Desktop Metal announced the first shipment of their Production system to a client, opening the door for significant changes.

The company launched a few years ago with an inexpensive desktop system for 3D printing metal objects, hence their name. However, soon after they announced the development of a production 3D printing system, which was intended for “Production” use.

At the time of the announcement, the Production system appeared to be quite a shift in direction for the company. Not only was it designed for larger-scale manufacturing, as opposed to prototypes, but it uses an entirely different 3D printing process than the company’s prior equipment. Even the materials were quite different.

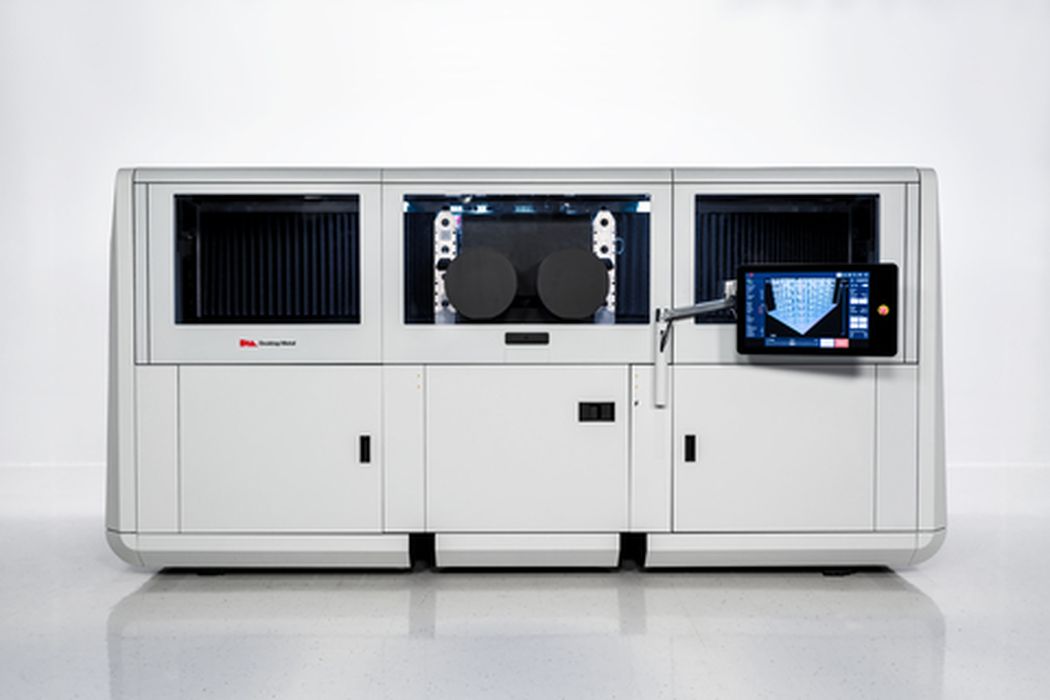

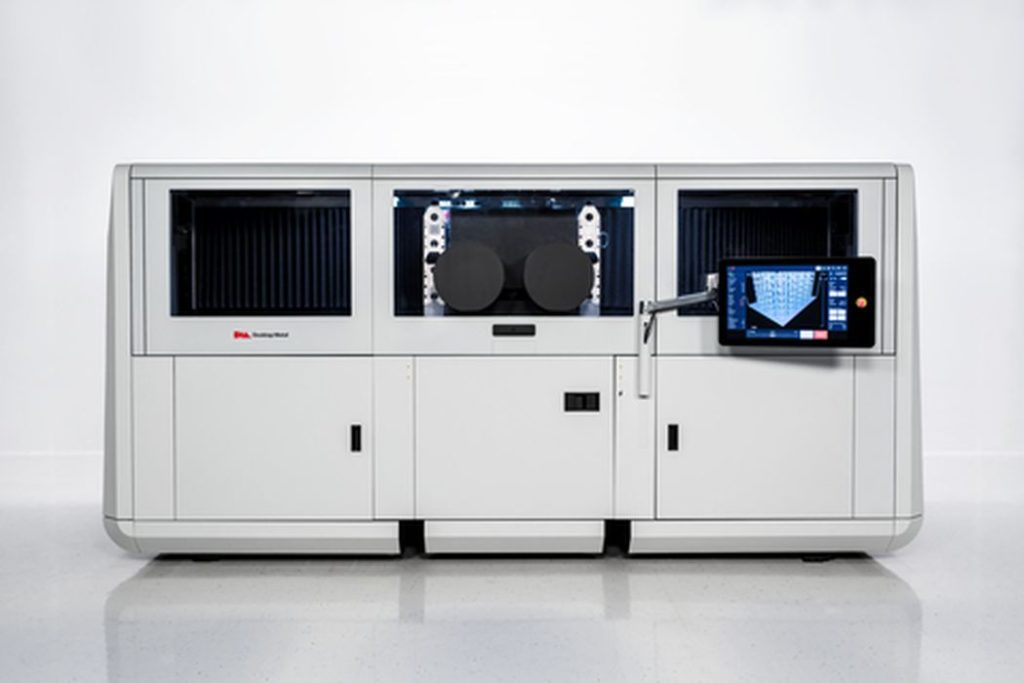

While the company’s original technology was a filament-based metal prototyping system, the Production system uses a binder jet process with powder. The system uses a “single pass” inkjet delivery system to produce layers apparently 100X faster than typical PBF systems, and can produce objects made from a variety of metals. Subsequently, Desktop Metal has made a number of interesting acquisitions to dramatically broaden their portfolio of 3D printing processes.

Nevertheless, Desktop Metal spent no less than four years developing the system, apparently spending a massive US$100M to do so. Now, a P-50 system is set to get working at Stanley Black & Decker, a manufacturer well-known for its forays into a number of 3D printing technologies.

Normally the announcement of a product shipment isn’t really newsworthy. Companies make products and ship them, everyone understands that. However, this one is a bit different.

For many years the 3D printing world has been dominated by prototyping applications. Here designers and engineers would produce objects iteratively to finalize a product’s geometry. While that was quite a productive market, it is dwarfed by the manufacturing market.

A company might use a couple of 3D printers for prototyping, but their manufacturing operation would produce far, far more units. If a 3D printer manufacturer could switch from the prototyping market to the higher volume manufacturing market they would have a lot more road to grow.

HP has long said they’re going after the US$12T manufacturing market, which is indeed huge. That’s massively larger than mere prototyping.

With this first customer deployment, Desktop Metal takes a step into that enormous manufacturing universe.

Should these first few machines succeed at Stanley Black & Decker, we could see their competitors also latch onto the concept to keep up. This could ultimately lead to a large number of production system sales for Desktop Metal, and that growth could transform the company into something quite different.

Via Desktop Metal