Charles R. Goulding and Preeti Sulibhavi take a look at thermal imaging systems used in 3D printing.

FLIR Systems is a large and long-standing manufacturer of thermal imaging camera systems. FLIR is a publicly traded Nasdaq company with 2019 sales of $1.9 billion and 3,649 employees.

“FLIR” stands for forward-looking infrared cameras. These systems have numerous applications including virus detection, precision farming, vineyard management, and surveillance including police and military usage.

Thermal imaging has a multi-faceted relationship with 3D printing. Thermal imaging cameras are used for monitoring and improving the 3D printing process. Data such as in-process temperature can be used to identify the source of quality issues and correlate temperature with the necessary process parameters such as printer settings or materials used and observe the effects of the changes.

Due to the numerous applications of thermal imaging, 3D printing is used to design camera tripods and a variety of mounting fixtures and applications for airplanes, helicopters and drones.

In FLIR’s recent acquisition of Altavian, Inc, a privately-held manufacturer of small unmanned aerial systems (sUAS) for defense and public safety customers, FLIR is leveraging Altavian’s expertise in aeronautics, avionics, and software solutions to meet the needs of government and defense customers. Altavian is one of the five Department of Defense (DoD) approved drone manufacturers.

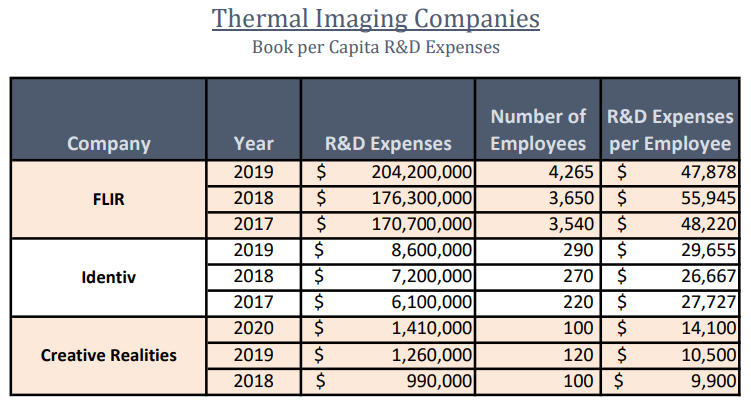

The R&D spend of leading thermal imaging manufacturers is shown in the table below.

Companies engaged in 3D printing activities and developments are eligible for federal and some state tax incentives such as the Research and Development (R&D) Tax Credit.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The pandemic has expanded the world’s knowledge of thermal imaging systems. As cameras and drone technology improve, thermal imaging will benefit from more applications. The 3D printing industry should follow these developments and participate in the growth of the thermal imaging industry.