Charles R. Goulding and Preeti Sulibhavi examine how 3D printing is gradually being used in the sport of Cricket.

Walt Disney Co., Sony Pictures Networks India and Viacom18 (a joint venture between ViacomCBS and Reliance Industries) are among several companies planning to bid for the broadcast and streaming rights for the Indian Premier League (IPL), the Nation’s most popular cricket league.

Cricket

To those who are completely unfamiliar with the global sport, Cricket is not an insect, but a game akin to baseball in the U.S. The sports paraphernalia includes bats, balls, wickets, bases, fielding equipment and safety gear as well. All of these items have the potential to be 3D printed.

3D Printing For Cricket

There are many examples of how 3D printing improves sports safety. Or how 3D printing can be used to make sports gear, such as sneakers, even better. We have previously written about how 3D printing is relevant in specific sports including archery, pickleball, and hunting, to name a few.

Cricket is no exception. Whether it is 3D printing the rubber grips on cricket bats, or fabricating cricket accessories on the latest 3D printer, there is more relevance to the sport now than ever before.

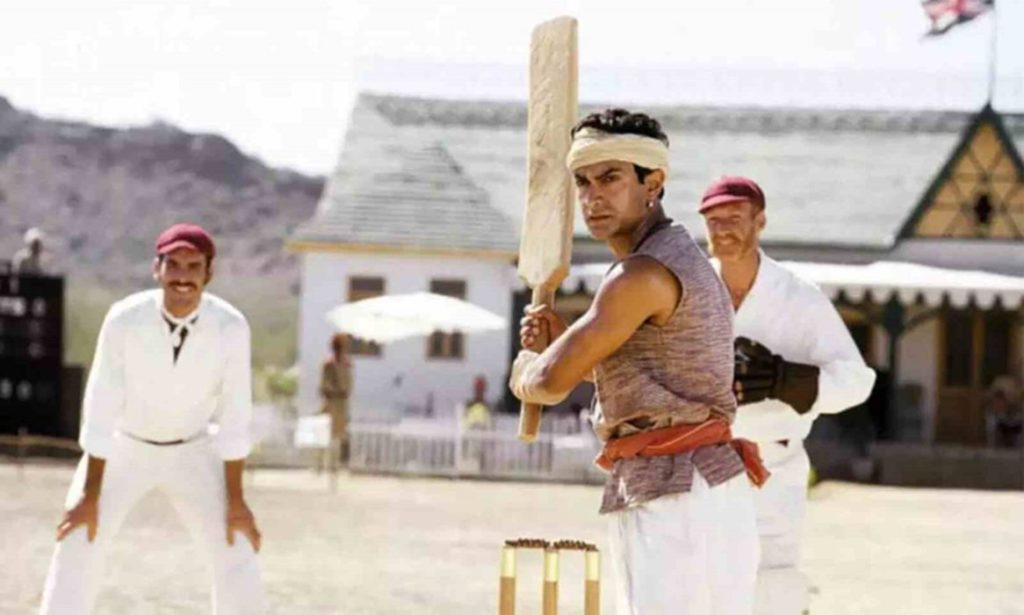

As the 2001 film Lagaan illustrated, Cricket is more than just a sport for so many. This global sport is becoming increasingly popular and there is room for 3D printing to join in with this popularity.

The cricket industry is ready for 3D printing.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

There are many reasons for the 3D printing industry to take notice of recent developments in the Cricket industry. With the worldwide fanbase for Cricket ever-growing, now is the time for 3D printing to come to bat.