Charles R. Goulding, Adam Friedman and Preeti Sulibhavi take a look at how 3D printing plays into near-term surgical delays.

The medical device industry is rapidly consolidating and concurrently advancing with new technologies. We have recently written three articles describing ongoing medical device mergers and the 3D printing implications, including Medtronic acquiring Medicrea, Stryker acquiring Wright Medical, and Zimmer Biomet acquiring A&E Medical.

In June 2020, Medtronic, one of the global leaders in medical technology, announced it will be acquiring Medicrea, a spinal surgery company with 30+ FDA approved spinal implant technologies that have been utilized in over 150,000 spinal surgeries to date. Medicrea leverages software analysis tools and scientific data to streamline efficient spinal care solutions.

Stryker, one of the global leaders in medical technology, announced in November 2020 that it will acquire Wright Medical, a company recognized as a leader in medical technology in its own right. Stryker (SYK) is a publicly traded company on the New York Stock Exchange and worth approximately $15 billion. Wright Medical (WMGI) is also a publicly traded company on the New York Stock Exchange worth approximately $1 billion, prior to the deal that is valued at $5.4 billion.

Zimmer Biomet, one of the international leaders in medical technology, announced in November 2020 that it will acquire A&E Medical, a company recognized for its medical equipment and device manufacturing. Zimmer (ZBH) is a publicly traded company on the New York Stock Exchange worth approximately $8 billion struck the deal to acquire A&E Medical for $250 Million. A&E Medical will contribute a full portfolio of sternal closure devices as well as temporary pacing wire and surgical punch products that will complement Zimmer Biomet’s growing profile of sternal closure products.

These transactions have occurred just when the second wave of the pandemic is straining hospital capacity and suspending elective surgeries on a mandatory or patient concern basis.

Deferred Elective Surgery

According to U.S. News, which is a proprietor of U.S. News Best Hospital and Best Doctor annual rankings, 2020 will have a backlog of 28.4 million elective surgeries in the United States. Most estimates, from news sources WebMD, NBC, and HealthDay, estimate that 90% or 25.56 million surgeries will be able to happen 16 months after hospitals are deemed safe from Covid-19. Given that the Covid-19 pandemic might last until 2022, many elective surgeries can be postponed for up to four years from the beginning of 2020. Elective surgery falls under two categories, with mandatory suspension from the surgical provider due to resources not being available or sufficient because of the pandemic and patient elected deferral as a result of fear of exposure to Covid-19. While many hospitals have been treating more Covid patients than those with other maladies, these same hospitals have resumed elective surgery and other treatments as well. However, because the general public has a fear of the Coronavirus and is aware patients are being treated at these hospitals, many individuals have been delaying entering hospitals for elective surgeries as a result.

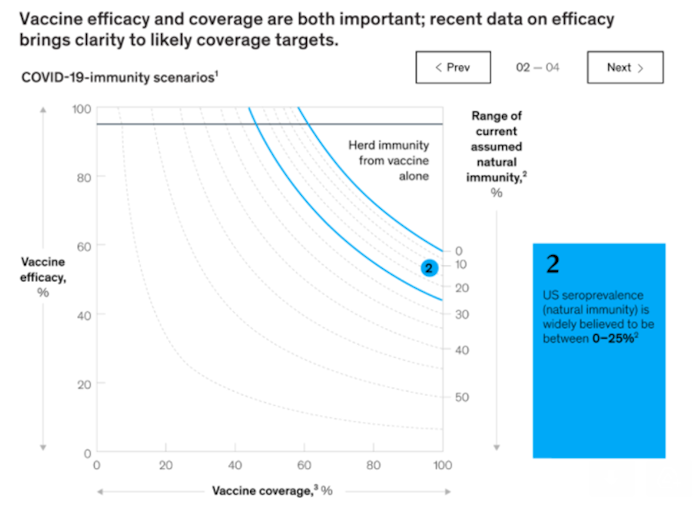

It is a reality that 7-9% of patients who have suspended elective surgery will not be able to resume surgery for another 2.5-4 years from now without their being at risk for Covid-19 exposure. There are some variables that can decrease that timeline such as widescale vaccination dramatically decreasing Covid-19 disease and spread. This can be a reality, according to analysts from the business and health care arenas. Large-scale vaccination can increase herd immunity to levels, where Covid-19 can be contained and will not disrupt normal hospital operations. The below graphic, provided by McKinsey & Company, shows that vaccination has to be given to between, on average, 40-67% of the population, or anywhere from 113-213 million people. If mass vaccination can be accomplished and achieve a near-elimination of the Covid-19 virus, the elective surgery queue will be decreased by 1.5-2 years, showing a resuming of the majority of surgeries between 2021 and 2023.

How Should the 3D Printing Medical Device Industry Prepare?

The 3D printing industry should be using the elective surgery suspension to improve patient care when the suspension comes to an end. Better care will result from more training that covers pre-operative procedures, clinical-care and post-operative procedures. The U.S. is known for great clinical care and mediocre pre-op and post-op services just aren’t acceptable.

Medical training will improve with better use of today’s communication technologies including:

- Zoom Video Conferencing

- Microsoft Office Teams

- Slack Messaging

- Salesforce Customer Relationship Management

- Telemedicine

- Conversational Commerce

At this time 3D printing medical device technicians should be training the surgical teams on how to use their technologies. The biomedical industry happens to be rapidly improving during the pandemic and surgical teams can use this gap in elective surgery care to catch up and get current.

We have recently published articles on medical devices related to ankle, shoulder, hip and spine surgeries, as well as the MedAccred program.

Companies engaged in 3D printing activities and developments are eligible for Federal and some state tax incentives such as Research and Development (R&D) tax credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Commencing medical device patient care in the year 2021 with a 2019 skillset isn’t going to serve the patient. Getting a respite in any profession is rare and augmenting skills can be time well spent.