Charles R. Goulding and Preeti Sulibhavi have a look at the AnkerMake 5 3D printer.

The U.S. Memorial weekend edition of the Financial Times “How to Spend It” (HTSI) magazine had an interesting issue on recommended “gadgets.” To help one “get crafty” HTSI has a circulation approaching 200,000 and is aimed at affluent customers with an interest in high-end products including design, fashion and luxury goods.

The gadget article shows cased 5 recommended products including an AnkerMake M5 printer (M5). The other four products included the Brother Luminaire Innov-is XP3 (a multi-function sewing machine, embroidery and quilting machine), the Atezr P20 Plus Laser Engraver, The Custom T-Shirt Heaven, and a Screen Dream, which allows users to draw directly into the software they select. All five of the gadgets are high-tech and useful in a very user-friendly way. But the AnkerMake M5 3D printer definitely caught our eye.

The Kickstarter campaign that launched the M5 product had over 11,000 sponsors and raised almost 9 million dollars. The 3D printer technology is remarkable as well. It reduces printing time by 80% thanks to its PowerBoost 2.0 system, while increasing power release by 30%. AnkerMake M5 also uses an AI-enabled camera to monitor processes.

With high-speed precision, the 3D printer uses extra processing power and an integrated intelligent camera to keep the model matching the input design.

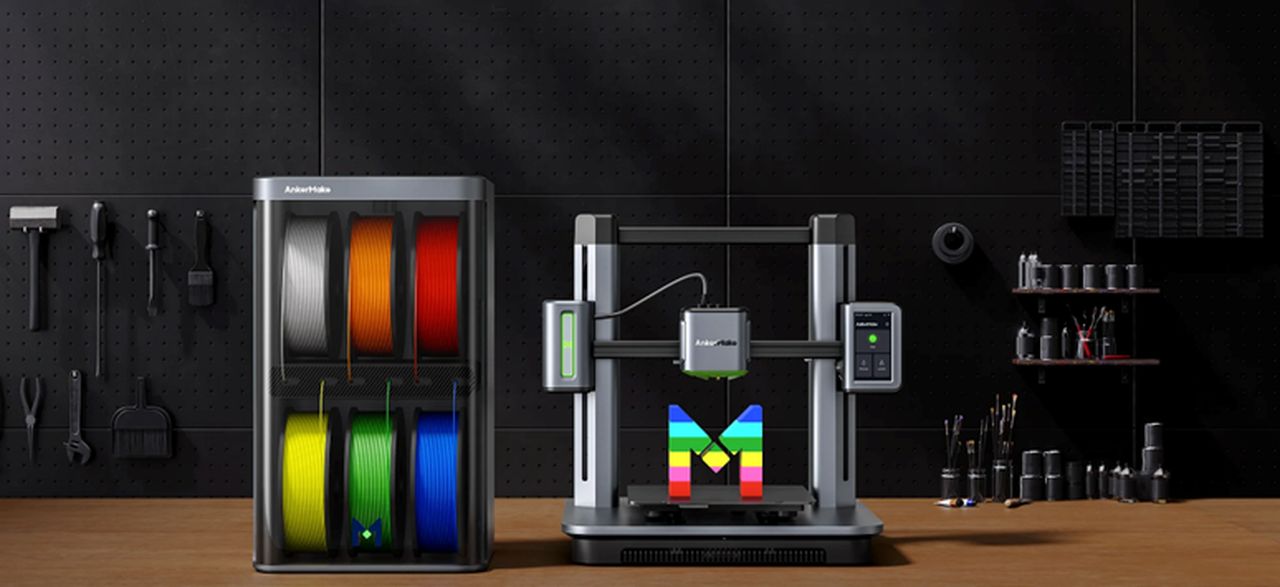

The printer can be accessed whether the user is on their mobile, on Alexa or using their laptop. All this without losing complete control with slicing and parameter changes.

The color add-on features allow users to get creative with their designs and as the company says, “lets your imagination decide the limits.”

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

We have covered how to get crafty on Fabbaloo before. But the HTSI section of the FT really highlighted the user-friendly and accessibility of 3D printers today. We see this exposure as a positive development for the industry.