A new survey has revealed the troubles 3D printer resellers encountered during last year’s catastrophic events.

Resellers are the backbone of 3D printer sales throughout the world, as most 3D printer manufacturers do not have their own sales forces. While some sell direct via websites or Amazon, that’s often not the best way to sell professional devices where more direct contact is required to make mid- and large-sized buyers comfortable.

As a result most 3D printer manufacturers work with a network of regional resellers who have good access to their products. Through these resellers travel most of the purchases of professional and industrial 3D printing gear.

Because of that, knowledge of the reseller situation can indicate what’s happening on a larger scale within the 3D printing world. That’s apparent in the new survey results from 3D Alliances, a 3D printing management services company.

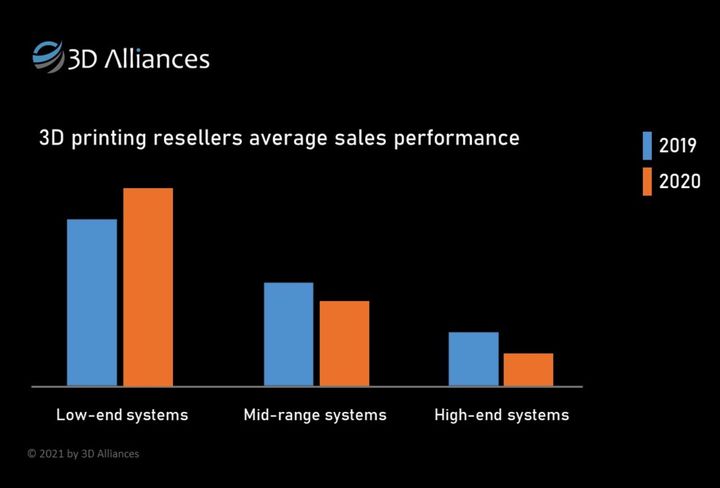

In the survey 3D Alliances was able to rate sales performance for their responding resellers in three categories:

- Low-end: US$2,500-20,000

- Mid-range: US$20,000-100,000

- High-end: US$100,000-1,000,000

The results showed the low-end category had sales growth over 2019 of an amazing 14%, even though the year started out incredibly slowly for everyone in the industry.

3D Alliances explains the low-end results this way:

“The two main reasons for the higher demand were (1) a shift of their customers to lower budgets for more accessible solutions that are reducing the technological gap from professional ones and (2) diverting yearly trade show budgets to online marketing and lead generation activities.”

I would add one more significant reason: with professionals quarantined at home for most of the year, some companies began to equip them with home 3D printers to assist in their design work. This phenomenon is likely to continue since the work-at-home paradigm is here to stay well after the pandemic.

Meanwhile, the survey showed declines in the mid-range and high-end categories. The mid-range suffered a “moderate decline”, while the high-end category incurred a more serious loss of business in 2020. 3D Alliances explained their reasoning for this:

“Naturally, selling high-end 3D printing systems with minimal personal interaction with the customers, plus the fact that many organizations either froze, postponed, or lowered their budgets was challenging. The result was lower sales in 2020 compared with 2019. Despite this, about 25% of these resellers managed to increase their sales in 2020 due to local market conditions, special projects in the medical sector, and increased automotive/bike sector business due to new scenarios in personal mobility.”

This is my anecdotal observation as well; some companies were fortunate to be in the right place with the right tools, or ingenious enough to re-invent themselves in a “COVID Mode”. Often these companies made out better than they did the prior year. However, it remains to be seen how they adapt over the long term when the COVID-19 pandemic eventually fades away.

I agree with 3D Alliances’ proposition that 2021 reseller performance is likely to be a regional phenomenon. Each country seems to be taking different approaches to handling the end of the virus crisis, with different priorities for vaccination, ongoing mitigation efforts and industry restarts. Depending on the country, we will likely see different reseller results.

What will be most interesting is how 3D printer sales evolves after the pandemic. Previously sales were often made face-to-face, and that hasn’t been happening in the last year. It also seems that for at least the higher-end equipment, virtual sales didn’t catch on as much as some hoped. This leads me to think that future in-person events might be more focused on higher-end equipment, as it seems there are virtual approaches to selling the lower-end gear.

Via 3D Alliances