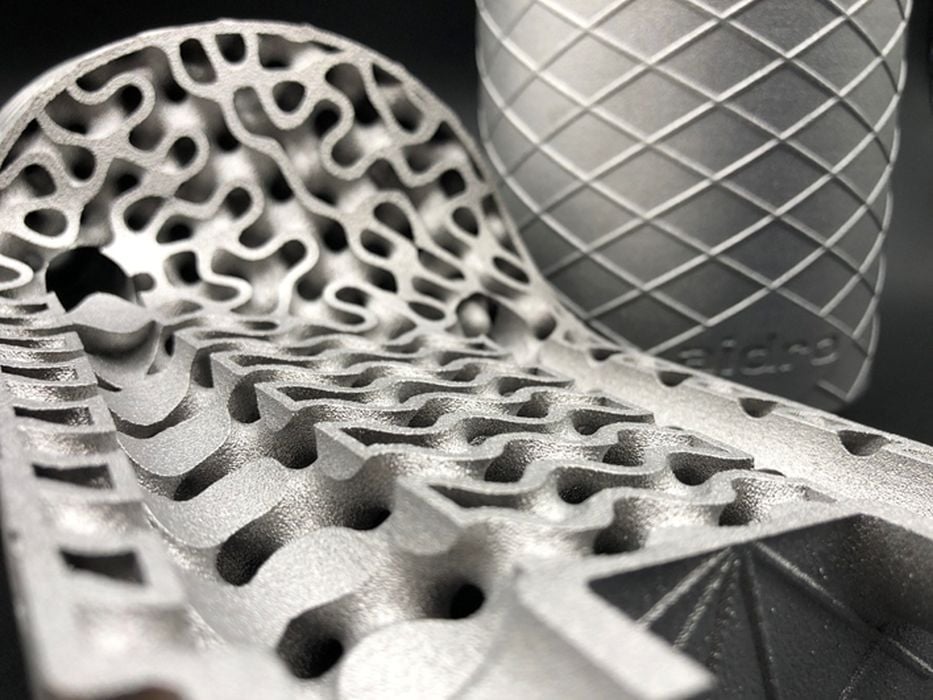

In 2015, Aidro began incorporating additive manufacturing into their fabrication process, finding that these methods allowed them to improve performance, reduce cost of production, reduce CO2 production, and reduce the weight of their products. This was fully introduced in 2017. Additive manufacturing allowed Aidro to develop more functional designs with fewer manufacturing limitations.

This led to fully converting their manufacturing processes to utilizing exclusively additive manufacturing. Aidro also has a variety of aerospace qualifications (among various other industries) that give them the experience required to develop and produce a variety of innovative products.

What are the implications?

As mentioned, this is not the first acquisition by Desktop Metal of a company in a specific field. Previously, Desktop Metal acquired EnvisionTEC (as discussed in our prior article “Desktop Metal’s Acquisition Of EnvisionTEC And 3D Bioprinting”), a 3D bio-printing company that produces bioengineering-focused 3D printers. They also recently acquired Beacon Bio, a bio-fabrication company that developed the unique 3D printed PhonoGraft product. Both acquisitions were for their internal healthcare business “Desktop Health”, which seeks to integrate 3D printing into personalized medicine.

Now with their entrance into the hydraulic and aerospace manufacturing industry through Aidro, Desktop Metal will be able to develop new 3D printing solutions for specific industries with expertise they did not previously have. The companies they acquire, such as Aidro, will also be able to innovate on their products at a level that was unavailable previously. This combination will allow Desktop Metal to produce specialized AM 2.0 solutions.

However, the acquisition of Aidro shows that Desktop Metal is willing to enter the same businesses as their own clients.

This is a challenging business strategy, as Desktop Metal must balance their role as a supplier of equipment to clients while simultaneously competing with them. A notable example could be Parker Hannafin, an American company that also specializes in the production of various industrial parts and components, such as hydraulics, pumps, and filters. Parker has begun to incorporate additive manufacturing throughout its production process (as discussed in “Parker Hannifin and 3D Printing”). Similarly, aerospace industry members have continued to incorporate additive manufacturing, which is a unique area of expertise for Aidro and of many Desktop Metal clients.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies and startups developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

As Desktop Engineering continues to expand into new, specialized fields, they will have to manage changing relationships with many of their clients. This will surely come with increased innovation, as Desktop Metal will now have newfound experience in specific fields that can combine with their own 3D printing expertise. However, entering the same industry as their clients will require some management as they continue to expand. As Desktop Engineering continues to execute its AM 2.0 plans, this will be an interesting development to watch in the 3D printing industry.