Charles R. Goulding and Arianna Coger consider new advances that could lead to great strides forward in bioprinting capabilities.

Scaffolds are commonly used within the biomedical industry and academia to facilitate the tissue engineering process. To successfully develop a lab-grown tissue, the scaffolding material must closely resemble the properties of the native tissue. The scaffolding helps cells grow and differentiate to achieve proper functionality. Currently, researchers struggle to fully customize the characteristics of their 3D printed scaffolds. A team of researchers from Washington State University (WSU) has recently explored the possibility of using a new bioink for bioprinting that would enable the greater capability to imitate native tissue properties.

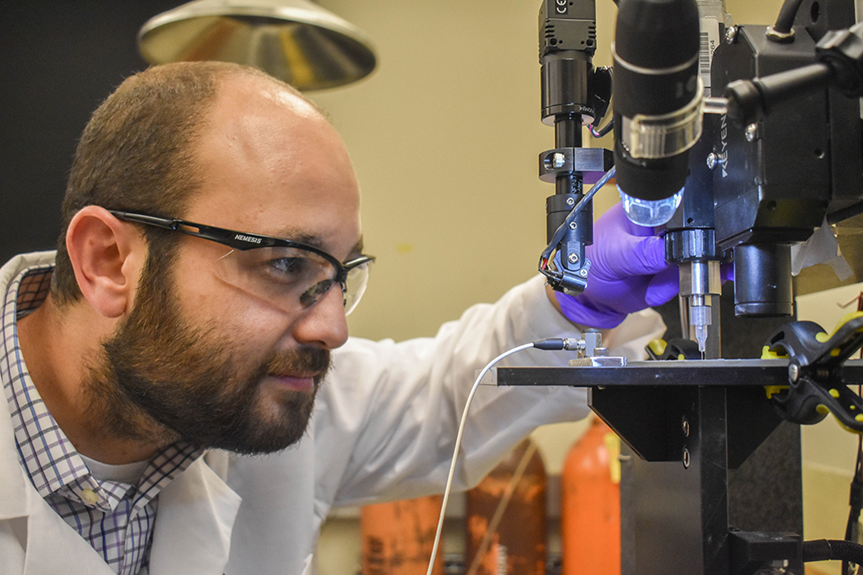

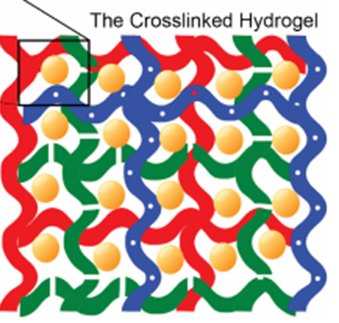

Arda Gozen, an Associate Professor at WSU School of Mechanical and Materials Engineering, along with a team of researchers from WSU’s School of Chemical and Bioengineering, University of Texas-San Antonio, Morehouse College, and the University of Rochester worked on developing this technology. The team performed a study with the goal of demonstrating the improved customizability of bioprinted scaffolds using a material made up of sodium alginate (SA), gelatin (GEL), and gum arabic (GA). This bioink is simply known as SA-GEL-GA hydrogel, with each of its components chemically crosslinked together through three unique processes.

The mechanical properties of potential scaffolds are some of the most important factors for effective biomimicking. Typical methods of 3D bioprinting scaffolds are not always effective because the temperatures needed to achieve the desired mechanical properties can reduce cell viability and the materials used are often stiffer than native tissue. The number of ways to control the mechanical characteristics is limited.

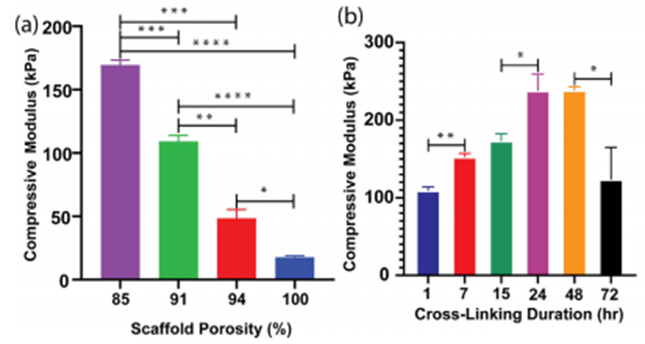

The mechanical properties of prints using SA-GEL-GA can be controlled by altering the scaffold porosity as well as the duration of two of the crosslinking processes unique to this hydrogel. Gozen states this technique “gives you the capability of tuning the properties without changing the scaffold design and gives you an additional degree of freedom that we are seeking.” The WSU research team specifically looked at how the compressive elastic moduli, representing stiffness or resistance to compression, can be controlled by altering these variables.

The addition of new variables that can be regulated for the printing process allows greater control of the resulting scaffold’s properties. The researchers stated that SA-GEL-GA would be particularly useful for biomimicking soft tissue. Further research on SA-GEL-GA and other hydrogel compositions can help researchers enhance their ability to engineer tissues that are identical to the tissues found in patients. It may become possible to further refine the elastic modulus as well as other mechanical properties of bioprinted materials. Advancements in this technology would lead to greater success with tissue development and engineering.

Federal tax incentives, such as the Research and Development Tax Credit, are available for companies that engage in 3D printing activities.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

With the development of new tissue engineering methods, researchers and doctors will be able to replicate and produce tissue that can more effectively meet the needs of individual patients. This progress would increase the attainability of personalized medicine and the viability of new, improved treatments.