3D Hubs released their periodic Trends Report, and this edition packs a lot of very interesting data.

The company has been issuing Trends Reports for at least seven years. We covered one of the first ones way back in 2014, when 3D Hubs was more of a DIY community 3D printer network.

Today things are vastly different for the Amsterdam-based company. They’ve shifted away from the fun but unprofitable DIY market and moved directly into the manufacturing space. Their network is now composed of many professional workshops, able to use a variety of making technologies in addition to the original 3D printing option.

The latest report covers the majority of the pandemic period. 3D Hubs writes:

“3D printing gained mainstream exposure due to the difference it made in rapidly producing PPE during the beginning of the outbreak. Global supply chain disruption made it more difficult to source parts from overseas and forced businesses to consider more local solutions, which included 3D printing, for both prototyping and end-use parts. The 3D printing industry hasn’t been completely resilient to the past year’s challenges but is nevertheless set to continue growing 17 percent year-over-year in the next three years.”

The report was based on a comprehensive survey of 1,504 engineering businesses worldwide.

You can download the full report yourself at the link below, but I’ve already done so and reviewed the material. Here are some of the more interesting findings I observed:

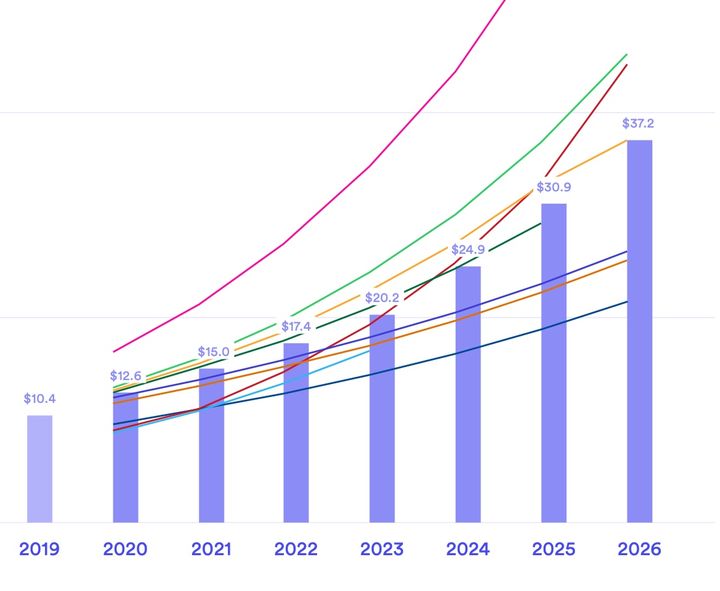

3D Hubs believes the 3D printing market to be US$12.6B in 2020, and expects it to almost triple to US$37.2B in 2026. While 3D printing has grown significantly in past years, the shape of the curve they propose is dramatic and showing exponential qualities.

A question about COVID-19 effects yielded an interesting answer. While 17% surveyed said it decreased their usage, 33% said it actually increased their usage. This is in line with observations we’ve made in the industry: companies were forced to use additive techniques when their normal supply chains broke down. Some of them are new to 3D printing, and they may stay with the technology going forward.

Some 64% of print jobs produce only 1-10 parts each, while only 2% of jobs produce over 1,000 parts each. This suggests that the industry could use equipment that is more capable of producing higher part volumes, as the part volumes in the survey seem to make the relatively low throughput on most of today’s equipment.

As is often found in this type of survey, the major barriers continue to be cost of parts and quality of parts. I have a suspicion that some of this will be gradually eroded over the next few years as we’re expecting to see 3D printers with much higher capacities emerge, which might lower costs. In addition, there are an increasing number of AI-based systems being incorporated into 3D printers, mostly to address quality concerns.

Finally, 3D Hubs says 65% of respondents made more 3D printed parts in 2020 than they made in 2019. That’s notable growth, particularly so when considering the business conditions of 2020.

The 2021 report should be even more interesting as the world finally recovers.

Via 3D Hubs