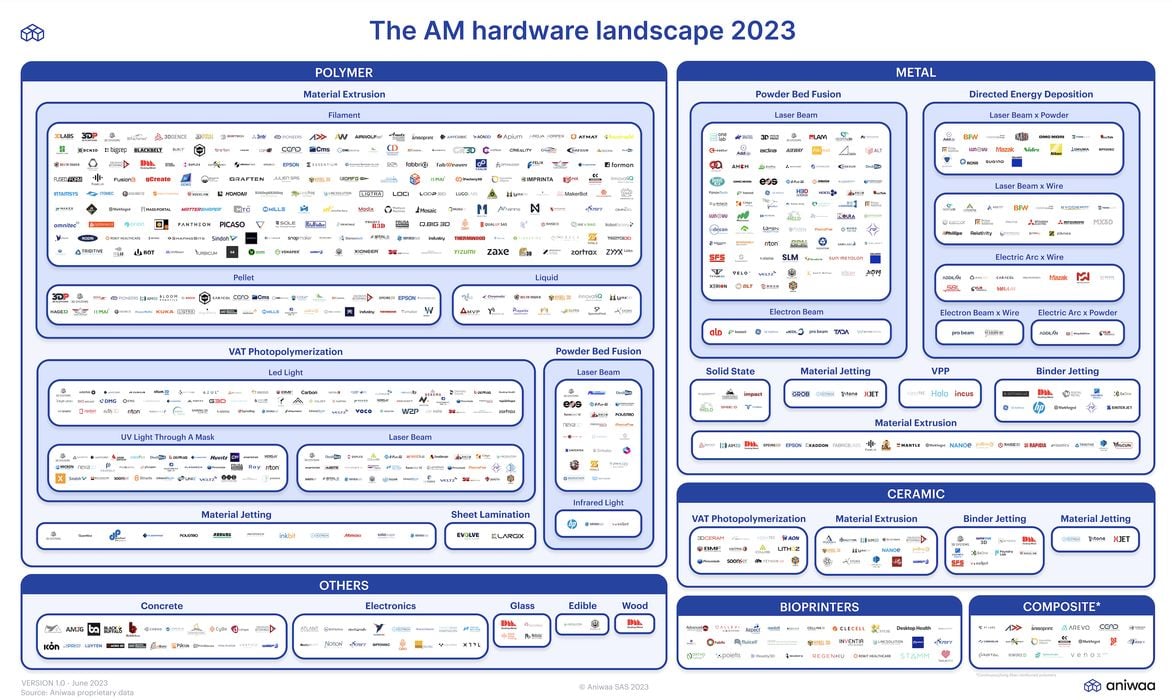

Aniwaa has produced a massively comprehensive chart of known 3D print processes and providers.

We’ve seen this type of chart previously, but this one is certainly the largest seen so far.

How can Aniwaa do this? It turns out they operate the largest database of known 3D print equipment on the planet, with many thousands of entries describing nearly every machine that’s ever existed. Using the data they’ve collected over many years it was possible to put it all together into a unique chart.

As you may have noticed, the cover image on this story is in fact the new Aniwaa chart. However, it’s a little hard to read. That’s because there are so many entries it couldn’t easily be reduced and still load properly on this post.

This clearly demonstrates the vast expansion of 3D print technology, not only in terms of number of companies, but also in terms of the different 3D printing processes.

The chart includes major categories for polymer, metal, ceramic, bioprinting, composite and “other”, and breaks down these into further categories that specify the more specific making process involved.

As you might suspect, the largest single category is polymer material extrusion, which includes the popular FFF process. There my count is 181 different brands. Some may be redundant, however, such as UltiMaker and MakerBot, which are now a single company — but they are separate brands.

Even in the metal zone, there are 70ish LPBF brands, an incredible number considering there were only a handful a decade ago.

Aniwaa discusses some findings after preparing this chart:

“Key findings from Aniwaa’s industry landscape include the dominance of polymer 3D printers (offered by 57% of polymer AM manufacturers) and the popularity of laser powder bed fusion technology in metal AM (50% of metal AM manufacturers). The correlation between the companies currently making headlines for potential mergers and their extensive technology portfolios is also noteworthy. Leading the pack is 3D Systems, boasting an impressive range of 9 print technologies. Desktop Metal closely follows with 6 technologies available in its portfolio of solutions, while Stratasys holds a strong position with 5 technologies in its arsenal.”

This analysis puts into perspective the importance of the possibility that Desktop Metal, Stratasys and 3D Systems could merge together given current proposals being discussed.

Aniwaa CEO Martin Lansard explained:

“At Aniwaa, we understand the challenges faced by professional buyers in navigating the complex additive manufacturing ecosystem. Our landscape infographic, combined with our product catalogs, provides buyers with a comprehensive view of all active manufacturers and solutions in each market segment. These insights are invaluable in their journey to make informed purchasing decisions.”

The full, 13MB infographic may be obtained from Aniwaa.

Via Aniwaa