Charles R. Goulding and Preeti Sulibhavi consider innovation in 2020, when many are returning to their own garage setups.

Hewlett Packard’s famous Silicon Valley garage startup is considered the birth of America’s tech industry. With COVID-19 many engineers now need to go back to their homes to continue working on their projects. A recent New York Times article featured Aaron Lear, an engineer at Natron Energy working from home on a new kind of battery which requires a substantial amount of equipment.

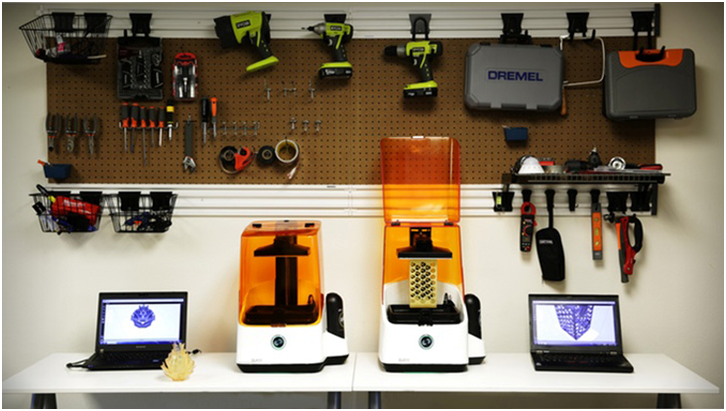

Hardware design including 3D printing typically requires manufacturing equipment, tooling, tools, materials and testing equipment. The NYT article described Cerebras, an LA startup company building the world’s largest dinner plate-size computer chip and self-driving car startup Voyage a Palo Alto, both of which enabled their engineers to transition to home operations.

For most, moving into a garage space is not without its own set of challenges. Often hardware manufacturing, including 3D printing, generates heat and requires a level of HVAC cooling and ventilation that are not typically in home and garage facilities. In the Cerebras situation, they had to install chillers which are HVAC units for enhanced cooling. The pumps on the chillers were also noisy and required muffling devices. However, commercial equipment and enhanced HVAC typically require higher, more robust electrical service at higher voltage levels than standard home electrical service allows for. Furthermore, commercial operations need to meet local zoning, building code, energy code and fire code standards.

There are also of course trade-offs with home hardware design. If a garage – the garage – is no longer available for vehicle and miscellaneous home storage, home improvement project space, hobby space and other spatial needs. There are also new safety concerns for all occupants, including children and pets.

Startups operating in homes and garages are entitled to R&D tax credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Startups moving back to the garage are to be applauded for their perseverance and tenacity. For families, this can be a stressful situation but may also result in important innovation.