Fictiv announced yet another massive investment into their manufacturing network.

The San Francisco-based company operates a growing network of professional manufacturers that accept work from requestors through Fictiv’s extensive network. Fictiv handles quoting, connections, quality control and generally makes life a lot easier for someone seeking quick manufacture of precision parts.

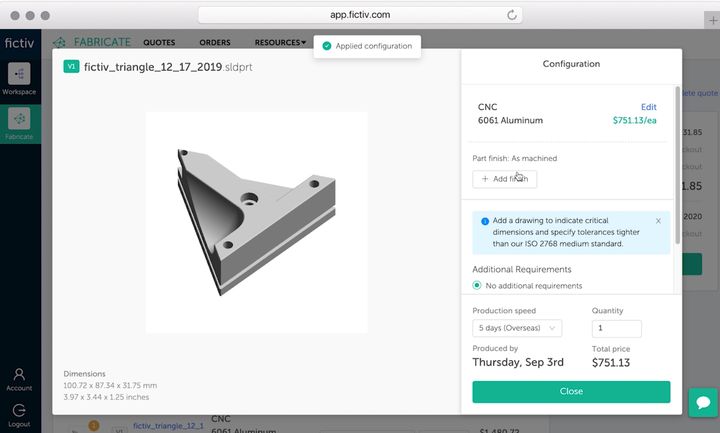

While their network includes partners providing all popular forms of polymer 3D printing, Fictiv also provides services in CNC milling, injection molding and urethane casting, as well as a wide variety of finishing options.

Fictiv and other manufacturing services have seen a boom in business during the pandemic, as short-circuited supply chains forced many manufacturers to turn to manufacturing services like Fictiv to make up production shortfalls.

However, once exposed to the idea of 3D printing and services, some have realized they are actually quite feasible for operations. In addition to resolving immediate supply chain issues, services like Fictiv provide a far greater degree of flexibility in production. This is especially true with a 3D printing network, as the many points of manufacture are far more resilient than a single factory.

Fictiv Investment

If manufacturers have caught onto the idea of manufacturing services, so too have investors. Fictiv’s most recent raise was a staggering US$35M, the single biggest public investment they’ve yet received.

This investment is a “Series D”, meaning it was preceded by large Series A, B and C investment rounds. According to Crunchbase, these were valued at US$9.6M, US$15M and US$32M, and thus Fictiv is known to have received at least US$92.6M in investment. That is an amount that puts Fictiv in the heavyweight class, investment-wise in the 3D world.

You might be wondering what Fictiv will be doing with this investment, and there are two answers.

First, there’s the public statement from Fictiv explaining their intentions, where they say they will “aggressively” expand their ecosystem. That’s likely quite true, as expansion in their case is largely picking up additional participants for their network, perhaps in new technologies (they don’t offer metal 3D printing yet, for example), and marketing the services to more manufacturers. The amount of cash raised is easily more than enough to accomplish these things at scale.

Fictiv Valuation

But there’s another reason for this seemingly continuous rounds of investment: valuations.

Like all companies, Fictiv ownership is divided up into shares that are privately owned by a number of parties. Since these shares are private and not publicly traded on an exchange, it’s a bit more difficult to figure out what each share is worth. In privately-held companies this is done through transactions. For example, if shares were sold and bought by an investor for US$10, then that is evidence the shares are currently worth US$10 each, regardless of what they were valued at previously.

Back to the Series investments: each series will certainly establish a new — and inevitably higher — share price. When you see “Series, A, B, C, D” happening, know that the share valuation is jumping up at each raise. Perhaps Series A investors bought at US$10, but Series B bought at US$20, and so on.

The bottom line here is that with all these investments the valuation of Fictiv as a whole must be massive. The publicly released information shows only the amount of investment, and not the percentage of the company being purchased, so we can’t calculate Fictiv’s private valuation.

But you can be absolutely certain several folks inside Fictiv have done so.

Via Fictiv