Charles R. Goulding and Preeti Sulibhavi examine BlackRock’s recent acquisition of Global Infrastructure Partners and the implications of 3D printing.

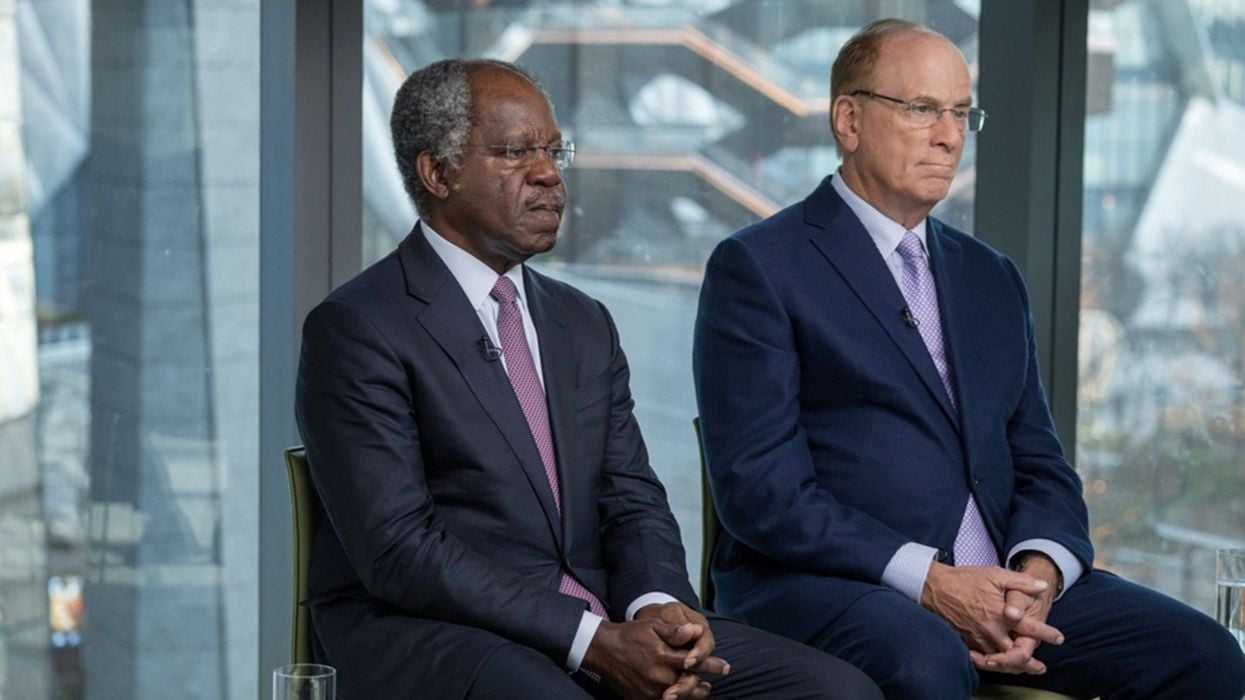

Larry Fink, CEO of BlackRock, the world’s largest asset manager with US$9.42 trillion under management, recently announced a US$12.5 billion deal to acquire a majority stake in Global Infrastructure Partners (GIP), one of the leading private infrastructure investment firms. Co-founded by Adebayo Ogunlesi, who started out as a banker at Credit Suisse, GIP was built in less than two decades. This deal opens eyes to the massive potential of infrastructure as an asset class, as governments and companies invest trillions to upgrade aging facilities and build resilience against climate change.

The infrastructure category covers a vast range – roads, bridges, railways, airports, seaports, energy grids, pipelines, and communication networks. GIP itself owns major stakes in projects like the Port of Brisbane in Australia, Delhi Airport in India, and natural gas pipelines in the U.S. The deal comes amidst a worldwide infrastructure investment boom, with governments across the globe earmarking multi-trillion dollar budgets.

Some of the other large investment infrastructure companies are Tiger Infrastructure Partners, Brookfield Infrastructure Partners, H.I.G Infrastructure and the Macquarie Group.

In the U.S., the recently passed US$1.2 trillion Infrastructure Investment and Jobs Act targets over US$550 billion in new infrastructure spending over 5 years. Major categories include:

- Roads & Bridges – US$110 billion to repair aging roads and bridges and improve safety.

- Public Transit – US$91 billion to modernize and expand transit systems.

- Railways – US$66 billion for freight and passenger rail, including high-speed rail.

- Power Infrastructure – US$73 billion to update power grids and transition to clean energy.

- The Water Infrastructure – US$55 billion to ensure clean drinking water through lead pipe replacement.

- Broadband – US$65 billion to provide universal access to reliable high-speed internet.

In addition to federal funding, U.S. state & city governments have budgets for local infrastructure. And events like Hurricane Ian recently demonstrate the ever-growing need for climate-resilient infrastructure.

The global rebuilding of Ukraine’s battered infrastructure and the wider Europe energy transition will likely require trillions in investment as well over the coming decade.

3D Printing’s Potential Here…

For the fast-growing 3D printing industry, this worldwide infrastructure boom unlocks an entirely new category beyond the current focus on manufacturing and prototyping applications. The global construction industry has been slow to adopt new technologies, but is now recognizing the advantages 3D printing offers:

- Agile Production – 3D printers can quickly generate specialized components on-demand near project sites.

- Design Flexibility – Freeform 3D printing handles complex geometries not feasible with conventional builds.

- Waste Reduction – Additive 3D printing only uses required materials vs. subtractive techniques.

- Lightweighting – Organic 3D printed designs allow concrete strength with less material.

We have previously written articles about some leading 3D printing companies involved in the construction industry that include:

- ICON – Pioneering low-cost 3D printed affordable housing, printed an entire neighborhood of homes in Mexico.

- COBOD – Uses a giant 3D printer called BOD2 to print commercial and residential buildings with architectural freedom.

- Cemex Ventures – a global construction materials company providing sustainable products and solutions. The Mexican multinational leader offers cement, ready-mix concrete, aggregates and urbanization solutions for growing markets around the world. Cemex is in partnership with COBOD.

- SQ4D – SQ4D aims to leverage its additive manufacturing system to develop and build affordable homes at a lightning-fast pace compared to conventional construction means. One of the main goals of the minds behind SQ4D was to originally eliminate the need to confer with building departments which are often very bureaucratic. Especially in the Long Island, NY metropolitan area, municipalities are very particular about building code and energy code standards.

For the 3D printing industry, the focus on infrastructure creates a large new business category for currently developing products and applications that can support this industry. The construction industry has previously lagged in embracing new technology but this gap is beginning to close. Brad Jacobs’ billion-dollar investment in a new building materials logistics company including infrastructure based on employing technology including 3D printing is a leading example. A second example is Nippon Steel’s proposed US$14 billion acquisition of U.S. Steel.

Just as 3D printing enabled mass customization in manufacturing, it promises a revolution in bespoke infrastructure builds optimized to geographic and climate conditions with potential cost and sustainability benefits versus traditional construction.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

The Future

BlackRock’s majority stake in market leader GIP positions it to lead in this infrastructure investing mega-trend, with its legendary scale and access to vast pools of institutional capital. And 3D construction printing firms like ICON, COBOD, CEMEX and SQ4D now have a US$10+ trillion gorilla investor potentially taking interest in their transformative technology.

With trillions in government infrastructure funding needing to be deployed, innovative technologies and visionary investors have an unprecedented opportunity to rebuild our physical foundations for the 21st century. The BlackRock/GIP deal ushers in this new era of infrastructure advancement and innovation.