Charles R. Goulding and Preeti Sulibhavi discuss the attempted merger between 3D Systems, Stratasys, Desktop Metal and Nano Dimension.

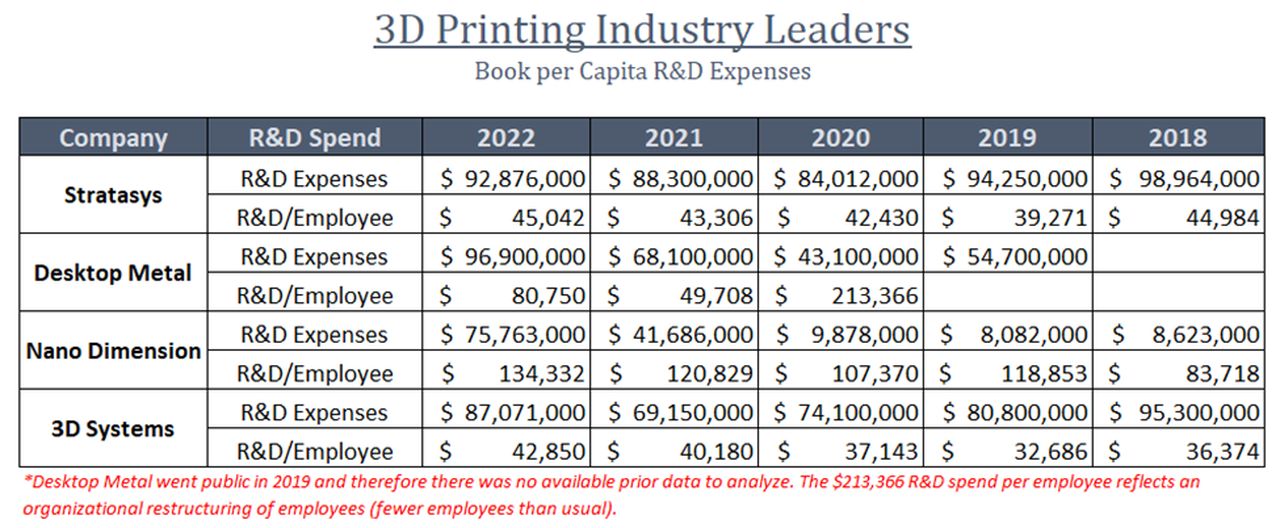

Stratasys and 3D Systems have remarkably similar levels of R&D spend and Desktop Metal has a much larger recent spend reflecting a series of major acquisitions.

Nano Dimension has a much larger R&D expense level.

The soap opera related to the potential merger of different combinations of four leading 3D printing players is finally over. The four companies that were in play are 3D Systems, Stratasys, Desktop Metal and Nano Dimension. The saga commenced on May 23, 2023, and finally ended with the September 28, 2023, announcement that Stratasys would not be proceeding with the anticipated acquisition of Desktop Metal.

Certainly, the one group that benefitted was the myriad of law firms, PR firms and advisors assisting all four parties. Hopefully, the four companies learned something about the overall 3D printing market and their competitors that can be put to good use.

Now each of the companies must get back to business. During the process, there were substantial promises about cost reduction and perhaps some of those ideas can be executed on an individual company basis.

We like to analyze comparative R&D spend to evaluate each company and those results are presented below.

We always felt the Nano Dimension had unique opportunities in the electronics space and they have acted on that concept by recently acquiring some niche companies including:

- Global Inkjet Systems (GIS) was acquired in January 2022. GIS is a UK-based, leading developer and supplier of application software, drive electronics and ink system components – supporting a wide range of industrial inkjet printheads.

- Essemtec was acquired in November 2021. Based out of Waltham, Massachusetts, their business revolves around adaptive highly flexible SMT pick-and-place equipment, elaborate dispensers suitable for both high-speed dispensing and micro dispensing as well as an intelligent production material storage and logistic system.

- Fabrica was acquired in April 2021. Headquartered in Windsor, Connecticut, Fabrica is committed to the craft of designing unique façade systems. Every project is a custom artwork, every design solution is unique, and every part is singular.

- DeepCube was also acquired in April 2021. DeepCube is recognized as the experts in deep learning and AI for 3D printing. DeepCube’s pioneering inference accelerator drastically improves performance on additive manufacturing hardware.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

The M&A process, and in particular hostile acquisitions, can consume valuable management time. The 3D printing industry has large organic growth opportunities with incredible government and university support. We hope the industry will reflect on this debacle and get back to business.