Stratasys made an extremely bold move by announcing they’ve acquired the additive manufacturing materials business of Covestro.

There are a number of significant implications to this move, but let’s level set everyone on who the players are in this deal.

Covestro is a major chemical company, originally a spin-off from Bayer launched in 2015. Today they sell almost €16B (US$16B) of polyurethane and polycarbonate materials each year, with ten percent of that being income. The market valuation of this company is currently well over US$6.5B, making them 5X larger than Stratasys.

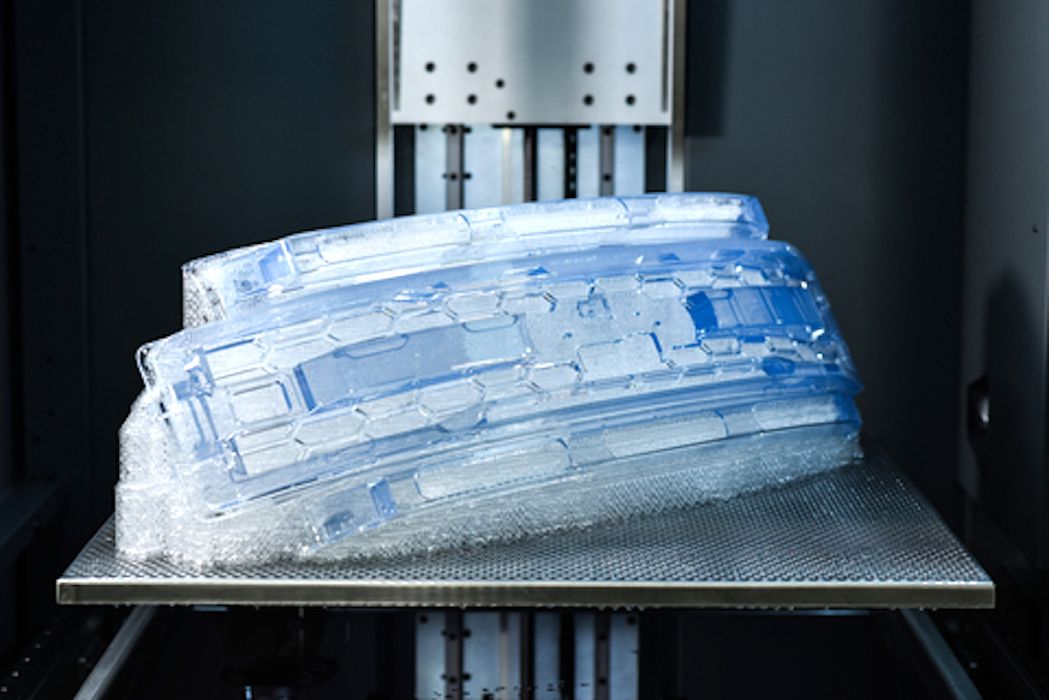

Stratasys is one of the major players in 3D printing, and was the inventor of the FDM process that dominates the unit sales of 3D printers worldwide today, although their patent on FDM expired some years ago. However, through a series of corporate acquisitions, Stratasys now boasts of a wide breadth of different 3D printing technologies that offer unique part production capabilities.

It’s important to note that Stratasys did not acquire Covestro: they could never afford to do so. Instead, they’ve captured Covestro’s additive manufacturing materials business, which is comprised of quite a few assets. Stratasys explains:

“It will include R&D facilities and activities, global development and sales teams across Europe, the U.S. and China, a portfolio of approximately 60 additive manufacturing materials, and an extensive IP portfolio comprised of hundreds of patents and patents pending.”

The deal is expected to close early next year, and it sounds like Stratasys will largely maintain existing staff and facilities, although history shows they may consider swapping in their own people at the top.

The purchase price was said to be near US$44M, with the possibility of paying out an additional US$38M should “various performance metrics” be achieved by Stratasys.

I take that to mean that Covestro believes that Stratasys could do more with the AM materials business than Covestro could do themselves. The extra payment hints that Stratasys is expected to sell more AM materials, and that Covestro would scoop up a portion of that action.

For Stratasys, the acquisition could provide a massive materials platform for their newly acquired 3D printing processes from Xaar, RPS and Origin, which could form the base revenue of the company in years to come. These systems are focused on production, rather than prototyping, so it’s very likely there will be massive amounts of materials to be sold once their use is widespread.

The acquisition also provides a platform for Stratasys to develop new kinds of AM materials, and that can only be good for the company. Many buyers will only purchase if machines can make parts in particular materials, so having more material choice means more machines will be sold.

I would expect to see quite a blossoming of new entries on Stratasys’ material portfolio in coming months and years.

For the rest of the 3D print industry, this is perhaps a milestone moment. In the recent past we’ve seen chemical companies finally “turn on” to 3D printing and enter the space with adaptations of their existing chemical portfolio. BASF is perhaps the most notable and aggressive party in that respect, however, there are many other chemical players like Covestro.

This acquisition takes the pattern forward in that the AM portion of one of these chemical companies has now been absorbed by a 3D printer manufacturer. This has never happened previously, at least on this scale.

The fact that both Covestro and Stratays seem to believe that business is best left with the 3D printing experts suggests only one outcome: The other major 3D printer manufacturers will also seek to acquire their own materials division in the same way Stratasys has done. The chemical companies may be agreeable, if they see the world the same way Covestro apparently does.

The result will no doubt be an explosion of unique AM-specific materials for many different machines and 3D printing processes in coming years.

This is a day that the 3D print world changed.